Calstrs Refund 2015

What is the Calstrs Refund

The Calstrs refund refers to the process by which members of the California State Teachers' Retirement System can withdraw their contributions upon leaving service. This refund includes the member's contributions along with any interest accrued. It is essential for educators who may not continue their careers in California or who wish to access their funds for personal reasons. Understanding the specifics of this refund can help members make informed decisions about their retirement savings.

Steps to complete the Calstrs Refund

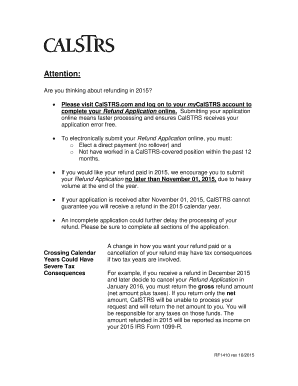

Completing the Calstrs refund application involves several key steps. First, members must gather necessary personal information, including their Social Security number and employment details. Next, they should fill out the Calstrs refund application form accurately, ensuring all required fields are completed. After completing the form, members can submit it online or by mail, depending on their preference. It is crucial to double-check all information to avoid delays in processing.

Eligibility Criteria

To qualify for a Calstrs refund, members must meet specific eligibility criteria. Generally, individuals who have contributed to the system for a minimum period and have separated from service can apply. Additionally, members should not be eligible for retirement benefits at the time of application. Understanding these criteria ensures that applicants know their rights and options when considering a refund.

Required Documents

When applying for a Calstrs refund, certain documents are necessary to complete the process. Members typically need to provide proof of identity, such as a driver's license or state ID, along with their Social Security number. Employment records may also be required to verify service duration. Having these documents ready can streamline the application process and facilitate quicker approval.

Legal use of the Calstrs Refund

The legal use of the Calstrs refund is governed by specific regulations that ensure the process is compliant with state laws. Members must adhere to guidelines set forth by the California State Teachers' Retirement System, which outlines how and when refunds can be requested. Understanding these legal parameters is vital for members to protect their rights and ensure that their applications are processed correctly.

Form Submission Methods (Online / Mail / In-Person)

Members have multiple options for submitting their Calstrs refund application. The most convenient method is online submission, which allows for quick processing and immediate confirmation. Alternatively, members can choose to mail their completed application form to the appropriate address or visit a local Calstrs office for in-person submission. Each method has its advantages, and members should select the one that best fits their needs.

Quick guide on how to complete calstrs refund

Effortlessly Prepare Calstrs Refund on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without any delays. Manage Calstrs Refund across any platform with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and eSign Calstrs Refund with Ease

- Find Calstrs Refund and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your choice. Edit and eSign Calstrs Refund to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calstrs refund

Create this form in 5 minutes!

How to create an eSignature for the calstrs refund

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is a Calstrs Refund and how does it work?

A Calstrs Refund refers to the process through which eligible California State Teachers' Retirement System members can withdraw their contributions. This refund can be requested after leaving employment, allowing members to obtain funds they have contributed to the retirement system. Understanding the process of applying for a Calstrs Refund is crucial for managing your retirement funds effectively.

-

How can airSlate SignNow help with my Calstrs Refund documents?

AirSlate SignNow simplifies the process of preparing and signing documents related to your Calstrs Refund. With its user-friendly interface, you can easily upload, edit, and eSign necessary forms, ensuring that your refund application is processed smoothly and efficiently. This saves time and reduces the hassle of dealing with paperwork.

-

What features does airSlate SignNow offer for processing Calstrs Refund requests?

AirSlate SignNow offers features like customizable templates, in-app eSignature capabilities, and secure document storage, all of which are beneficial for managing your Calstrs Refund requests. These features enhance the overall user experience by streamlining the documentation process and ensuring compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for Calstrs Refund applications?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, making it a cost-effective solution for managing Calstrs Refund applications. Each plan provides access to essential features and tools, ensuring that you can process your documentation efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for my Calstrs Refund process?

Absolutely! AirSlate SignNow seamlessly integrates with various business tools such as Google Drive, Dropbox, and Microsoft Office. This means you can easily access your Calstrs Refund documents from multiple platforms, enhancing your workflow and making document management a breeze.

-

What are the benefits of using airSlate SignNow for my Calstrs Refund?

Using airSlate SignNow for your Calstrs Refund offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your sensitive documents. The platform's eSignature feature allows for quick approvals, which can signNowly speed up the refund process.

-

How secure is airSlate SignNow when handling Calstrs Refund documents?

AirSlate SignNow prioritizes security, employing advanced encryption methods to protect your Calstrs Refund documents. The platform complies with industry standards for data protection, ensuring that all your sensitive information remains confidential and secure throughout the signing process.

Get more for Calstrs Refund

- 2020 california form 589 nonresident reduced withholding request 2020 california form 589 nonresident reduced withholding

- California form 3500 a submission of exemption request california form 3500 a submission of exemption request

- Form drs pw portalctgov

- Cdtfa 501 wg winegrower tax return form

- Form ct 706 nt estate tax return for nontaxable estates

- Fillable online 2014 municipal data sheet riverton new form

- Cdtfa 106 vehiclevessel use tax clearance request cdtfa 106 vehiclevessel use tax clearance request form

- Government entity diesel fuel tax return cdtfa 501 dg government entity diesel fuel tax return form

Find out other Calstrs Refund

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now