Florida Ds De 104 Form

What is the Florida Ds De 104 Form

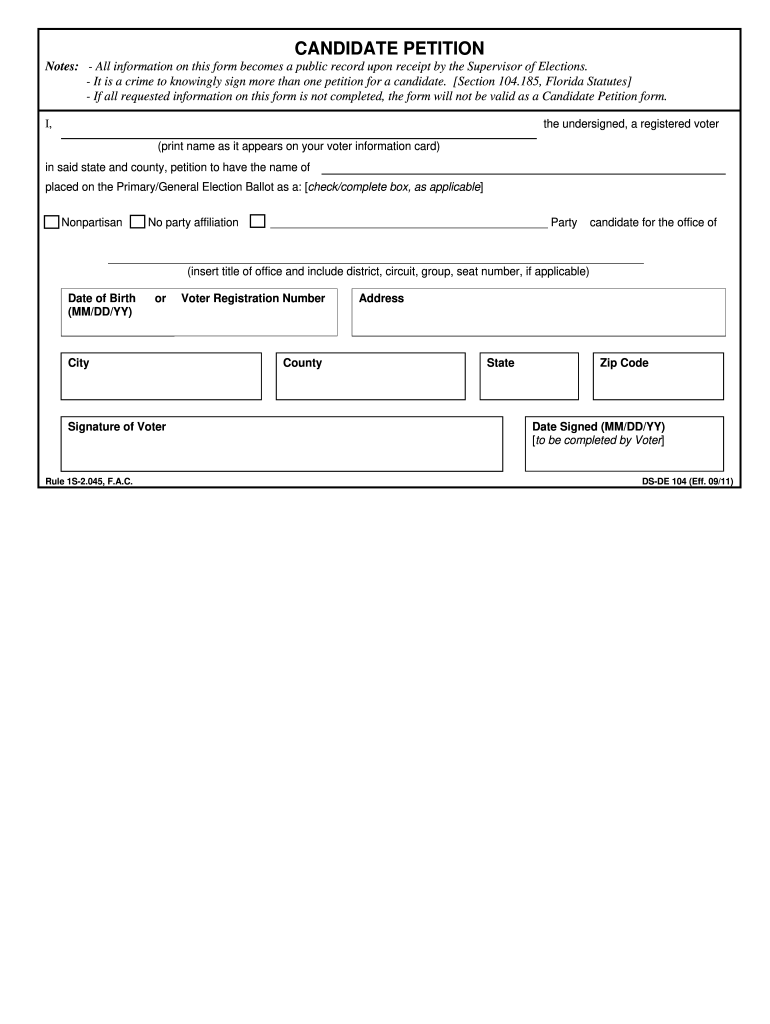

The Florida Ds De 104 form is a candidate petition form used in the state of Florida. It serves as an official document for individuals seeking to qualify for election to various offices. This form is essential for candidates who wish to gather signatures from registered voters to support their candidacy. By submitting the Ds De 104, candidates demonstrate their commitment to the electoral process and compliance with state regulations.

How to use the Florida Ds De 104 Form

Using the Florida Ds De 104 form involves several steps to ensure proper completion and submission. Candidates must first download the blank Ds De 104 form from an official source. Once obtained, candidates can begin collecting signatures from registered voters. It is important to follow the guidelines provided with the form, ensuring that all required information is accurately filled out. After collecting the necessary signatures, candidates must submit the completed form to the appropriate election office by the specified deadline.

Steps to complete the Florida Ds De 104 Form

Completing the Florida Ds De 104 form requires careful attention to detail. Here are the key steps:

- Download the blank Ds De 104 form from a reliable source.

- Fill in the candidate's name and the office they are seeking.

- Gather signatures from registered voters, ensuring that each signature is valid and legible.

- Verify that all required fields are completed, including the date and the candidate's contact information.

- Submit the form to the designated election office before the deadline.

Legal use of the Florida Ds De 104 Form

The Florida Ds De 104 form is legally binding when completed and submitted according to state laws. It is crucial for candidates to understand the legal implications of their signatures and the signatures collected from voters. The form must adhere to the regulations set forth by the Florida Division of Elections to ensure that it is recognized as valid. Failure to comply with these regulations may result in disqualification from the election process.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Ds De 104 form are critical for candidates. Each election cycle has specific dates by which the form must be submitted to ensure eligibility. Candidates should check the Florida Division of Elections website for the most current deadlines. Missing these dates can result in disqualification from the election, making it essential for candidates to stay informed and organized throughout the process.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Florida Ds De 104 form can be done through various methods, depending on the preferences of the candidate and the regulations of the local election office. Candidates may have the option to submit the form online, by mail, or in person. Each method has its own set of requirements, so it is advisable for candidates to confirm the preferred submission method with their local election office to ensure compliance.

Quick guide on how to complete florida ds de 104 form

Complete Florida Ds De 104 Form effortlessly on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Florida Ds De 104 Form on any platform using the airSlate SignNow Android or iOS apps and simplify any document-based task today.

How to modify and electronically sign Florida Ds De 104 Form with ease

- Find Florida Ds De 104 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the specialized tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Florida Ds De 104 Form and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

Is it okay to pay visa fees before filling out the DS-160 form?

No you can’t make visa fee before submitting the DS-160, because once you submit the DS-160 form, it send a email to you with submission confirmation number which is important to synch the payments under your application. Bother how will they ever know who paid for which application.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the florida ds de 104 form

How to generate an eSignature for the Florida Ds De 104 Form online

How to create an eSignature for the Florida Ds De 104 Form in Google Chrome

How to generate an eSignature for signing the Florida Ds De 104 Form in Gmail

How to create an eSignature for the Florida Ds De 104 Form straight from your smart phone

How to generate an electronic signature for the Florida Ds De 104 Form on iOS

How to generate an eSignature for the Florida Ds De 104 Form on Android

People also ask

-

What is a 104 form and how is it used?

The 104 form, commonly known as the IRS Form 1040, is used for individual income tax filing in the United States. It allows taxpayers to report their income, claim deductions, and calculate their tax liabilities. Understanding the 104 form is essential for effectively managing your taxes, and airSlate SignNow simplifies the process of signing and sharing this document securely.

-

How can airSlate SignNow help with the 104 form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 104 form, making tax filing faster and more convenient. With its user-friendly interface, you can easily manage your documents, reducing the chances of errors and ensuring a smooth submission process. Our eSignature solution ensures that your 104 form is signed and sent securely.

-

Is airSlate SignNow cost-effective for handling the 104 form?

Yes, airSlate SignNow offers competitive pricing that makes it an affordable solution for individuals and businesses alike. By eliminating the need for paper, printing, and mailing costs associated with the 104 form, you save money and time. Choose from various plans that fit your needs without compromising on features.

-

What features does airSlate SignNow offer for the 104 form?

airSlate SignNow includes features like customizable templates, secure storage, and document tracking specifically for the 104 form. These features enhance the preparation and submission process, allowing users to manage their tax documents more effectively. Additionally, the platform supports multiple file formats, facilitating easy uploads of your tax-related documents.

-

Can I integrate airSlate SignNow with my accounting software for the 104 form?

Absolutely! airSlate SignNow offers integrations with popular accounting software, which streamlines the process of preparing and submitting your 104 form. This allows for seamless data transfer, ensuring that all relevant information is accurately captured. By connecting your tools, you'll simplify your tax filing experience and improve efficiency.

-

What are the benefits of using airSlate SignNow for the 104 form?

Using airSlate SignNow for the 104 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. With e-signatures, you can speed up the signing process while ensuring compliance with legal standards. Additionally, airSlate SignNow provides a simple way to store and access your documents at any time.

-

How secure is airSlate SignNow when handling the 104 form?

Security is a top priority at airSlate SignNow. We use advanced encryption technology to protect your sensitive information, including the data within your 104 form. Our platform also complies with industry regulations, ensuring that your documents are safe and secure throughout the signing and storage process.

Get more for Florida Ds De 104 Form

Find out other Florida Ds De 104 Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document