Form 3523 Credit 2019

What is the Form 3523 Credit

The Form 3523 Credit is a tax form utilized by businesses to claim a specific tax credit. This form is designed to help eligible entities reduce their overall tax liability by providing documentation of qualified expenses. Understanding the purpose and function of this form is essential for businesses aiming to maximize their tax benefits. The credit can vary based on specific criteria, including the type of business and the nature of the expenses incurred.

How to use the Form 3523 Credit

Using the Form 3523 Credit involves several steps to ensure accurate completion and submission. First, gather all necessary documentation that supports the claim, including receipts and records of eligible expenses. Next, fill out the form with the required information, ensuring that all details are accurate and complete. After completing the form, it can be submitted either electronically or by mail, depending on the guidelines provided by the IRS. It is crucial to keep copies of the submitted form and supporting documents for your records.

Steps to complete the Form 3523 Credit

Completing the Form 3523 Credit requires careful attention to detail. Follow these steps for a successful submission:

- Review the eligibility criteria to ensure your business qualifies for the credit.

- Collect all relevant documentation, including invoices and receipts.

- Fill out the form accurately, entering all necessary information in the designated fields.

- Double-check the completed form for any errors or omissions.

- Submit the form electronically through the IRS website or mail it to the appropriate address.

Legal use of the Form 3523 Credit

The legal use of the Form 3523 Credit is governed by IRS regulations. To ensure compliance, businesses must adhere to all guidelines associated with the credit. This includes accurately reporting eligible expenses and maintaining proper documentation. Failure to comply with these regulations may result in penalties or denial of the credit. It is advisable for businesses to consult with a tax professional to navigate the legal requirements effectively.

Eligibility Criteria

To qualify for the Form 3523 Credit, businesses must meet specific eligibility criteria set forth by the IRS. These criteria typically include the type of business entity, the nature of the expenses incurred, and adherence to any relevant tax laws. Additionally, businesses must ensure that they have proper documentation to support their claims. Understanding these criteria is vital for ensuring that the credit can be successfully claimed.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3523 Credit are crucial for businesses to observe. Typically, the form must be submitted by the tax filing deadline for the year in which the expenses were incurred. It is important to stay informed about any changes to deadlines that may occur due to IRS updates or changes in tax law. Missing the deadline can result in the inability to claim the credit for that tax year.

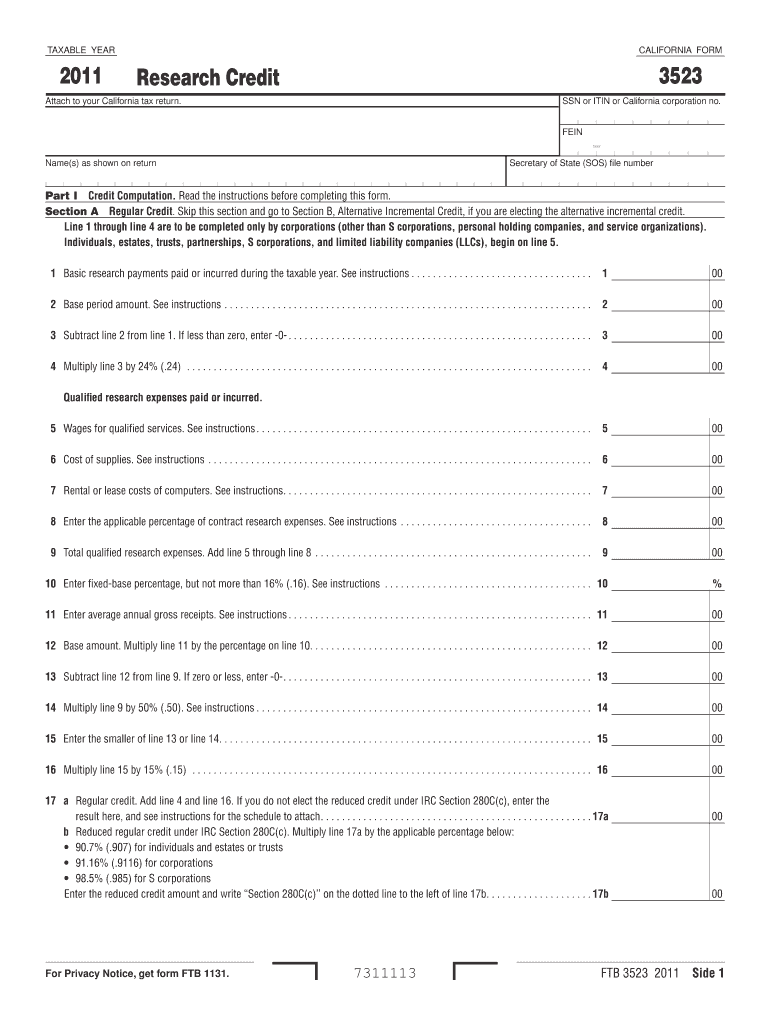

Quick guide on how to complete form 3523 credit 2011

Prepare Form 3523 Credit effortlessly on any device

Digital document management has gained increased popularity among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the features necessary to draft, modify, and eSign your documents quickly without delays. Manage Form 3523 Credit on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to alter and eSign Form 3523 Credit with ease

- Locate Form 3523 Credit and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 3523 Credit and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3523 credit 2011

Create this form in 5 minutes!

How to create an eSignature for the form 3523 credit 2011

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 3523 Credit?

Form 3523 Credit is a tax form used to claim credit for environmentally beneficial practices. It can help businesses reduce their tax liability and is essential for those looking to benefit from specific state or federal incentives related to sustainability.

-

How can airSlate SignNow help with Form 3523 Credit submissions?

With airSlate SignNow, businesses can easily send and eSign documents related to Form 3523 Credit submissions. Our platform ensures a seamless workflow, allowing you to quickly manage all necessary paperwork and signatures, ultimately speeding up the submission process.

-

Is there a cost associated with using airSlate SignNow for Form 3523 Credit?

Yes, airSlate SignNow offers competitively priced plans that can cater to businesses of different sizes. The cost of using our platform for Form 3523 Credit includes features that enhance document management and electronic signatures, making it a cost-effective choice.

-

What features does airSlate SignNow provide for Form 3523 Credit documentation?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure storage for your Form 3523 Credit documentation. These tools streamline the process of preparing and signing your forms, enhancing efficiency and compliance.

-

What are the benefits of using airSlate SignNow for Form 3523 Credit?

Using airSlate SignNow for Form 3523 Credit provides numerous benefits, including time savings, improved accuracy, and enhanced security. The intuitive interface allows users to quickly navigate the eSigning process, ensuring that your forms are completed correctly and efficiently.

-

Can airSlate SignNow integrate with other software for Form 3523 Credit processing?

Yes, airSlate SignNow offers integrations with various business applications that can improve your Form 3523 Credit processing. This means you can synchronize data between our platform and your existing systems, optimizing your workflow and reducing redundancy.

-

How secure is airSlate SignNow for handling Form 3523 Credit documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Form 3523 Credit. Our platform adheres to industry-standard security protocols, including encryption and secure cloud storage, to protect your data throughout the signing process.

Get more for Form 3523 Credit

Find out other Form 3523 Credit

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form