Iht400 Form 2020

What is the Iht400 Form

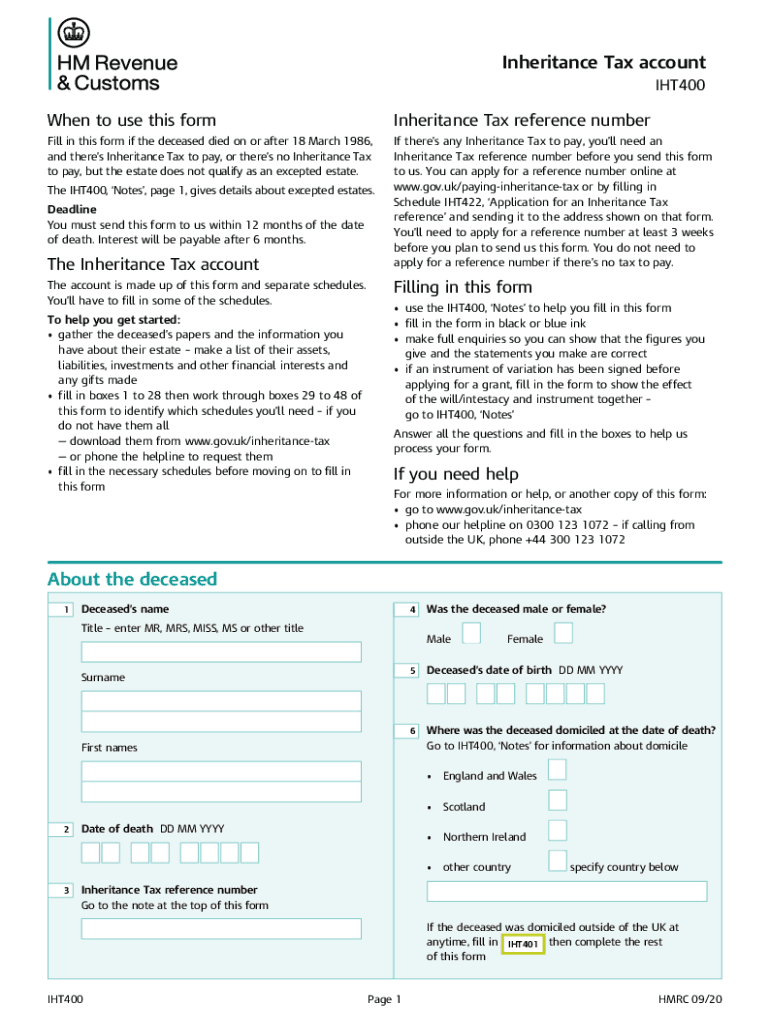

The Iht400 form, also known as the HMRC inheritance tax form, is a crucial document used in the United Kingdom to report the value of an estate upon an individual's death. This form is essential for calculating the inheritance tax owed to HMRC (Her Majesty's Revenue and Customs). The Iht400 form provides a comprehensive overview of the deceased's assets, liabilities, and any applicable exemptions or reliefs. It is a key component of the estate administration process, ensuring that all relevant information is disclosed for tax purposes.

How to use the Iht400 Form

Using the Iht400 form involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the deceased's estate, including property values, bank accounts, investments, and debts. Next, fill out the form with detailed information about each asset and liability, ensuring that all values are current and accurate. After completing the form, review it carefully for any errors or omissions. Once satisfied, submit the form to HMRC, either online or via traditional mail, depending on your preference and the specific requirements of your case.

Steps to complete the Iht400 Form

Completing the Iht400 form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including bank statements, property deeds, and investment records.

- Determine the value of the estate by assessing all assets and liabilities accurately.

- Fill out the Iht400 form, ensuring that each section is completed thoroughly.

- Double-check the form for accuracy, including names, dates, and financial figures.

- Submit the completed form to HMRC through the preferred method.

Legal use of the Iht400 Form

The Iht400 form serves a legal purpose in the context of inheritance tax. It is required by law for estates exceeding a certain value, ensuring that all tax obligations are met. The completion and submission of this form are necessary for the legal transfer of assets to beneficiaries. Failure to submit the Iht400 form can result in penalties and delays in the estate administration process. It is essential to adhere to all legal requirements associated with this form to avoid complications.

Required Documents

When completing the Iht400 form, several documents are necessary to provide a comprehensive overview of the estate. These documents typically include:

- Death certificate of the deceased.

- Valuations of all assets, including real estate and personal property.

- Bank statements and investment account statements.

- Details of any debts or liabilities owed by the deceased.

- Documentation supporting any claims for exemptions or reliefs.

Form Submission Methods (Online / Mail / In-Person)

The Iht400 form can be submitted through various methods, providing flexibility for users. The available submission options include:

- Online Submission: Completing and submitting the form electronically through the HMRC website.

- Mail Submission: Printing the completed form and sending it via postal service to the designated HMRC address.

- In-Person Submission: Although less common, some individuals may choose to deliver the form directly to an HMRC office.

Quick guide on how to complete iht400 form

Effortlessly Prepare Iht400 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Iht400 Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Simplest Method to Modify and eSign Iht400 Form with Ease

- Obtain Iht400 Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Iht400 Form and guarantee effective communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht400 form

Create this form in 5 minutes!

How to create an eSignature for the iht400 form

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the iht400 and how does it relate to airSlate SignNow?

The iht400 is a specific form used for reporting inheritance tax in the UK. With airSlate SignNow, users can easily prepare, send, and eSign iht400 forms digitally, streamlining the process and ensuring compliance.

-

How can airSlate SignNow simplify the process of filling out the iht400?

airSlate SignNow provides an intuitive interface that simplifies the completion of the iht400 form. Users can fill in their information digitally, which reduces errors and speeds up the submission process.

-

Are there any costs associated with using airSlate SignNow for the iht400?

There are various pricing plans for airSlate SignNow depending on the features you need. Users can choose a plan that suits their business requirements for handling documents like the iht400 efficiently.

-

What features does airSlate SignNow offer for managing the iht400?

airSlate SignNow offers features such as templates, electronic signature capabilities, and document tracking that are crucial for managing the iht400. These features enhance the user experience and streamline document workflows.

-

Can I integrate airSlate SignNow with other tools for processing the iht400?

Yes, airSlate SignNow offers robust integrations with various third-party applications, making it easy to connect your workflow for processing the iht400 with other essential tools used in your business.

-

What benefits does airSlate SignNow provide for businesses dealing with iht400 forms?

Using airSlate SignNow for iht400 forms brings signNow benefits, including time savings, reduced paperwork, and enhanced accuracy. Businesses can efficiently manage their tax documentation with a user-friendly solution.

-

Is airSlate SignNow secure for submitting sensitive information on the iht400?

Absolutely, airSlate SignNow prioritizes security with encryption and compliance features. This ensures that all sensitive information related to the iht400 remains protected throughout the submission process.

Get more for Iht400 Form

- Simple ira salary reduction agreement form pdf invesco

- Domestic wire transfer form usalliance financial

- Chase loan modification number 2018 2019 form

- 107453aeschet 0119 page 1 of 12 form

- Direction of signature evantage equity trust company form

- Ira distribution request form wells fargo asset management

- Tsp 17 2015 2019 form

- Entrust group inc 2018 2019 form

Find out other Iht400 Form

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter