Calstrs Refund Application 2011

What is the Calstrs Refund Application

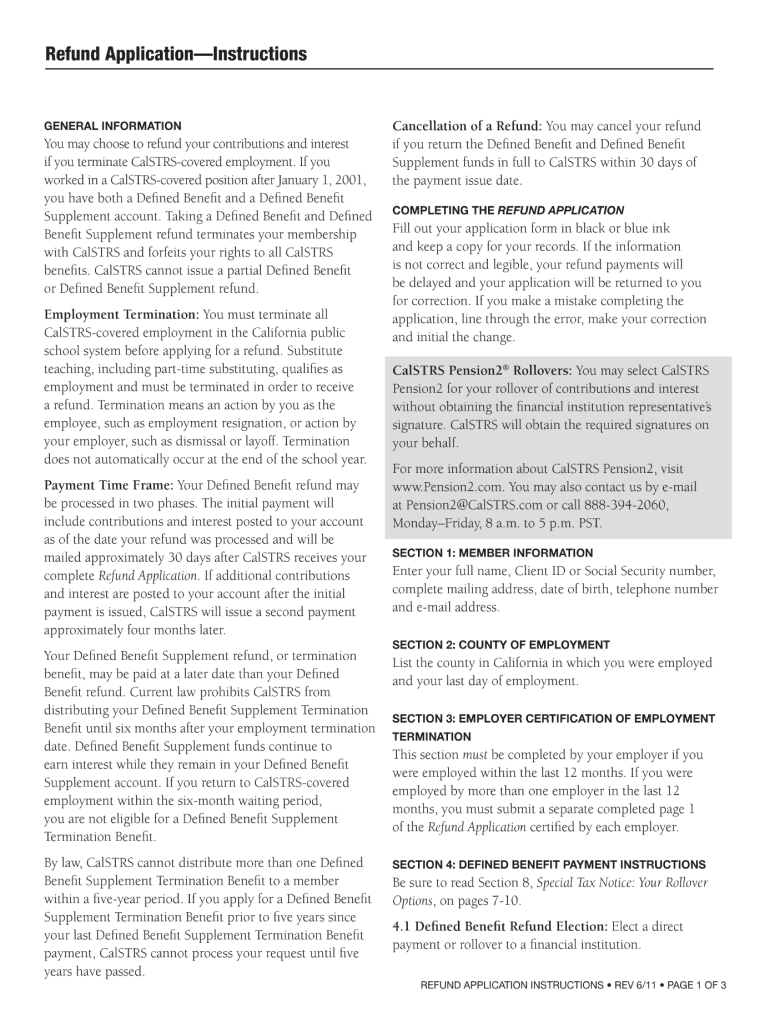

The Calstrs refund application is a formal request for members of the California State Teachers' Retirement System (CalSTRS) to withdraw their contributions and receive a refund of their retirement savings. This application is essential for individuals who have decided to leave their teaching positions or have become ineligible for benefits. The process ensures that members can access their funds while adhering to the regulations set forth by CalSTRS.

Steps to complete the Calstrs Refund Application

Completing the Calstrs refund application involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and employment details. Next, download the Calstrs refund application form, often referred to as the RF-1360. Carefully fill out the required fields, ensuring all information is correct. After completing the form, review it for any errors, then sign and date it. Finally, submit the application according to the specified methods, whether online, by mail, or in person.

Required Documents

When submitting the Calstrs refund application, certain documents are necessary to support your request. These typically include:

- Proof of identity, such as a government-issued ID

- Documentation of your employment history with CalSTRS

- Any additional forms required by CalSTRS, which may vary based on individual circumstances

Ensuring you have all required documents will facilitate a smoother application process.

Form Submission Methods

There are multiple methods available for submitting the Calstrs refund application. Members can choose to submit their application online through the CalSTRS member portal, which provides a convenient and efficient way to manage submissions. Alternatively, applications can be mailed directly to CalSTRS or delivered in person at designated locations. It is important to select the method that best suits your needs while ensuring that you adhere to any deadlines associated with your submission.

Eligibility Criteria

To qualify for a refund through the Calstrs refund application, applicants must meet specific eligibility criteria. Generally, individuals must have terminated their employment with a CalSTRS-covered employer and must not be actively contributing to the retirement system. Additionally, there may be stipulations regarding the length of service and the timing of the application submission. Understanding these criteria is crucial for a successful application process.

Legal use of the Calstrs Refund Application

The legal validity of the Calstrs refund application hinges on compliance with established regulations governing retirement benefits. The application must be completed accurately and submitted in accordance with CalSTRS guidelines. Utilizing a reliable digital platform for signing and submitting the application can enhance its legal standing, ensuring that it meets the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws.

Quick guide on how to complete calstrs refund application form

Effortlessly Prepare Calstrs Refund Application on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and keep it securely online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and efficiently. Manage Calstrs Refund Application on any device with the airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to Modify and eSign Calstrs Refund Application with Ease

- Obtain Calstrs Refund Application and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you would prefer to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Alter and eSign Calstrs Refund Application and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calstrs refund application form

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill the JEE (Main) application form?

This is a step by step guide to help you fill your JEE (Main) application form online brought to you by Toppr. We intend to help you save time and avoid mistakes so that you can sail through this whole process rather smoothly. In case you have any doubts, please talk to our counselors by first registering at Toppr. JEE Main Application Form is completely online and there is no offline component or downloadable application form. Here are some steps you need to follow:Step 1: Fill the Application FormEnter all the details while filling the Online Application Form and choose a strong password and security question with a relevant answer.After entering the data, an application number will be generated and it will be used to complete the remaining steps. Make sure your note down this number.Once you register, you can use this number and password for further logins. Do not share the login credentials with anyone but make sure you remember them.Step 2: Upload Scanned ImagesThe scanned images of photographs, thumb impression and signature should be in JPG/JPEG format only.While uploading the photograph, signature and thumb impression, please see its preview to check if they have been uploaded correctly.You will be able to modify/correct the particulars before the payment of fees.Step 3: Make The PaymentPayment of the Application Fees for JEE (Main) is through Debit card or Credit Card or E Challan.E-challan has to be downloaded while applying and the payment has to be made in cash at Canara Bank or Syndicate Bank or ICICI bank.After successful payment, you will be able to print the acknowledgment page. In case acknowledgment page is not generated after payment, then the transaction is cancelled and amount will be refunded.Step 4: Selection of Date/SlotIf you have opted for Computer Based Examination of Paper – 1, you should select the date/slot after payment of Examination Fee.If you do not select the date/slot, you will be allotted the date/slot on random basis depending upon availability.In case you feel you are ready to get started with filling the application form, pleaseclick here. Also, if you are in the final stages of your exam preparation process, you can brush up your concepts and solve difficult problems on Toppr.com to improve your accuracy and save time.

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

Create this form in 5 minutes!

How to create an eSignature for the calstrs refund application form

How to generate an eSignature for the Calstrs Refund Application Form in the online mode

How to generate an electronic signature for your Calstrs Refund Application Form in Google Chrome

How to generate an electronic signature for putting it on the Calstrs Refund Application Form in Gmail

How to create an eSignature for the Calstrs Refund Application Form right from your mobile device

How to make an eSignature for the Calstrs Refund Application Form on iOS devices

How to create an electronic signature for the Calstrs Refund Application Form on Android devices

People also ask

-

What is the calstrs refund application process?

The calstrs refund application process involves filling out the necessary forms and providing relevant documentation to request a refund of your contributions. It’s important to follow the steps outlined on the CalSTRS website to ensure your application is processed efficiently.

-

How can airSlate SignNow help with the calstrs refund application?

airSlate SignNow streamlines the calstrs refund application process by allowing you to electronically sign and send documents securely. This ensures that your application is submitted swiftly and reduces the chances of delays in processing.

-

What features does airSlate SignNow offer for the calstrs refund application?

airSlate SignNow provides features such as customizable templates, real-time tracking, and seamless integration with other applications which can enhance the calstrs refund application process. These features facilitate easier document management and improve overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the calstrs refund application?

Yes, there are different pricing plans available for airSlate SignNow which cater to various business needs and sizes. The investment is minimal compared to the time saved in managing your calstrs refund application effectively.

-

How long does it take to process the calstrs refund application?

Processing times for the calstrs refund application can vary depending on several factors, including the completeness of your submission. Utilizing airSlate SignNow can help speed up submission, potentially reducing waiting times for your refund.

-

What benefits does eSigning provide for the calstrs refund application?

eSigning with airSlate SignNow offers benefits such as enhanced security, reduced paper usage, and faster transactions for the calstrs refund application. It ensures your documents are legally binding and can be accessed from anywhere.

-

Can I track my calstrs refund application status with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking features that allow you to monitor your calstrs refund application status easily. This transparency helps you stay informed throughout the process and ensures that no steps are overlooked.

Get more for Calstrs Refund Application

Find out other Calstrs Refund Application

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document