Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri 2020

What is the Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri

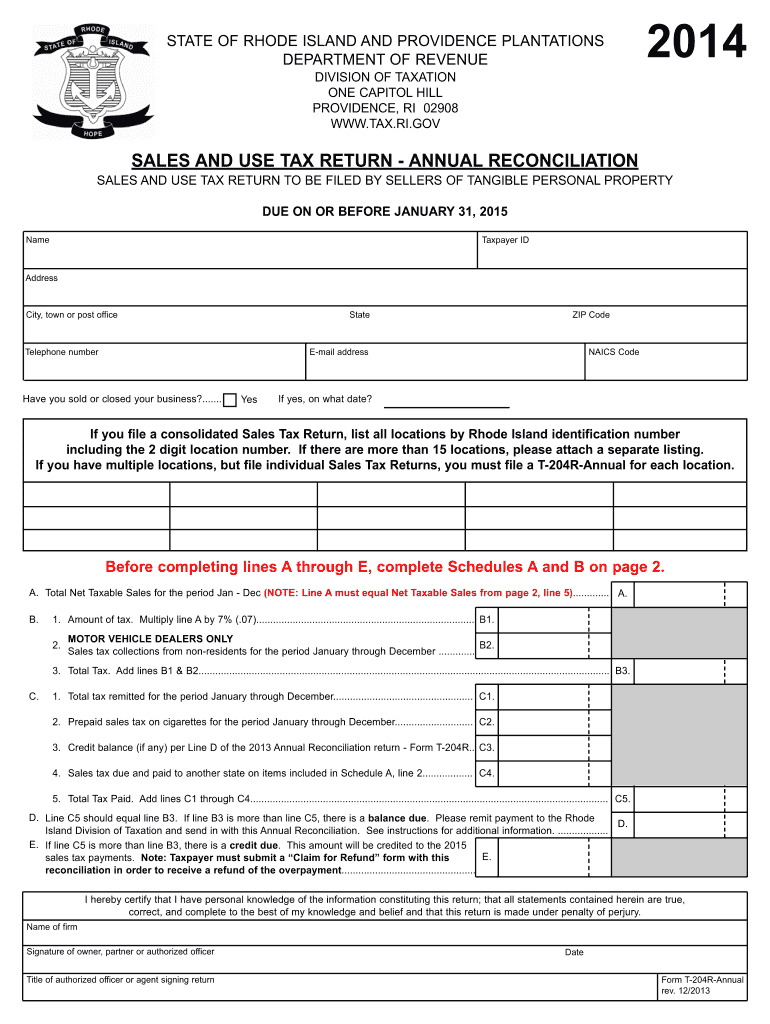

The Annual Reconciliation Form from the Rhode Island Division of Taxation is a crucial document for businesses operating within the state. This form is designed to summarize and reconcile the total amount of taxes withheld from employees throughout the year. It ensures that employers report accurate withholding amounts to the state tax authority, allowing for proper tax credit calculations and compliance with state tax laws.

How to use the Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri

Using the Annual Reconciliation Form involves several steps to ensure accurate completion. First, gather all necessary payroll records, including the total wages paid and taxes withheld for each employee. Next, fill out the form with the required information, including your business details and the total amounts. After completing the form, review it for accuracy before submission. This form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the Rhode Island Division of Taxation.

Steps to complete the Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri

Completing the Annual Reconciliation Form requires careful attention to detail. Follow these steps:

- Collect payroll records for the entire year, including W-2 forms and other relevant documentation.

- Enter your business information accurately, including the name, address, and Employer Identification Number (EIN).

- Calculate the total wages paid and the total taxes withheld for each employee.

- Summarize the total amounts in the appropriate sections of the form.

- Review the completed form for accuracy, ensuring all figures match your records.

- Submit the form by the specified deadline to avoid penalties.

Key elements of the Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri

Several key elements must be included when filling out the Annual Reconciliation Form. These include:

- Employer Information: Name, address, and EIN.

- Total Wages: The total amount of wages paid to all employees.

- Total Withholding: The total amount of state taxes withheld from employee wages.

- Signature: An authorized representative must sign the form to validate it.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Annual Reconciliation Form. Typically, this form must be submitted by the end of January following the tax year. Employers should also keep in mind any additional deadlines related to quarterly tax filings to ensure full compliance with Rhode Island tax regulations.

Penalties for Non-Compliance

Failure to submit the Annual Reconciliation Form on time or inaccuracies in reporting can lead to penalties. The Rhode Island Division of Taxation may impose fines for late submissions or incorrect information. It is advisable for businesses to adhere strictly to deadlines and ensure the accuracy of all reported data to avoid these potential penalties.

Quick guide on how to complete annual reconciliation form rhode island division of taxation ri tax ri

Complete Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri effortlessly

- Obtain Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Thoroughly review all the details and click the Done button to save your changes.

- Decide how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual reconciliation form rhode island division of taxation ri tax ri

Create this form in 5 minutes!

How to create an eSignature for the annual reconciliation form rhode island division of taxation ri tax ri

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri?

The Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri is a required document for businesses in Rhode Island to report their tax withholding information. This form helps ensure that businesses are compliant with state tax regulations and accurately report their employee withholdings.

-

How can airSlate SignNow help with the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri?

airSlate SignNow streamlines the process of preparing and signing the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri. Our platform enables users to easily fill out the form digitally, ensuring accuracy and compliance while simplifying the eSignature process.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as document templates, secure cloud storage, and customizable workflows to manage your tax documents like the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri effectively. These features save you time and help you maintain organization throughout tax season.

-

Is there a cost associated with using airSlate SignNow for the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs. Our cost-effective solutions streamline document handling, making it affordable for businesses of all sizes to manage their Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri and other essential documents.

-

Can I integrate airSlate SignNow with other software for tax reporting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software solutions. This allows you to streamline your workflow for preparing the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri and synchronize data across different platforms.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation like the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently and stored securely, reducing the risk of errors.

-

How secure is my information with airSlate SignNow when handling tax forms?

Security is a top priority at airSlate SignNow. When handling sensitive documents like the Annual Reconciliation Form Rhode Island Division of Taxation RI Tax Ri, we utilize advanced encryption protocols and strict access controls to ensure that your information remains protected throughout the signing and storage process.

Get more for Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri

Find out other Annual Reconciliation Form Rhode Island Division Of Taxation RI Tax Ri

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now