California Tax Form 2019

What is the California Tax Form

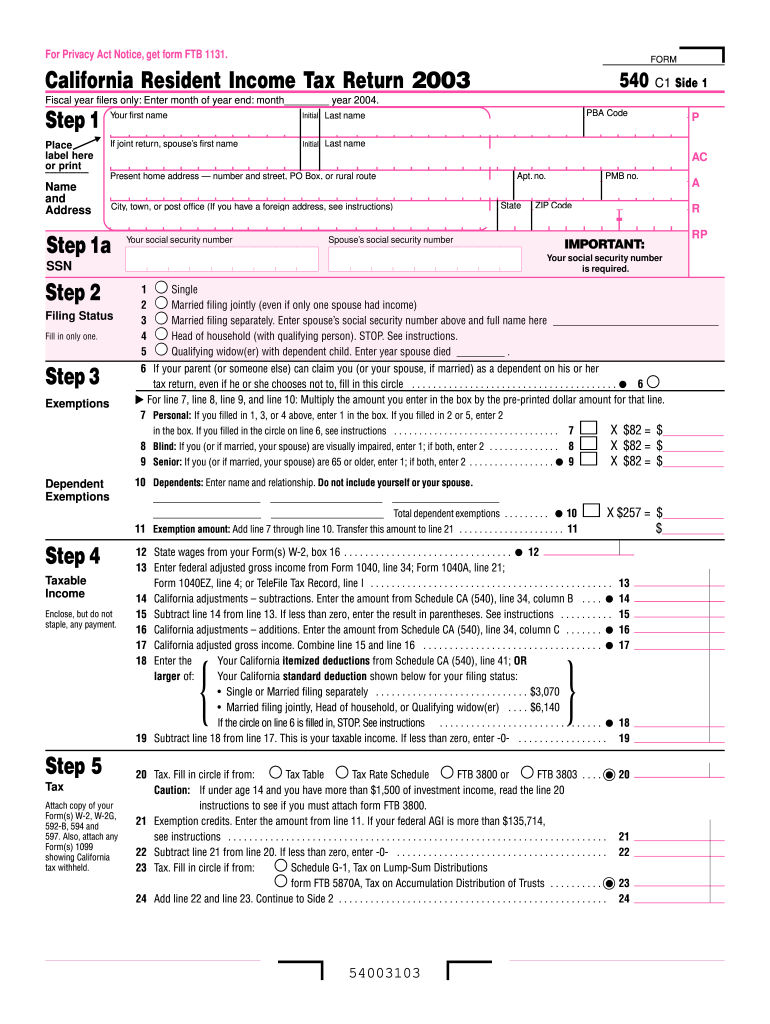

The California Tax Form is an essential document used by residents and businesses in California to report income, claim deductions, and calculate tax liabilities. This form is part of the state's tax system, which is administered by the California Franchise Tax Board (FTB). Various types of California Tax Forms exist, including personal income tax forms, corporate tax forms, and sales tax forms, each tailored to specific taxpayer needs.

How to use the California Tax Form

Using the California Tax Form involves several steps, starting with gathering necessary financial information. Taxpayers must accurately report their income, deductions, and credits on the appropriate form. After completing the form, individuals can submit it either electronically or via mail. It's important to ensure that all information is correct to avoid delays or penalties.

Steps to complete the California Tax Form

Completing the California Tax Form requires careful attention to detail. Here are the key steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Choose the correct form based on your filing status and income type.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income and claim any deductions or credits you qualify for.

- Review the completed form for accuracy before submission.

Legal use of the California Tax Form

The California Tax Form is legally binding when filled out and submitted according to state regulations. To ensure compliance, taxpayers must adhere to guidelines set forth by the California Franchise Tax Board. This includes using the correct form for their specific tax situation and providing accurate information to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the California Tax Form vary based on the type of tax being reported. Typically, personal income tax returns are due on April 15 each year, while extensions may be available. It is crucial to stay informed about these dates to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the California Tax Form. The most common methods include:

- Online Submission: Many taxpayers choose to file electronically through the California Franchise Tax Board's website or approved e-filing software.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the FTB.

- In-Person: Some taxpayers may prefer to submit their forms in person at designated FTB offices.

Quick guide on how to complete 2003 california tax form

Effortlessly prepare California Tax Form on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources you need to create, adjust, and electronically sign your documents quickly without any delays. Manage California Tax Form on any device using the airSlate SignNow apps available for Android and iOS and enhance any document-driven process today.

How to modify and electronically sign California Tax Form effortlessly

- Find California Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, laborious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign California Tax Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2003 california tax form

Create this form in 5 minutes!

How to create an eSignature for the 2003 california tax form

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a California Tax Form and how can airSlate SignNow help?

A California Tax Form is a document required for tax filing in California, detailing income and deductions. airSlate SignNow simplifies the process of digitally signing and submitting these forms, ensuring compliance and saving you time. With our user-friendly platform, you can easily manage your California Tax Form electronically.

-

How much does it cost to use airSlate SignNow for California Tax Form signing?

airSlate SignNow offers flexible pricing plans to fit your needs, starting at a competitive rate. The cost includes unlimited electronic signatures, making it a cost-effective solution for managing California Tax Forms. You can choose from monthly or annual subscriptions to maximize your savings.

-

Can I integrate airSlate SignNow with other software for my California Tax Form processes?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. These integrations allow you to streamline the collection and processing of California Tax Forms within your existing workflows. This enhances efficiency and reduces the chance of errors.

-

What features does airSlate SignNow offer for handling California Tax Forms?

airSlate SignNow offers features like customizable templates, automatic reminders, and secure storage for your California Tax Forms. These tools help you manage your documents effectively and ensure that you never miss a submission deadline. Additionally, our robust security measures keep your sensitive tax information safe.

-

Is airSlate SignNow compliant with California tax regulations?

Yes, airSlate SignNow is compliant with California tax regulations, ensuring that your California Tax Form signatures are legally binding. Our platform adheres to industry standards and offers an audit trail for added security. This means you can trust that your documents are processed in accordance with the law.

-

How can I ensure my California Tax Form is signed promptly using airSlate SignNow?

To ensure your California Tax Form is signed promptly, you can utilize our automatic reminder feature. This feature sends notifications to signers, prompting them to complete the necessary actions without delay. It helps keep the process on track and prevents last-minute rushes.

-

Can I track the status of my California Tax Form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your California Tax Form in real time. You can see when documents are viewed, signed, and completed, giving you peace of mind that everything is progressing smoothly.

Get more for California Tax Form

Find out other California Tax Form

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later