Form 2102 S 2015

What is the Form 2102 S

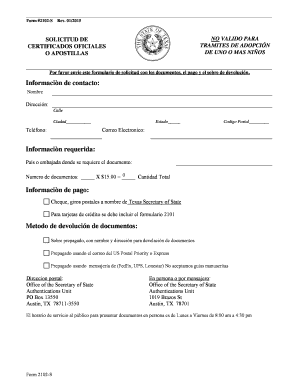

The Form 2102 S is a tax document used primarily for reporting certain expenses related to business operations. This form is essential for individuals and businesses to accurately account for deductions, ensuring compliance with IRS regulations. It serves as a simplified version of the original Form 2102, focusing on specific reporting requirements that streamline the filing process for taxpayers.

How to use the Form 2102 S

Using the Form 2102 S involves several steps to ensure accurate completion. First, gather all necessary documentation that supports the expenses you plan to report. This may include receipts, invoices, and other relevant records. Next, fill out the form carefully, ensuring that all required fields are completed. After completing the form, review it for accuracy before submission to avoid potential delays or penalties. Finally, submit the form according to the instructions provided, either electronically or via mail.

Steps to complete the Form 2102 S

Completing the Form 2102 S requires a systematic approach:

- Gather documentation: Collect all receipts and records related to the expenses you intend to report.

- Fill out the form: Enter your information in the designated fields, ensuring accuracy in numbers and details.

- Review: Double-check all entries for errors or omissions.

- Submit: Send the completed form to the appropriate IRS address or file it electronically if applicable.

Legal use of the Form 2102 S

The legal use of the Form 2102 S is governed by IRS guidelines, which stipulate that the information reported must be truthful and accurate. Misrepresentation or fraudulent claims can lead to penalties, including fines or audits. It is crucial to maintain accurate records and ensure that all reported expenses are legitimate and substantiated by documentation. Compliance with these regulations not only protects you from legal repercussions but also ensures that you maximize your eligible deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2102 S typically align with the annual tax filing schedule. For most taxpayers, the deadline is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and to file your form on time to avoid penalties. Taxpayers may also consider filing for an extension if they require additional time to complete their tax returns.

Required Documents

To successfully complete the Form 2102 S, you will need several key documents:

- Receipts for all expenses claimed.

- Invoices from service providers.

- Bank statements that reflect the transactions.

- Any additional documentation that supports your claims.

Having these documents organized and accessible will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete form 2102 s

Complete Form 2102 S effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 2102 S on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The most efficient way to modify and eSign Form 2102 S with ease

- Obtain Form 2102 S and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from the device of your choice. Modify and eSign Form 2102 S and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2102 s

Create this form in 5 minutes!

How to create an eSignature for the form 2102 s

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is form 2102 and how can airSlate SignNow help with it?

Form 2102 is often used for various administrative tasks in businesses. airSlate SignNow streamlines the process of eSigning and sending form 2102, ensuring that you can complete your documents quickly and securely.

-

Is there a cost to use airSlate SignNow for processing form 2102?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features specifically designed to streamline your handling of form 2102 and other documents.

-

What features does airSlate SignNow offer for managing form 2102?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure storage, all aimed at enhancing your experience with form 2102. These features ensure that your documents are organized and accessible anytime.

-

Can airSlate SignNow integrate with other software for form 2102 processing?

Yes, airSlate SignNow integrates seamlessly with several popular applications, allowing you to manage form 2102 alongside your existing workflow. These integrations help optimize productivity by connecting to tools you already use.

-

How secure is airSlate SignNow when handling form 2102?

Security is a priority at airSlate SignNow. The platform uses industry-standard encryption and compliance measures to protect your information while handling form 2102, ensuring peace of mind when signing sensitive documents.

-

What are the benefits of using airSlate SignNow for form 2102?

Using airSlate SignNow for form 2102 offers several benefits, including speed, efficiency, and a user-friendly interface. This allows you to focus on your core business tasks while we handle the signatures and document management.

-

Can I track the status of my form 2102 with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for form 2102, so you can know exactly when it has been viewed and signed. This feature keeps you updated throughout the document process.

Get more for Form 2102 S

Find out other Form 2102 S

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure