Wi Homestead Form 2017

What is the Wi Homestead Form

The Wi Homestead Form is a crucial document used in Wisconsin for property tax relief. It allows eligible homeowners to apply for a property tax credit based on their income and the value of their home. This form is designed to assist individuals and families in reducing their property tax burden, making homeownership more affordable. The program aims to support low- to moderate-income homeowners by providing financial relief, which can be particularly beneficial for those on fixed incomes or experiencing financial hardships.

How to use the Wi Homestead Form

Using the Wi Homestead Form involves several straightforward steps. First, gather all necessary information, including your income details, property value, and any relevant documentation that supports your eligibility. Next, fill out the form accurately, ensuring that all sections are completed. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified instructions, which may include online submission, mailing, or in-person delivery to your local tax office.

Steps to complete the Wi Homestead Form

Completing the Wi Homestead Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Wi Homestead Form from the appropriate state website or local tax office.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your household income, ensuring you include all sources of income.

- Report the assessed value of your property as indicated on your property tax statement.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form by the deadline, ensuring you keep a copy for your records.

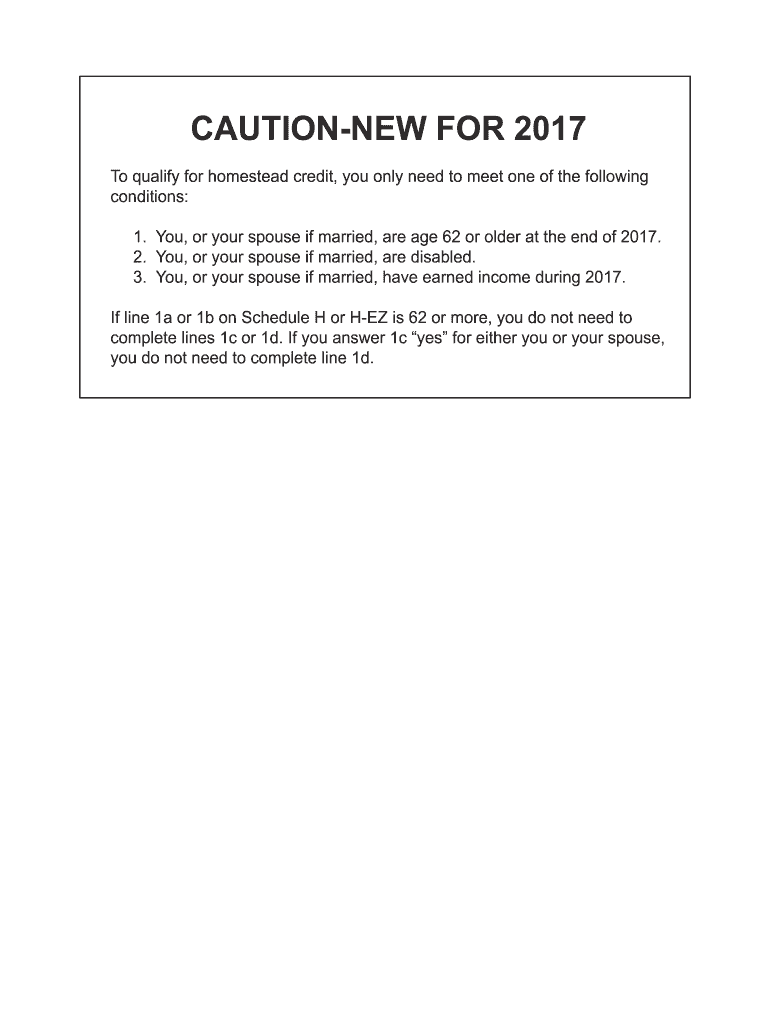

Eligibility Criteria

To qualify for the benefits associated with the Wi Homestead Form, applicants must meet specific eligibility criteria. Generally, you must be a Wisconsin resident and the owner of the property for which you are applying. Additionally, there are income limits that vary based on household size. It is essential to review the current income thresholds and other requirements, such as age or disability status, to ensure you meet all conditions before applying.

Required Documents

When completing the Wi Homestead Form, certain documents are typically required to substantiate your application. These may include:

- Proof of income, such as pay stubs, tax returns, or Social Security statements.

- Documentation of property ownership, including the deed or property tax statement.

- Any additional forms or schedules that may be required based on your specific situation.

Having these documents ready will facilitate a smoother application process and help ensure that your form is processed efficiently.

Form Submission Methods

The Wi Homestead Form can be submitted through various methods, providing flexibility for applicants. Common submission options include:

- Online submission through the state’s tax portal, if available.

- Mailing the completed form to your local tax office.

- Delivering the form in person to the appropriate tax authority.

Be sure to check the specific submission guidelines and deadlines to ensure your application is considered timely.

Quick guide on how to complete 2017 wi homestead form

Complete Wi Homestead Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly without hassle. Handle Wi Homestead Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to alter and eSign Wi Homestead Form effortlessly

- Locate Wi Homestead Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure private information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your edits.

- Select your preferred method for sharing your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of locating forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Wi Homestead Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 wi homestead form

Create this form in 5 minutes!

How to create an eSignature for the 2017 wi homestead form

How to generate an electronic signature for the 2017 Wi Homestead Form online

How to generate an eSignature for the 2017 Wi Homestead Form in Google Chrome

How to create an electronic signature for signing the 2017 Wi Homestead Form in Gmail

How to generate an eSignature for the 2017 Wi Homestead Form from your smart phone

How to make an eSignature for the 2017 Wi Homestead Form on iOS devices

How to create an electronic signature for the 2017 Wi Homestead Form on Android OS

People also ask

-

What is the Wi Homestead Form?

The Wi Homestead Form is a specific document used by property owners in Wisconsin to claim property tax benefits. By filling out the Wi Homestead Form, eligible homeowners can receive tax credits, making it an essential form for various financial advantages.

-

How does airSlate SignNow help with the Wi Homestead Form?

airSlate SignNow streamlines the process of completing and eSigning the Wi Homestead Form, removing the hassle of paper documents. With our easy-to-use platform, you can fill out, sign, and send the form securely, ensuring your documentation is both efficient and compliant.

-

Is there a cost associated with using airSlate SignNow for the Wi Homestead Form?

Yes, airSlate SignNow offers a cost-effective solution for managing documents, including the Wi Homestead Form. We provide various pricing plans to meet the needs of individuals and businesses, ensuring everyone can benefit from simplified eSigning.

-

What features does airSlate SignNow offer for the Wi Homestead Form?

With airSlate SignNow, you get features like customizable templates, secure signing, and integrated reminders for the Wi Homestead Form. These tools enhance productivity and ensure you never miss critical deadlines related to property tax benefits.

-

Can I integrate airSlate SignNow with other platforms for the Wi Homestead Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to automate workflows involving the Wi Homestead Form. Whether you use CRM systems or project management tools, you can streamline document processes effortlessly.

-

What benefits can I expect from using airSlate SignNow for my Wi Homestead Form?

Using airSlate SignNow for your Wi Homestead Form means saving time and reducing paperwork hassles. You’ll enjoy increased efficiency, enhanced security for your documents, and improved compliance with local tax regulations.

-

How secure is my information when I use airSlate SignNow for the Wi Homestead Form?

Security is a top priority at airSlate SignNow. When you eSign the Wi Homestead Form, your information is encrypted and stored securely, ensuring both your personal data and signed documents are protected from unauthorized access.

Get more for Wi Homestead Form

Find out other Wi Homestead Form

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself