T1013 PDF 2018-2026

What is the T1013 PDF?

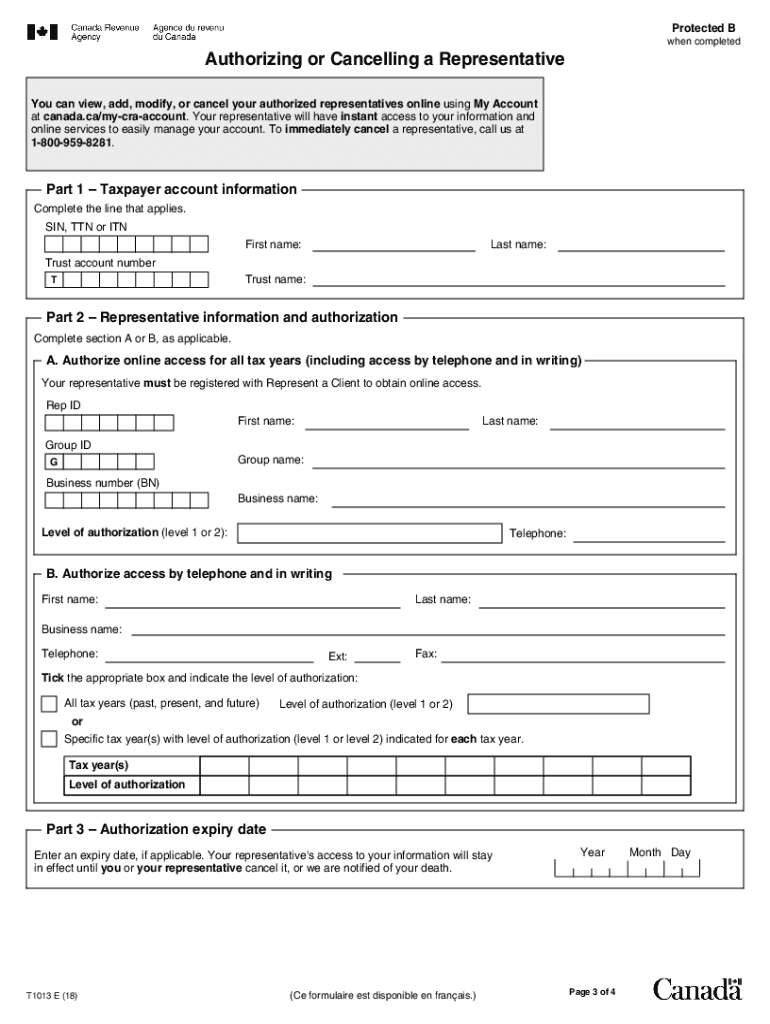

The T1013 PDF, also known as the T1013 printable form, is a document used in Canada that allows taxpayers to authorize the Canada Revenue Agency (CRA) to communicate with a representative on their behalf. This form is essential for individuals who wish to have someone else manage their tax affairs, ensuring that their representative has the necessary permissions to act in their stead. The T1013 form is particularly useful for tax professionals, accountants, or family members assisting with tax-related matters.

How to Obtain the T1013 PDF

To obtain the T1013 PDF, individuals can visit the official Canada Revenue Agency website, where the form is available for download. The form can be found in the forms and publications section, and it is provided in a fillable format, making it easy to complete electronically. Users can also request a physical copy of the form through the CRA if they prefer to fill it out by hand.

Steps to Complete the T1013 PDF

Completing the T1013 PDF involves several straightforward steps:

- Download the T1013 form from the CRA website.

- Fill in your personal information, including your name, address, and social insurance number.

- Provide the details of the representative you are authorizing, including their name and contact information.

- Indicate the specific tax years or periods for which the authorization is valid.

- Sign and date the form to confirm your consent.

Once completed, the form can be submitted to the CRA either by mail or electronically, depending on the preferences of the taxpayer.

Legal Use of the T1013 PDF

The T1013 PDF is legally binding when completed correctly and submitted according to CRA guidelines. It ensures that the designated representative can access and discuss the taxpayer's information with the CRA. To maintain compliance, it is essential to ensure that the form is filled out accurately and that the authorization is limited to the specified time frame and purposes. This legal framework protects both the taxpayer and the representative, ensuring that sensitive information is handled appropriately.

Key Elements of the T1013 PDF

Several key elements are crucial for the T1013 PDF to be valid:

- Taxpayer Information: Accurate personal details of the taxpayer must be provided.

- Representative Information: Complete details of the authorized representative are necessary.

- Authorization Scope: Clearly defined tax years or periods for which the authorization applies.

- Signature: The taxpayer's signature is required to validate the authorization.

These elements ensure that the form serves its intended purpose and complies with legal requirements.

Form Submission Methods

The T1013 PDF can be submitted to the CRA through various methods:

- Online Submission: If you are using the CRA's online services, you may be able to submit the form electronically.

- Mail: The completed form can be printed and sent to the CRA by postal mail.

- In-Person: Taxpayers may also visit a local CRA office to submit the form directly.

Choosing the appropriate submission method depends on the taxpayer's preferences and the urgency of the request.

Quick guide on how to complete t1013 pdf

Effortlessly prepare T1013 Pdf on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage T1013 Pdf on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to adjust and electronically sign T1013 Pdf with ease

- Locate T1013 Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign T1013 Pdf and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1013 pdf

Create this form in 5 minutes!

How to create an eSignature for the t1013 pdf

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the t1013 printable form?

The t1013 printable form is a specific document used by businesses when authorizing tax representatives. This form enables you to grant permission for someone to manage your tax affairs with the Canada Revenue Agency. Utilizing the t1013 printable form ensures all tax-related documents are handled correctly and efficiently.

-

How can airSlate SignNow help with the t1013 printable form?

airSlate SignNow streamlines the process of completing and signing the t1013 printable form. With our easy-to-use platform, you can fill out the form, add signatures, and securely send it to relevant parties. This increases efficiency and minimizes delays in processing your tax submissions.

-

Are there costs associated with using the t1013 printable form on airSlate SignNow?

Using the t1013 printable form on airSlate SignNow comes with a flexible pricing structure to meet different business needs. You can choose from various subscription plans that suit your budget—ensuring that you get the most value for a cost-effective solution. Regardless of the plan, our services enhance how you handle forms like the t1013.

-

What features does airSlate SignNow offer for managing the t1013 printable form?

airSlate SignNow offers several features for managing the t1013 printable form, including electronic signatures, document templates, and secure storage. Our platform allows you to track the signing process in real time, ensuring that you know the status of your form at all times. This comprehensive feature set makes managing the t1013 form straightforward and efficient.

-

Can I integrate airSlate SignNow with other applications while handling the t1013 printable form?

Yes, airSlate SignNow easily integrates with various applications, allowing you to manage the t1013 printable form alongside your favorite tools. Whether you are using CRM, cloud storage, or project management software, our integration capabilities enhance your workflow and save time. This ensures a more seamless experience in handling important documents.

-

What are the benefits of using airSlate SignNow for the t1013 printable form?

Using airSlate SignNow for the t1013 printable form provides numerous benefits, including increased speed, enhanced security, and improved organization. Electronic signatures on the form not only accelerate the process but also maintain compliance with legal standards. Furthermore, our platform ensures that all documents are stored securely, giving you peace of mind.

-

Is it easy to fill out the t1013 printable form using airSlate SignNow?

Absolutely! Filling out the t1013 printable form with airSlate SignNow is designed to be user-friendly. Our platform guides you through the process, allowing for easy data entry and signature placement, regardless of your technical skills. This simplicity helps you focus on what matters most—completing the form accurately and efficiently.

Get more for T1013 Pdf

- Fr 399qualified high technology companies formsend

- Articles of incorporation pursuant to article 1528e texas formsend

- Pa schedule c ez 2004 form

- Wr 1 formpdffillercom

- Vec fc 21 form formsend

- Form n 35 rev 2006 s corporation income tax return formsend

- Cover page bid proposal 1884 electric meters of bid form

- Beachbody coach canceling form

Find out other T1013 Pdf

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself