Ir886 2016-2026

What is the ir886?

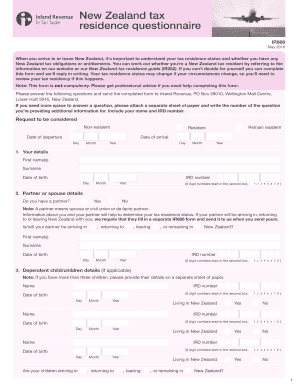

The ir886 is a tax form used by individuals in New Zealand to assess their tax residence status. This form is essential for determining whether a person qualifies as a tax resident in New Zealand, which affects their tax obligations. Understanding the ir886 form is crucial for anyone who has lived or worked in New Zealand, as it helps clarify their tax responsibilities based on their residency status.

How to use the ir886

Using the ir886 involves several steps to ensure accurate completion. First, gather all necessary personal information, including your tax identification number and details about your residency status. Next, follow the instructions provided with the form to fill it out accurately. Ensure that all information is complete and correct to avoid delays in processing. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the ir886

Completing the ir886 requires careful attention to detail. Here are the steps to follow:

- Gather your personal information and tax identification number.

- Review the instructions provided with the form to understand each section.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the completed form electronically or by mail, as preferred.

Legal use of the ir886

The ir886 must be completed and submitted in accordance with New Zealand tax laws. It is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to comply with the legal requirements can result in penalties. It is important to understand the implications of the information you provide on this form, as it directly affects your tax obligations.

Required Documents

When completing the ir886, certain documents may be required to support your claims. These may include:

- Proof of identity, such as a passport or driver's license.

- Tax identification number documentation.

- Any previous tax returns or residency documentation.

Having these documents ready can streamline the process and ensure that your application is processed without delays.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the ir886 to avoid penalties. Generally, the ir886 should be submitted by the end of the tax year. Keeping track of important dates related to tax filings can help ensure compliance and avoid unnecessary issues with the tax authorities.

Quick guide on how to complete ir886 448734963

Complete Ir886 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without hold-ups. Manage Ir886 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Ir886 effortlessly

- Locate Ir886 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from a device of your choice. Modify and eSign Ir886 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir886 448734963

Create this form in 5 minutes!

How to create an eSignature for the ir886 448734963

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is ir886 in relation to airSlate SignNow?

ir886 refers to a specific regulatory compliance requirement that many businesses need to address. With airSlate SignNow, you can easily manage document signing while ensuring adherence to ir886 guidelines. Our platform allows users to create and store documents securely, helping to streamline compliance processes.

-

How does airSlate SignNow ensure compliance with ir886?

AirSlate SignNow provides features that allow users to maintain compliance with ir886, including secure document storage and audit trails of all signed documents. The platform also offers customizable templates that can be tailored to meet ir886 requirements, ensuring that your signing processes are both efficient and compliant.

-

What are the pricing options for airSlate SignNow for ir886 compliance?

AirSlate SignNow offers various pricing plans that cater to different business needs, starting with affordable options for small businesses. Each plan includes the necessary features to facilitate ir886 compliance, ensuring you only pay for what your business requires. Visit our pricing page for detailed information and to find the right plan for your needs.

-

Can airSlate SignNow integrate with other tools for ir886 compliance?

Yes, airSlate SignNow easily integrates with a variety of third-party applications, enhancing your workflow for ir886 compliance. Popular integrations include CRM systems, cloud storage, and project management tools, allowing you to streamline document management further. This connectivity helps ensure that all aspects of your business adhere to ir886 guidelines.

-

What benefits does airSlate SignNow provide for businesses needing ir886 documentation?

By using airSlate SignNow, businesses can improve their efficiency in managing ir886 documentation through easy eSigning and document tracking. Our platform minimizes paperwork and speeds up the signing process, helping you meet ir886 compliance deadlines. Additionally, the user-friendly interface makes it accessible for teams of all sizes.

-

Is airSlate SignNow user-friendly for businesses new to ir886 compliance?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for businesses new to ir886 compliance to get started. Our intuitive interface allows users to navigate through the eSigning process with minimal training, ensuring you can quickly comply with ir886 requirements and focus on your core business activities.

-

How secure is airSlate SignNow for handling ir886 documents?

Security is a top priority for airSlate SignNow, especially when dealing with ir886 documents. Our platform uses advanced encryption and secure authentication processes to protect your data. Compliance with industry standards and regulations helps ensure that all information related to ir886 is safeguarded against unauthorized access.

Get more for Ir886

Find out other Ir886

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract