Employer Monthly Schedule Inland Revenue Ird Govt 2012

What is the Employer Monthly Schedule Inland Revenue Ird Govt

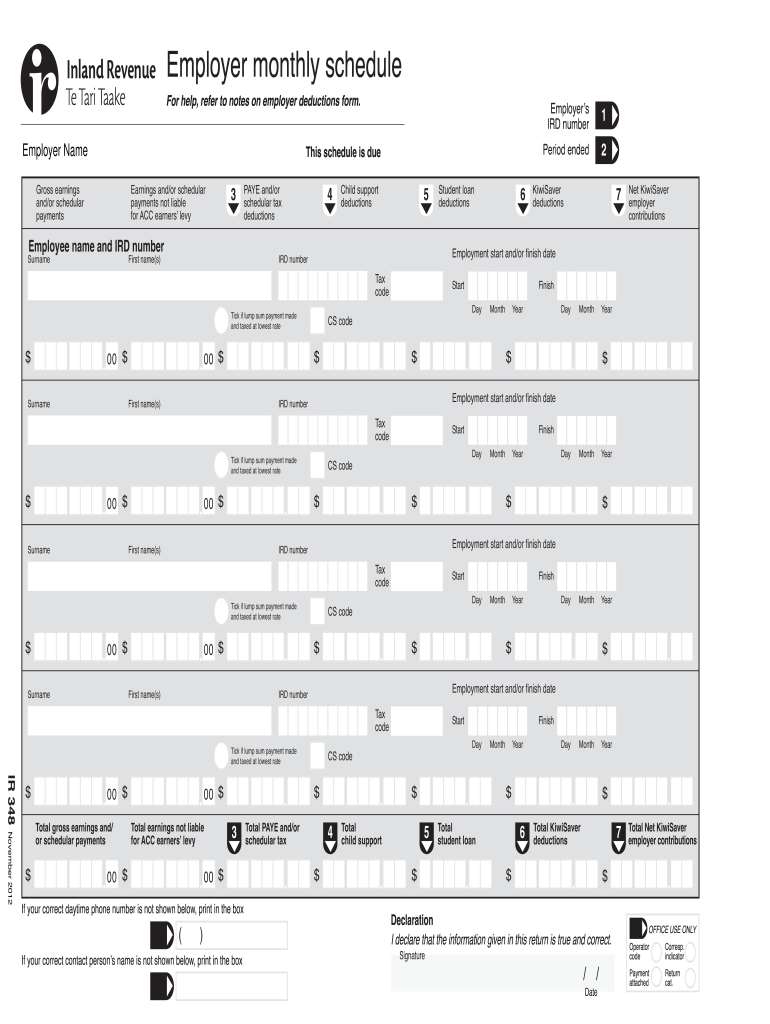

The Employer Monthly Schedule Inland Revenue Ird Govt is a crucial document for employers in the United States. It serves as a formal record of the monthly payroll tax obligations, detailing the amounts owed to the government for employee wages. This schedule helps ensure compliance with federal tax regulations and is essential for accurate reporting of employee earnings and tax withholdings. Employers must complete this form to report their contributions to Social Security, Medicare, and other relevant taxes.

Steps to complete the Employer Monthly Schedule Inland Revenue Ird Govt

Completing the Employer Monthly Schedule involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records, including employee wages, hours worked, and tax withholdings. Next, accurately fill out the required fields on the form, ensuring that all calculations are correct. Employers should double-check their entries for any discrepancies. Once completed, the form should be submitted by the specified deadline, either electronically or via mail, depending on the preferred submission method.

Legal use of the Employer Monthly Schedule Inland Revenue Ird Govt

The legal use of the Employer Monthly Schedule is vital for maintaining compliance with tax laws. This form must be filled out accurately and submitted on time to avoid penalties. The information provided on this schedule is used by the IRS to verify that employers are meeting their tax obligations. Failure to comply can result in fines or other legal repercussions, making it essential for employers to understand the legal implications of this document.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the Employer Monthly Schedule. Typically, this schedule is due on the last day of the month following the reporting period. For example, the schedule for January must be submitted by the end of February. Staying informed about these deadlines is crucial to avoid late fees and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Employer Monthly Schedule. The form can be filed online through the IRS e-filing system, which is often the quickest and most efficient method. Alternatively, employers may choose to mail the completed form to the designated IRS address. In some cases, in-person submission may be available at local IRS offices, although this is less common. Each method has its own advantages, and employers should select the one that best suits their needs.

Key elements of the Employer Monthly Schedule Inland Revenue Ird Govt

The Employer Monthly Schedule includes several key elements that are essential for accurate reporting. These elements typically include the employer's identification information, total wages paid to employees, tax withholdings for Social Security and Medicare, and any other relevant deductions. Each section must be filled out completely to ensure that the form is processed correctly by the IRS.

Penalties for Non-Compliance

Non-compliance with the requirements of the Employer Monthly Schedule can lead to significant penalties. Employers who fail to file the schedule on time or provide inaccurate information may face fines imposed by the IRS. Additionally, persistent non-compliance can result in more severe consequences, including audits or increased scrutiny of the employer's tax practices. Understanding these penalties underscores the importance of timely and accurate completion of the form.

Quick guide on how to complete employer monthly schedule inland revenue ird govt

Complete Employer Monthly Schedule Inland Revenue Ird Govt seamlessly on any device

Online document management has become prevalent among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your paperwork swiftly without interruptions. Manage Employer Monthly Schedule Inland Revenue Ird Govt on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Employer Monthly Schedule Inland Revenue Ird Govt effortlessly

- Find Employer Monthly Schedule Inland Revenue Ird Govt and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow accommodates all your needs in document management in just a few clicks from any device of your choice. Edit and eSign Employer Monthly Schedule Inland Revenue Ird Govt while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employer monthly schedule inland revenue ird govt

Create this form in 5 minutes!

How to create an eSignature for the employer monthly schedule inland revenue ird govt

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is the Employer Monthly Schedule Inland Revenue Ird Govt. and how does it work?

The Employer Monthly Schedule Inland Revenue Ird Govt. is a document required by the New Zealand government for employers to report their tax obligations for employees. airSlate SignNow streamlines this process, enabling businesses to create, sign, and submit these schedules effectively. Our platform ensures compliance with regulations, offering a simple solution for managing these mandatory reports.

-

How does airSlate SignNow help businesses with the Employer Monthly Schedule Inland Revenue Ird Govt.?

airSlate SignNow allows businesses to effortlessly prepare and send their Employer Monthly Schedule Inland Revenue Ird Govt. with electronic signatures. This not only saves time but also minimizes errors associated with manual document handling. Our intuitive interface makes it easy for users to manage their schedules without stress.

-

What are the pricing options for airSlate SignNow when dealing with the Employer Monthly Schedule Inland Revenue Ird Govt.?

airSlate SignNow offers several pricing plans tailored to suit different business needs regarding the Employer Monthly Schedule Inland Revenue Ird Govt. Pricing starts with a basic plan that provides essential features, and it scales to more advanced options with additional functionalities. Each plan ensures you have the necessary tools for efficient document management.

-

Can I integrate airSlate SignNow with other tools for the Employer Monthly Schedule Inland Revenue Ird Govt.?

Yes, airSlate SignNow offers various integrations with popular software solutions that can enhance your workflow for the Employer Monthly Schedule Inland Revenue Ird Govt. You can connect it with accounting, HR, and management tools to streamline data sharing and improve efficiency. This flexibility allows you to maintain a cohesive system across your business operations.

-

What features does airSlate SignNow provide for managing the Employer Monthly Schedule Inland Revenue Ird Govt.?

Our platform boasts features like custom templates, automated workflows, and secure eSigning tailored for the Employer Monthly Schedule Inland Revenue Ird Govt. By utilizing these features, you can ensure that your documents are both compliant and efficient. Enhanced tracking and reporting tools are also available to monitor document status seamlessly.

-

Is airSlate SignNow secure for handling the Employer Monthly Schedule Inland Revenue Ird Govt.?

Absolutely. airSlate SignNow employs advanced security measures to protect your documents related to the Employer Monthly Schedule Inland Revenue Ird Govt. We adhere to industry standards and compliance regulations, ensuring that your data is safe throughout the signing process. You can confidently manage sensitive information knowing it is well protected.

-

How can airSlate SignNow benefit my business concerning the Employer Monthly Schedule Inland Revenue Ird Govt.?

Using airSlate SignNow for the Employer Monthly Schedule Inland Revenue Ird Govt. can signNowly enhance your operational efficiency and reduce turnaround times. By automating document processes and providing a user-friendly eSigning solution, your business can focus more on growth and less on administrative tasks. Additionally, you'll improve compliance and accuracy with our smart tools.

Get more for Employer Monthly Schedule Inland Revenue Ird Govt

- Amateur softball association notice of background check and form

- Linden little league how to sponsor form

- Player verification form

- Il secretary of state natural disaster disclosure statement 2015 form

- Ahead program project status report form

- Bupersinst 161010 form

- Ctu grievance form

- At in the matter of the estate of alaska court system form

Find out other Employer Monthly Schedule Inland Revenue Ird Govt

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now