I 010 Form 1, Wisconsin Income Tax Fillable 2022

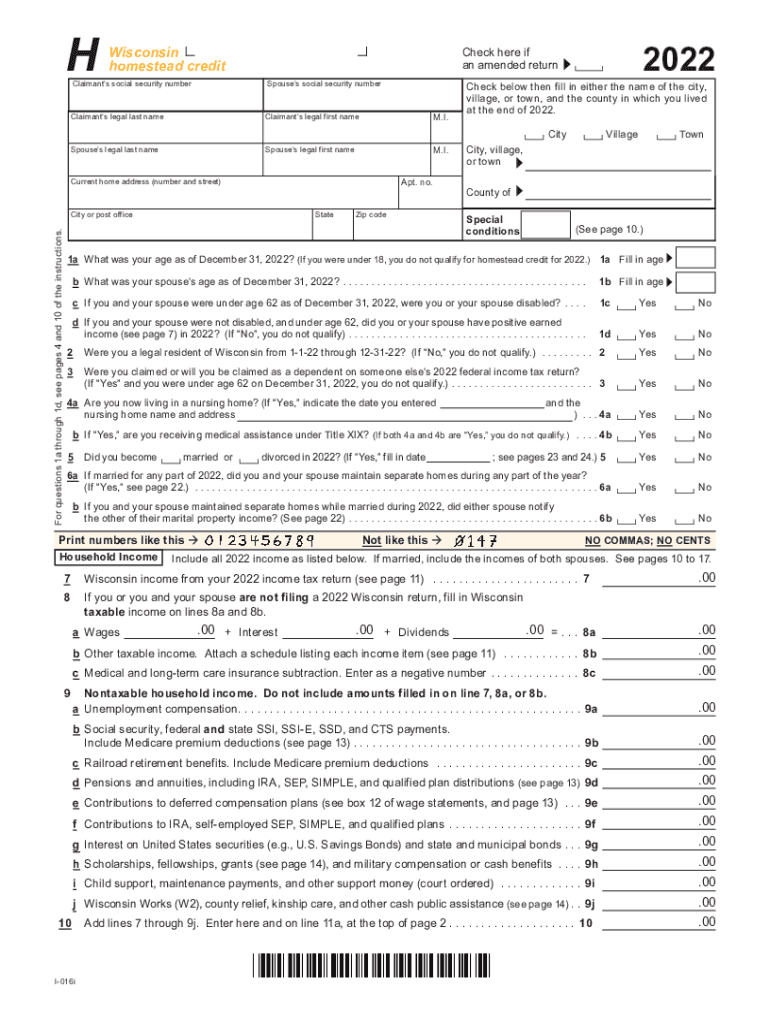

What is the Wisconsin Homestead Credit Form 2023?

The Wisconsin Homestead Credit Form 2023 is a tax document that allows eligible residents to claim a credit on their state income tax. This credit is designed to assist low-income homeowners and renters by reducing their property tax burden. The form is officially known as the H EZ Form and is essential for those who qualify based on income and residency criteria. Understanding the purpose and eligibility requirements of this form is crucial for maximizing benefits.

Eligibility Criteria for the Wisconsin Homestead Credit

To qualify for the Wisconsin Homestead Credit, applicants must meet specific criteria, including:

- Being a resident of Wisconsin for the entire tax year.

- Age 18 or older, or being a dependent of a qualifying individual.

- Meeting income limits set by the state, which vary annually.

- Owning or renting a home that is your primary residence.

Reviewing these criteria before completing the form can help ensure that applicants do not miss out on potential benefits.

Steps to Complete the Wisconsin Homestead Credit Form 2023

Completing the Wisconsin Homestead Credit Form involves several steps to ensure accuracy and compliance:

- Gather necessary documentation, such as proof of income and residency.

- Obtain the wisconsin homestead credit form 2023 printable from a reliable source.

- Fill out the form, providing accurate information regarding income, property taxes, and residency.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline, either electronically or by mail.

Following these steps can help streamline the application process and improve the likelihood of approval.

Form Submission Methods for the Wisconsin Homestead Credit

The Wisconsin Homestead Credit Form can be submitted through various methods, providing flexibility for applicants:

- Online Submission: Eligible individuals can submit the form electronically through the Wisconsin Department of Revenue's website.

- Mail Submission: Completed forms can also be printed and mailed to the appropriate tax office.

- In-Person Submission: Applicants may choose to deliver their forms directly to local tax offices for processing.

Choosing the right submission method can depend on personal preference and the urgency of processing.

Required Documents for the Wisconsin Homestead Credit Form

When completing the Wisconsin Homestead Credit Form, applicants must provide several supporting documents to verify their eligibility:

- Proof of income, such as W-2 forms or tax returns.

- Documentation of property taxes paid, which may include tax bills or receipts.

- Identification that verifies residency, such as a driver's license or utility bills.

Having these documents ready can facilitate a smoother application process and help avoid delays.

Legal Use of the Wisconsin Homestead Credit Form

The Wisconsin Homestead Credit Form is legally binding when completed and submitted according to state guidelines. It is important for applicants to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or denial of the credit. The form must comply with state laws regarding income reporting and residency verification.

Quick guide on how to complete 2022 i 010 form 1 wisconsin income tax fillable

Complete I 010 Form 1, Wisconsin Income Tax fillable effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Handle I 010 Form 1, Wisconsin Income Tax fillable on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and eSign I 010 Form 1, Wisconsin Income Tax fillable without hassle

- Find I 010 Form 1, Wisconsin Income Tax fillable and click on Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your convenience. Edit and eSign I 010 Form 1, Wisconsin Income Tax fillable and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 i 010 form 1 wisconsin income tax fillable

Create this form in 5 minutes!

How to create an eSignature for the 2022 i 010 form 1 wisconsin income tax fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin homestead credit form 2023 printable used for?

The Wisconsin homestead credit form 2023 printable is utilized by homeowners in Wisconsin to apply for property tax relief through the homestead credit program. This form helps eligible residents claim credits based on their property taxes and income, ensuring they receive the financial assistance they deserve.

-

How can I obtain the Wisconsin homestead credit form 2023 printable?

You can easily access the Wisconsin homestead credit form 2023 printable by visiting the Wisconsin Department of Revenue's official website. Additionally, airSlate SignNow offers PDF forms that can be filled out and signed electronically, making the process even more convenient.

-

Is there a fee associated with the Wisconsin homestead credit form 2023 printable?

The Wisconsin homestead credit form 2023 printable itself does not have a fee; however, there may be costs associated with filing or additional services you choose. Utilizing airSlate SignNow provides a cost-effective solution for eSigning and submitting documents online without hidden fees.

-

Can I fill out the Wisconsin homestead credit form 2023 printable online?

Yes, the Wisconsin homestead credit form 2023 printable can be filled out online using airSlate SignNow's platform. Our user-friendly interface allows you to complete, sign, and send your forms digitally, enhancing the convenience of the filing process.

-

What features does airSlate SignNow provide for the Wisconsin homestead credit form 2023 printable?

airSlate SignNow offers a range of features for the Wisconsin homestead credit form 2023 printable, including electronic signatures, form templates, and secure document storage. These features streamline the process, making it easier to manage your paperwork efficiently.

-

Are there benefits to using airSlate SignNow for the Wisconsin homestead credit form 2023 printable?

Using airSlate SignNow for the Wisconsin homestead credit form 2023 printable provides numerous benefits, including time savings, improved accuracy, and easy accessibility. You can complete your forms quickly and securely from any device without the hassle of printing and mailing.

-

Can I track my submission of the Wisconsin homestead credit form 2023 printable with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the submission status of your Wisconsin homestead credit form 2023 printable. You will receive notifications once your form is signed and sent, ensuring you stay updated on your application's progress.

Get more for I 010 Form 1, Wisconsin Income Tax fillable

Find out other I 010 Form 1, Wisconsin Income Tax fillable

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter