Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS 2016

What is the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS

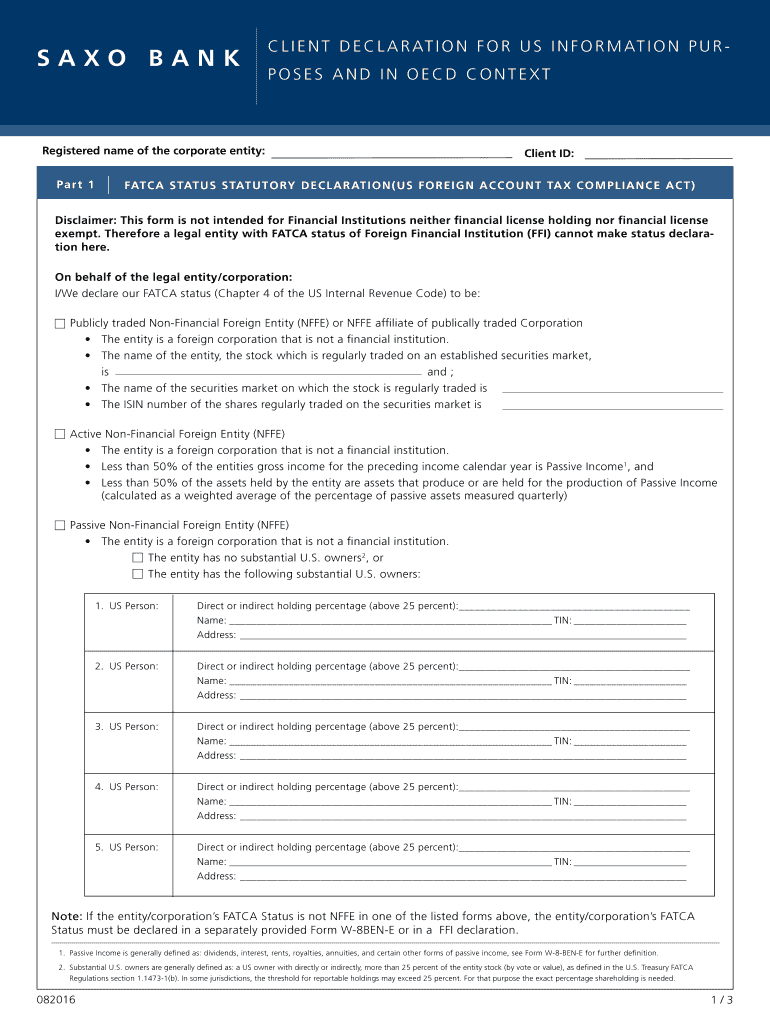

The Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS is a crucial document used for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is designed to collect information from U.S. taxpayers regarding their foreign financial accounts and assets. It serves to declare the status of the client in relation to FATCA regulations, ensuring that financial institutions can accurately report account information to the Internal Revenue Service (IRS). Understanding this form is essential for individuals and entities that hold foreign accounts or investments.

Steps to complete the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS

Completing the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS requires careful attention to detail. Here are the key steps to follow:

- Begin by gathering all necessary personal and financial information, including your Social Security number and details of any foreign accounts.

- Fill out the form accurately, ensuring that all sections are completed as required. Pay close attention to the client identification section.

- Review the information for accuracy and completeness. Any errors could lead to compliance issues.

- Sign and date the form to validate your declaration. Ensure that your signature is consistent with other official documents.

- Submit the completed form to the relevant financial institution or authority as instructed.

Legal use of the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS

The legal use of the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS is governed by U.S. tax laws and international agreements. This form must be completed truthfully and submitted to ensure compliance with FATCA requirements. Failure to provide accurate information can result in significant penalties, including fines and restrictions on account access. It is essential to understand the legal implications of this form and to seek professional guidance if needed to ensure compliance.

Key elements of the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS

Several key elements must be included in the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS to ensure its validity:

- Client Identification: Personal details such as name, address, and taxpayer identification number.

- FATCA Status: A declaration of the client's status under FATCA, including whether they are a U.S. person or a foreign entity.

- Signature: A signature is required to validate the information provided.

- Date: The date of completion must be included to establish the timeline of the declaration.

How to use the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS

The Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS is used primarily by financial institutions to determine the FATCA status of their clients. To use this form effectively, clients should:

- Provide accurate and complete information to avoid delays in processing.

- Submit the form to the appropriate financial institution as part of the account opening or maintenance process.

- Keep a copy of the submitted form for personal records and future reference.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS is critical for compliance. Generally, the form should be submitted as part of the account opening process or whenever there is a change in the client's FATCA status. It is advisable to check with the financial institution for any specific deadlines they may have, as these can vary. Additionally, staying informed about any updates to FATCA regulations can help ensure timely compliance.

Quick guide on how to complete client id part 1 fatca status statutory declarationus

Effortlessly Prepare Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to find the right template and securely store it on the web. airSlate SignNow equips you with all necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Modify and eSign Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS with Ease

- Find Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow parts of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to apply your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate creating new copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your preference. Alter and eSign Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct client id part 1 fatca status statutory declarationus

Create this form in 5 minutes!

How to create an eSignature for the client id part 1 fatca status statutory declarationus

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS?

The Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS is a document that helps organizations comply with the Foreign Account Tax Compliance Act (FATCA). It outlines the account holder's FATCA status, ensuring that all necessary tax information is recorded correctly for legal purposes.

-

How does airSlate SignNow simplify the process of signing the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS?

airSlate SignNow provides an intuitive platform for sending and eSigning the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS. With its user-friendly interface, you can manage and track documents seamlessly, making the compliance process more efficient.

-

What are the benefits of using airSlate SignNow for the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS?

Using airSlate SignNow for the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS allows for faster processing and improved accuracy. The platform reduces the risk of errors while ensuring that you remain compliant with FATCA regulations, saving you time and resources.

-

Is there a cost associated with using airSlate SignNow for the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. By investing in our solution, you’ll gain access to essential features that streamline the completion of the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS and other documents.

-

Can I integrate airSlate SignNow with other software for processing the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS?

Absolutely! airSlate SignNow supports numerous integrations with popular software and applications, allowing you to seamlessly incorporate its features for handling the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS into your existing workflows.

-

What security measures does airSlate SignNow implement for the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS?

airSlate SignNow ensures top-notch security for your documents, including the Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS, with advanced encryption and secure data storage. We adhere to industry standards to protect sensitive information and maintain compliance.

-

How can I track the status of my Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS in real-time. Our platform provides notifications and updates, ensuring you know exactly when your document is viewed, signed, or completed.

Get more for Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS

- Works sheet form

- Disclosure statement tamara g suttle licensed professional form

- Lien waiver release notary ohio sample form

- Dodea form 2942 0 m f2

- Canada summer jobs payment claim and activity report form

- Registro de negocio propio il 444 2790 form

- Stop notice form

- Complimentary multi point inspection nissan form

Find out other Client ID Part 1 FATCA STATUS STATUTORY DECLARATIONUS

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT