Va Form 21 0516 1 2004

What is the Texas Form ST?

The Texas Form ST is a crucial document used for sales tax exemption in the state of Texas. This form allows eligible entities, such as non-profit organizations, to claim exemption from sales tax on purchases made for specific purposes. Understanding the purpose and requirements of this form is essential for businesses and organizations that aim to reduce their tax liabilities.

How to Use the Texas Form ST

To effectively use the Texas Form ST, individuals or organizations must first determine their eligibility for sales tax exemption. Once eligibility is confirmed, the form must be completed accurately, providing all necessary information, including the name of the exempt organization and the type of purchases being made. After filling out the form, it should be presented to the vendor at the time of purchase to ensure that sales tax is not charged.

Steps to Complete the Texas Form ST

Completing the Texas Form ST involves several steps:

- Obtain the latest version of the Texas Form ST from the Texas Comptroller's website.

- Fill in the required fields, including the name and address of the organization, and specify the type of exemption being claimed.

- Ensure that the form is signed by an authorized representative of the organization.

- Provide the completed form to the vendor at the point of sale.

Legal Use of the Texas Form ST

The legal use of the Texas Form ST is governed by state tax laws. It is essential to use the form only for legitimate purchases that qualify for exemption. Misuse of the form, such as claiming exemptions for ineligible purchases, can lead to penalties and interest charges from the Texas Comptroller's office. Organizations should maintain accurate records of all transactions involving the form to ensure compliance with state regulations.

Required Documents for Texas Form ST

When utilizing the Texas Form ST, organizations may need to provide additional documentation to support their exemption claim. This may include:

- Proof of the organization's tax-exempt status, such as a letter from the IRS.

- Invoices or receipts for purchases made with the exemption.

- Any additional forms required by the vendor or specific to the type of exemption being claimed.

Form Submission Methods

The Texas Form ST does not require formal submission to a government agency. Instead, it is presented directly to the vendor at the time of purchase. However, organizations should keep a copy of the completed form for their records in case of audits or inquiries from the Texas Comptroller's office.

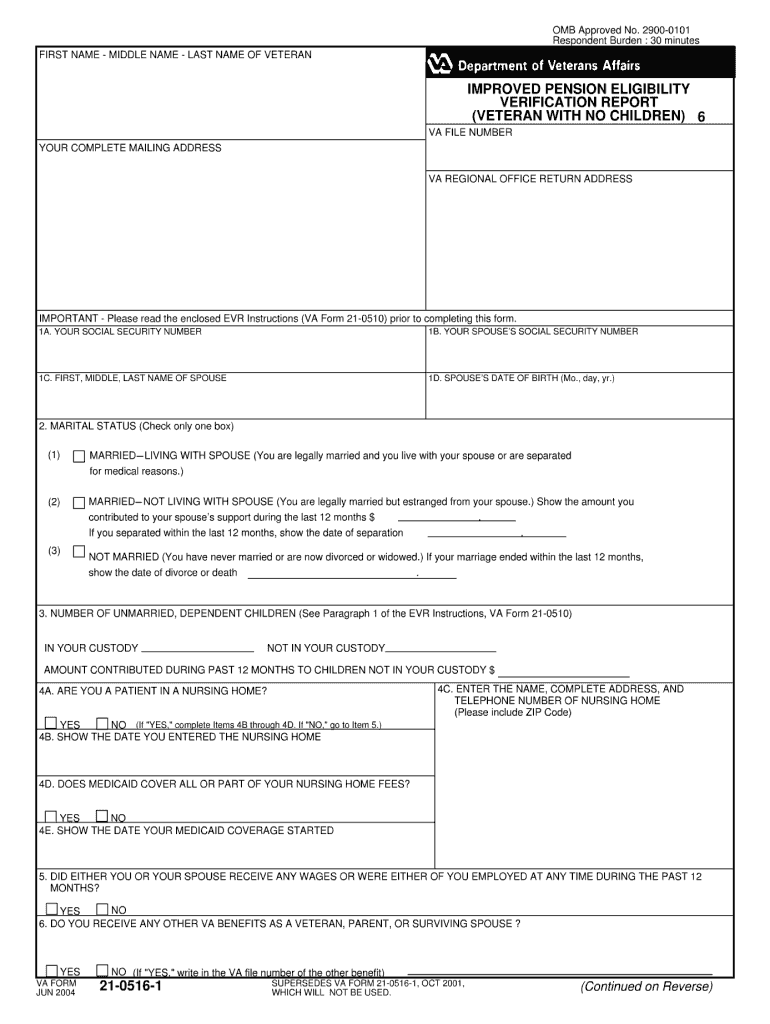

Quick guide on how to complete va form 21 0516 1

Uncover the easiest method to complete and endorse your Va Form 21 0516 1

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to fill out and endorse your Va Form 21 0516 1 and other forms for public services. Our intelligent eSignature solution equips you with all the necessary tools to handle documents swiftly and comply with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing functionalities all available within a user-friendly interface.

Only a few steps are needed to complete and sign your Va Form 21 0516 1:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to input in your Va Form 21 0516 1.

- Navigate through the fields with the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill the fields with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal sections that are no longer relevant.

- Select Sign to create a legally valid eSignature using your chosen method.

- Include the Date next to your signature and conclude your task with the Done button.

Store your finished Va Form 21 0516 1 in the Documents section of your profile, download it, or transfer it to your chosen cloud storage. Our service also provides versatile file sharing. There's no necessity to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct va form 21 0516 1

FAQs

-

Why do ex-employers refuse to fill out the VA form 21-4192 for a vet?

VA Form 21–4192 is an application for disability benefits and like similar state benefits, it must be filled out by the veteran or by his or her qualified representative. This is a private, sensitive, legal document and every dot or dash in it can be critical, so must be accurate and verifiable.Employers have zero responsibility to fill out this form or furnish information for it, however, Social Security would have all the information required that the Department of Defense did not have. The veteran’s DD-214 is likely required, but does not furnish all the information required on the form.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the va form 21 0516 1

How to generate an eSignature for the Va Form 21 0516 1 in the online mode

How to create an eSignature for the Va Form 21 0516 1 in Chrome

How to create an eSignature for signing the Va Form 21 0516 1 in Gmail

How to make an eSignature for the Va Form 21 0516 1 from your smart phone

How to create an eSignature for the Va Form 21 0516 1 on iOS devices

How to generate an electronic signature for the Va Form 21 0516 1 on Android OS

People also ask

-

What is the Va Form 21 0516 1 used for?

The Va Form 21 0516 1 is an important document used by veterans to apply for certain benefits. It assists in providing essential information to the Department of Veterans Affairs, ensuring that veterans receive the support they deserve. Using airSlate SignNow, you can easily eSign and manage your Va Form 21 0516 1 digitally.

-

How can airSlate SignNow help with the Va Form 21 0516 1?

airSlate SignNow simplifies the process of filling out and signing the Va Form 21 0516 1. With our user-friendly platform, you can easily upload the form, fill it out, and send it for eSignature, streamlining the entire application process. This ensures that your documentation is completed quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Va Form 21 0516 1?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. While there is a fee for using our platform, it is designed to be cost-effective, providing you with a powerful tool to manage your Va Form 21 0516 1 and other documents efficiently.

-

What features does airSlate SignNow offer for the Va Form 21 0516 1?

airSlate SignNow provides a host of features for managing the Va Form 21 0516 1, including customizable templates, secure eSignature options, and document tracking. These features enhance the overall experience, making it easier to handle your forms and ensuring that they are processed accurately.

-

Can I integrate airSlate SignNow with other applications for the Va Form 21 0516 1?

Absolutely! airSlate SignNow offers integrations with numerous applications, allowing you to streamline your workflow when managing the Va Form 21 0516 1. Whether you use CRM systems or cloud storage solutions, our integrations help you connect your tools for enhanced productivity.

-

How secure is using airSlate SignNow for the Va Form 21 0516 1?

Security is a top priority at airSlate SignNow. When handling the Va Form 21 0516 1, all documents are encrypted and stored securely, ensuring that your personal information remains protected. Our platform complies with industry standards to provide a safe environment for your important documents.

-

Can I access the Va Form 21 0516 1 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile use, allowing you to access the Va Form 21 0516 1 on the go. With our mobile app, you can easily fill out, sign, and send your forms directly from your smartphone or tablet, making it convenient to manage your documents anytime, anywhere.

Get more for Va Form 21 0516 1

- Cardiac diagnostic heart catheterization imaging request form

- Trustmark insurance claim form

- Cancer certificate form

- Waiver premium form

- Go red for women kansas city american heart association form

- Clery csa incidentreport form1docx

- Form 287434075

- A statewide assessment of sexual harassment and assault form

Find out other Va Form 21 0516 1

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit