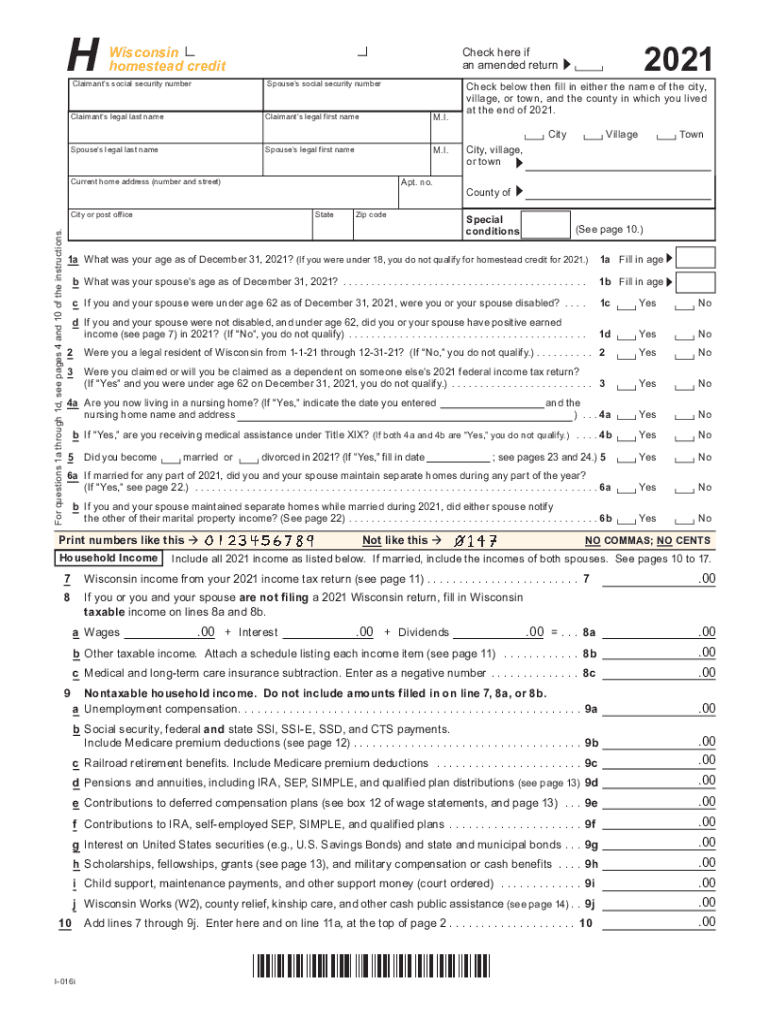

I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit 2021

What is the I-016 Schedule H, Wisconsin Homestead Credit?

The I-016 Schedule H is a crucial form used in Wisconsin to apply for the Homestead Credit. This credit is designed to provide property tax relief to eligible homeowners and renters in the state. By completing this form, individuals can claim a credit based on their property taxes or rent paid, which helps to alleviate the financial burden associated with housing costs. Understanding the purpose and significance of this form is essential for anyone looking to benefit from the Wisconsin Homestead Credit.

Eligibility Criteria for the I-016 Schedule H

To qualify for the Wisconsin Homestead Credit, applicants must meet specific eligibility requirements. These include:

- Being a resident of Wisconsin for the entire year.

- Owning or renting a home in the state.

- Meeting income limits set by the state.

- Being at least eighteen years old or being an emancipated minor.

It is important for applicants to review these criteria carefully to ensure they qualify before submitting the I-016 Schedule H.

Steps to Complete the I-016 Schedule H

Completing the I-016 Schedule H involves several steps to ensure accuracy and compliance. Here’s a brief overview of the process:

- Gather necessary documents, including proof of income, property tax statements, and rental agreements.

- Fill out the form with accurate personal information, including your name, address, and income details.

- Calculate your credit amount based on the guidelines provided in the form.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate state department by the deadline.

Following these steps can help ensure a smooth application process for the Wisconsin Homestead Credit.

Form Submission Methods for the I-016 Schedule H

The I-016 Schedule H can be submitted through various methods, providing flexibility for applicants. The available options include:

- Online submission via the Wisconsin Department of Revenue's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local government offices, if necessary.

Choosing the right submission method can help expedite the processing of your Homestead Credit application.

Required Documents for the I-016 Schedule H

When completing the I-016 Schedule H, certain documents are required to support your application. These typically include:

- Proof of income, such as W-2 forms or tax returns.

- Property tax bills or rent receipts.

- Identification documents, if necessary.

Having these documents ready can streamline the application process and ensure that all necessary information is provided.

Filing Deadlines for the I-016 Schedule H

Applicants should be aware of the filing deadlines associated with the I-016 Schedule H to ensure timely submission. Typically, the deadline for filing this form is set for a specific date each year, often coinciding with the tax filing deadline. It is essential to check the current year's deadlines to avoid any penalties or missed opportunities for claiming the Homestead Credit.

Quick guide on how to complete 2021 i 016 schedule h wisconsin homestead credit schedule h wisconsin homestead credit

Prepare I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-conscious alternative to conventional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Manage I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit with ease

- Find I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or errors requiring printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit and guarantee superior communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 i 016 schedule h wisconsin homestead credit schedule h wisconsin homestead credit

Create this form in 5 minutes!

People also ask

-

What is the h homestead credit?

The h homestead credit is a tax benefit that allows eligible homeowners to reduce their property taxes. It is designed to promote homeownership and provide financial relief to homeowners. Understanding the h homestead credit can help you save signNowly on your taxes.

-

How can airSlate SignNow help with the h homestead credit application process?

airSlate SignNow streamlines the application process for the h homestead credit by enabling users to easily create, send, and eSign necessary documents. Our intuitive platform simplifies document management, ensuring that your application is submitted accurately and on time. With airSlate SignNow, applying for the h homestead credit is efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the h homestead credit?

airSlate SignNow offers a cost-effective solution for managing documents related to the h homestead credit. We provide flexible pricing plans to cater to various needs, ensuring that users can find a solution that fits their budget. Our affordable plans give you access to premium features without the high costs typically associated with document signing services.

-

What features does airSlate SignNow offer for managing h homestead credit documents?

Our platform includes features such as advanced eSigning, document templates, and cloud storage, all tailored for h homestead credit applications. You can easily track the status of your documents and receive notifications when they are signed. Additionally, these features enhance your document management efficiency for the h homestead credit and beyond.

-

Can I integrate airSlate SignNow with other tools for h homestead credit management?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms to enhance your workflow. You can connect our solution with project management, CRM, and accounting software to streamline your h homestead credit document processes. These integrations enable a more cohesive approach to managing your important documents.

-

What are the benefits of using airSlate SignNow for the h homestead credit?

Using airSlate SignNow for the h homestead credit provides a number of benefits, including time savings, improved accuracy, and enhanced security. Our platform allows for faster processing of documents, which is critical for meeting application deadlines. Additionally, the electronic signature feature ensures that your documents are secure and legally binding.

-

How do I create documents for the h homestead credit with airSlate SignNow?

Creating documents for the h homestead credit with airSlate SignNow is straightforward. Simply choose from our existing templates or create custom documents tailored to your needs. The user-friendly interface guides you through adding necessary information, streamlining the document creation process for h homestead credit applications.

Get more for I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit

- Nh corporation 497318524 form

- Nh agreement form

- Nh bylaws form

- Corporate records maintenance package for existing corporations new hampshire form

- Nh llc form

- Limited liability company llc operating agreement new hampshire form

- Single member limited liability company llc operating agreement new hampshire form

- Nh pllc form

Find out other I 016 Schedule H, Wisconsin Homestead Credit Schedule H Wisconsin Homestead Credit

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney