Sebi Pacl Refund Application Form Fill Online, Printable 2020

Understanding the CalSTRS Refund Form

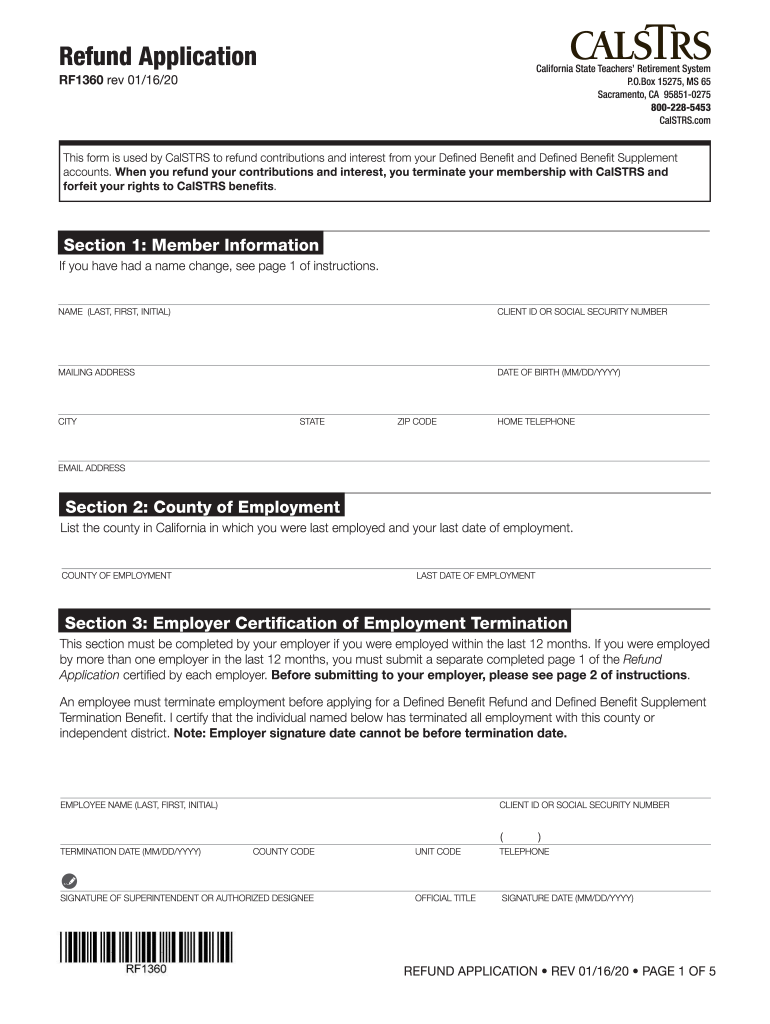

The CalSTRS refund form is a crucial document for members of the California State Teachers' Retirement System seeking to withdraw their contributions. This form allows educators to request a refund of their contributions after leaving service. It is essential to understand the implications of this withdrawal, including potential tax consequences and the impact on future retirement benefits. Members should carefully consider their options before submitting the form, as withdrawing funds may affect long-term retirement planning.

Steps to Complete the CalSTRS Refund Form

Completing the CalSTRS refund form involves several important steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and employment details. Next, fill out the form with precise information regarding your contributions and the reason for your refund request. It is important to review the completed form for any errors before submission. Finally, sign and date the form to validate your request. Ensuring all sections are filled out correctly will help expedite the processing of your refund.

Required Documents for the CalSTRS Refund Application

When submitting the CalSTRS refund application, certain documents are required to support your request. Typically, you will need to provide proof of identity, such as a government-issued ID, along with any relevant employment records. If applicable, include documentation that explains your reason for leaving the teaching profession, which may help clarify your eligibility for a refund. Having these documents ready will streamline the application process and reduce potential delays.

Form Submission Methods for the CalSTRS Refund Form

The CalSTRS refund form can be submitted through various methods, providing flexibility for applicants. You may choose to submit the form online through the CalSTRS member portal, ensuring a quicker processing time. Alternatively, you can mail the completed form to the designated CalSTRS office or deliver it in person. Each method has its advantages, so consider your circumstances and choose the one that best suits your needs for submitting the refund application.

Legal Considerations for the CalSTRS Refund Form

When completing the CalSTRS refund form, it is important to be aware of the legal implications associated with withdrawing funds. The refund may be subject to federal and state taxes, which can significantly reduce the amount received. Additionally, withdrawing contributions can impact your eligibility for future retirement benefits, as you may lose certain rights associated with your pension plan. Understanding these legal aspects will help you make informed decisions regarding your retirement savings.

Eligibility Criteria for the CalSTRS Refund Application

To qualify for a refund through the CalSTRS refund application, specific eligibility criteria must be met. Generally, members who have terminated their employment with a CalSTRS-covered employer and have not yet retired are eligible to apply for a refund of their contributions. It is crucial to verify that you meet all requirements before submitting your application to avoid potential complications or denial of your request.

Quick guide on how to complete sebi pacl refund application form fill online printable

Complete Sebi Pacl Refund Application Form Fill Online, Printable effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary template and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Sebi Pacl Refund Application Form Fill Online, Printable on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Sebi Pacl Refund Application Form Fill Online, Printable with ease

- Find Sebi Pacl Refund Application Form Fill Online, Printable and click Get Form to initiate.

- Utilize the tools we offer to finish your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically for that function.

- Create your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional pen-and-ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements within a few clicks from any device you choose. Alter and eSign Sebi Pacl Refund Application Form Fill Online, Printable and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sebi pacl refund application form fill online printable

Create this form in 5 minutes!

How to create an eSignature for the sebi pacl refund application form fill online printable

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the calstrs refund form and how can I access it?

The calstrs refund form is a document required for members of the California State Teachers' Retirement System to request a refund of contributions. You can access the calstrs refund form easily through the official CalSTRS website or by utilizing the document management features available in airSlate SignNow.

-

How can airSlate SignNow help me complete the calstrs refund form?

airSlate SignNow offers an intuitive platform to fill out and eSign the calstrs refund form seamlessly. With its user-friendly interface, you can complete the form electronically, ensuring all required fields are filled and submitted without hassle.

-

Is there a fee associated with using the calstrs refund form process through airSlate SignNow?

Using airSlate SignNow to process the calstrs refund form involves a subscription fee, which is competitive and designed to provide you with comprehensive document management features. This cost-effective solution streamlines your workflow and reduces paper-related expenses.

-

What features does airSlate SignNow offer for managing my calstrs refund form?

airSlate SignNow provides several features to enhance your experience with the calstrs refund form, including eSignature capabilities, document tracking, and templates for faster processing. These features ensure that your refund form is securely completed and easily accessible throughout the approval process.

-

Can I integrate airSlate SignNow with other tools for filing my calstrs refund form?

Yes, airSlate SignNow supports integration with various third-party applications, enabling you to manage the calstrs refund form alongside other workflows and tools. This flexibility helps streamline your document management processes and increases overall productivity.

-

What are the benefits of using airSlate SignNow for my calstrs refund form?

Using airSlate SignNow for your calstrs refund form offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security. By digitizing the process, you can track your submission and ensure compliance with all requirements effortlessly.

-

Is eSigning my calstrs refund form secure with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security measures to ensure that your eSigned calstrs refund form is safe and compliant with legal standards. You can trust that your sensitive information is protected throughout the entire signing process.

Get more for Sebi Pacl Refund Application Form Fill Online, Printable

- Private career school pcs renewal application state of new jersey form

- Private career school pcs renewal application department of form

- Nycers power of attorney 2016 2019 form

- Letter of representationletter of representation form

- Building 12 room 158 form

- Sh 9001 2018 2019 form

- Ls 55s 0117 labor ny form

- Medco 31 request for prior authorization of ohio bwc form

Find out other Sebi Pacl Refund Application Form Fill Online, Printable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors