593 V Form California Franchise Tax Board Ftb Ca 2021

What is the 593 V Form California Franchise Tax Board Ftb Ca

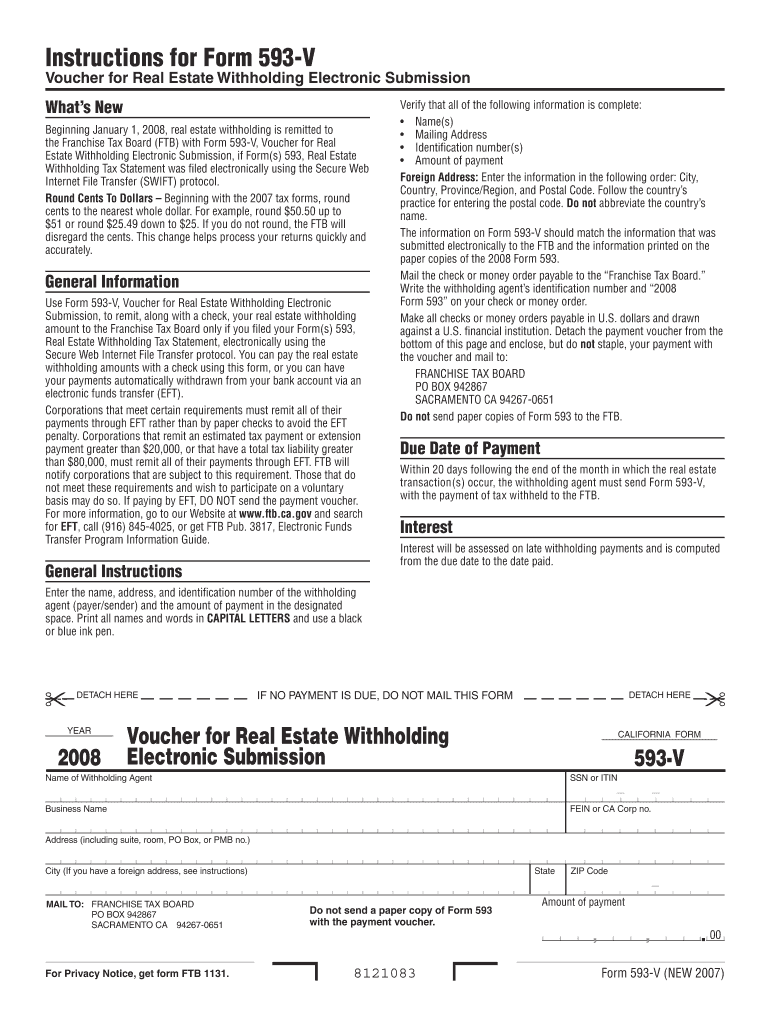

The 593 V Form, issued by the California Franchise Tax Board (FTB), is a crucial document used primarily for reporting the withholding of California state income tax. This form is typically utilized by payers who are required to report and remit withholding amounts for nonresident individuals and entities. The form helps ensure compliance with California tax laws and assists in the accurate reporting of income and tax withheld. Understanding the purpose and function of the 593 V Form is essential for both taxpayers and businesses operating in California.

Steps to complete the 593 V Form California Franchise Tax Board Ftb Ca

Completing the 593 V Form involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary information, including the payer's details and the recipient's information. Next, accurately fill out the form by providing the required data, such as the total amount withheld and any applicable exemptions. After completing the form, review it for errors to avoid potential penalties. Finally, submit the form to the California Franchise Tax Board by the specified deadline, ensuring that all information is correct and complete.

How to obtain the 593 V Form California Franchise Tax Board Ftb Ca

The 593 V Form can be easily obtained from the California Franchise Tax Board's official website. Users can download the form directly in PDF format, allowing for easy access and printing. Additionally, physical copies may be available at select FTB offices or through authorized tax professionals. It is advisable to ensure you have the most current version of the form to comply with any updates or changes in tax regulations.

Legal use of the 593 V Form California Franchise Tax Board Ftb Ca

The legal use of the 593 V Form is essential for ensuring compliance with California tax laws. This form serves as a formal declaration of tax withheld on payments made to nonresidents. Proper completion and submission of the form help protect both the payer and the recipient from potential legal issues related to tax withholding. It is important to understand the legal implications of the information reported on the form, as inaccuracies may lead to penalties or audits by the California Franchise Tax Board.

Key elements of the 593 V Form California Franchise Tax Board Ftb Ca

Key elements of the 593 V Form include the payer's identification information, the recipient's details, and the amount of tax withheld. The form also requires specific codes that indicate the type of payment made and any exemptions that may apply. Understanding these elements is crucial for accurate reporting and compliance with state tax regulations. Each section of the form must be filled out carefully to ensure that all necessary information is provided.

Filing Deadlines / Important Dates

Filing deadlines for the 593 V Form are critical for compliance with California tax law. Typically, the form must be submitted by the end of the month following the payment to the nonresident. It is important to stay informed about any changes to these deadlines, as failure to file on time may result in penalties. Keeping a calendar of important dates can help ensure that all forms are submitted promptly and accurately.

Form Submission Methods (Online / Mail / In-Person)

The 593 V Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online through the California Franchise Tax Board's e-file system, which offers a secure and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate FTB address or delivered in person at designated offices. Each submission method has its own guidelines, so it is essential to follow the instructions provided by the FTB to ensure successful filing.

Quick guide on how to complete 593 v form california franchise tax board ftb ca

Effortlessly complete 593 V Form California Franchise Tax Board Ftb Ca on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 593 V Form California Franchise Tax Board Ftb Ca on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign 593 V Form California Franchise Tax Board Ftb Ca with ease

- Find 593 V Form California Franchise Tax Board Ftb Ca and select Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 593 V Form California Franchise Tax Board Ftb Ca and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 593 v form california franchise tax board ftb ca

Create this form in 5 minutes!

How to create an eSignature for the 593 v form california franchise tax board ftb ca

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the 593 V Form California Franchise Tax Board Ftb Ca?

The 593 V Form California Franchise Tax Board Ftb Ca is a document used by California taxpayers to report and pay withholding taxes when income is earned from California sources. This form is essential for ensuring compliance with California tax laws, making it a vital tool for both individuals and businesses.

-

How can airSlate SignNow help with the 593 V Form California Franchise Tax Board Ftb Ca?

airSlate SignNow streamlines the process of completing and submitting the 593 V Form California Franchise Tax Board Ftb Ca with its intuitive eSignature features. Users can easily fill out the form, obtain necessary signatures, and securely send it to the California Franchise Tax Board, all from one platform.

-

Is there a cost to use airSlate SignNow for the 593 V Form California Franchise Tax Board Ftb Ca?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides access to essential features for managing documents, including the 593 V Form California Franchise Tax Board Ftb Ca, with competitive pricing designed to deliver value and efficiency.

-

What features does airSlate SignNow offer for the 593 V Form California Franchise Tax Board Ftb Ca?

airSlate SignNow includes features such as document templates, customizable workflows, eSigning capabilities, and secure storage designed specifically for lessening the hassle associated with the 593 V Form California Franchise Tax Board Ftb Ca. These features empower users to manage their documents effectively and efficiently.

-

Can I track the status of my 593 V Form California Franchise Tax Board Ftb Ca submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow users to monitor the status of their 593 V Form California Franchise Tax Board Ftb Ca submissions in real-time. This transparency ensures you’re always informed about the stages of your document processing.

-

Are there any integrations available with airSlate SignNow for managing the 593 V Form California Franchise Tax Board Ftb Ca?

Yes, airSlate SignNow integrates with various applications, enhancing the management of the 593 V Form California Franchise Tax Board Ftb Ca. Integrations with CRM and accounting software facilitate seamless data transfer and streamline processes, improving overall productivity.

-

How does airSlate SignNow ensure the security of the 593 V Form California Franchise Tax Board Ftb Ca?

Security is a top priority for airSlate SignNow. The platform employs robust encryption protocols and complies with data protection regulations, ensuring that your 593 V Form California Franchise Tax Board Ftb Ca and other sensitive documents remain secured against unauthorized access.

Get more for 593 V Form California Franchise Tax Board Ftb Ca

Find out other 593 V Form California Franchise Tax Board Ftb Ca

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free