Fill in This Form If the Deceased Died on or After 18 March 1986, 2023-2026

Understanding the iht400 Form

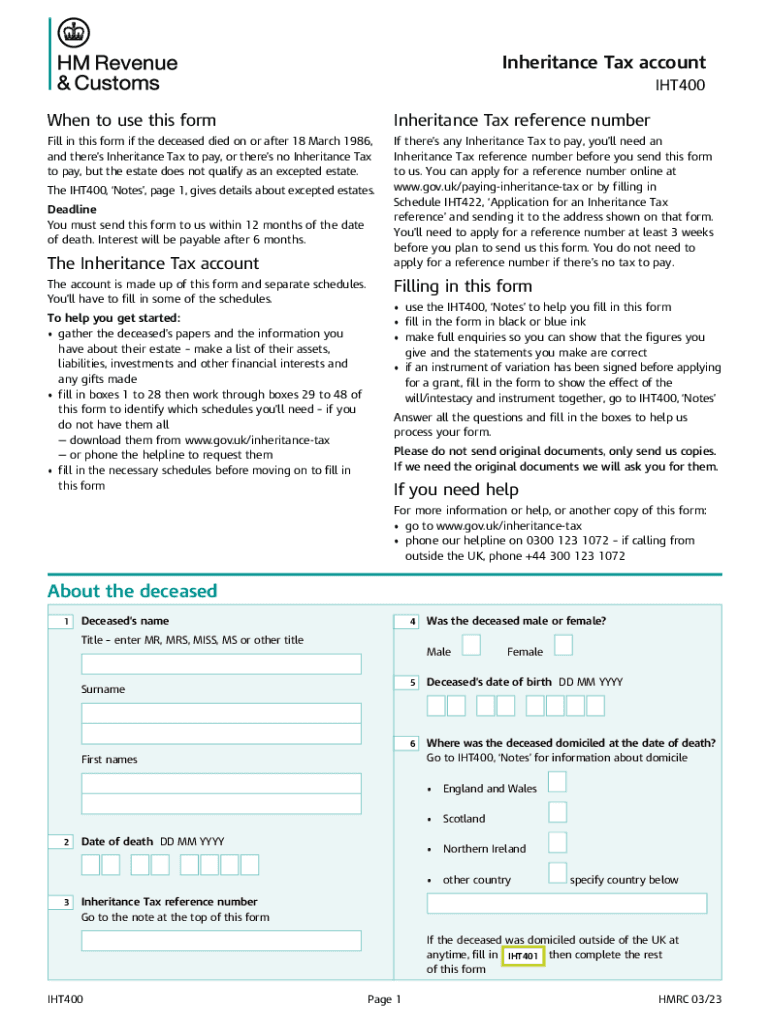

The iht400 form is a critical document used for reporting inheritance tax in the United Kingdom. It is specifically required when the deceased passed away on or after March 18, 1986. This form is essential for the executor or administrator of the estate to declare the value of the estate and determine the tax liability. Filling out this form accurately ensures compliance with tax regulations and helps avoid potential penalties.

Steps to Complete the iht400 Form

Completing the iht400 form involves several key steps to ensure accuracy and compliance with legal requirements. Start by gathering necessary information about the deceased's estate, including assets, liabilities, and any gifts made in the seven years prior to death. Next, fill out the form with detailed information about the deceased, including their full name, date of birth, and date of death. Ensure that all values are correctly calculated and reported. Finally, review the form for completeness before submission.

Required Documents for the iht400 Form

To successfully complete the iht400 form, certain documents are necessary. These include the death certificate, details of the deceased’s assets and liabilities, and any relevant financial statements. Additionally, records of any gifts made by the deceased within the last seven years are required to assess potential tax implications. Having these documents on hand will facilitate a smoother completion process.

Filing Methods for the iht400 Form

The iht400 form can be submitted in various ways. Individuals have the option to file online through the HMRC website or submit a paper version via mail. Online submissions are often faster and may provide immediate confirmation of receipt. It is important to choose the method that best suits your needs while ensuring that all information is submitted accurately and on time.

Penalties for Non-Compliance with the iht400 Form

Failing to comply with the requirements of the iht400 form can lead to significant penalties. These may include fines and interest on unpaid taxes. It is crucial to ensure that the form is completed accurately and submitted by the deadline to avoid these consequences. Understanding the implications of non-compliance emphasizes the importance of careful preparation and timely filing.

Digital vs. Paper Version of the iht400 Form

When considering the iht400 form, it is essential to understand the differences between the digital and paper versions. The digital version allows for easier data entry, automatic calculations, and faster submission. In contrast, the paper version may require manual calculations and longer processing times. Choosing the digital route can enhance efficiency and reduce the likelihood of errors.

Quick guide on how to complete fill in this form if the deceased died on or after 18 march 1986

Easily Prepare Fill In This Form If The Deceased Died On Or After 18 March 1986, on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents promptly without delays. Manage Fill In This Form If The Deceased Died On Or After 18 March 1986, on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Fill In This Form If The Deceased Died On Or After 18 March 1986, Effortlessly

- Locate Fill In This Form If The Deceased Died On Or After 18 March 1986, and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Fill In This Form If The Deceased Died On Or After 18 March 1986, to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fill in this form if the deceased died on or after 18 march 1986

Create this form in 5 minutes!

How to create an eSignature for the fill in this form if the deceased died on or after 18 march 1986

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IHT400 form and why is it important?

The IHT400 form is a crucial document used for reporting inheritance tax in the UK. This form must be completed when an estate's value exceeds a certain threshold, and it provides HMRC with all necessary details about the deceased's assets. Understanding the IHT400 form is essential for accurate estate management and tax compliance.

-

How can airSlate SignNow assist with the IHT400 form?

AirSlate SignNow streamlines the process of signing and submitting the IHT400 form electronically. With our platform, users can easily upload, eSign, and manage documents, reducing the time and effort required to handle such important paperwork. This feature ensures that your IHT400 form is completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for managing the IHT400 form?

Yes, airSlate SignNow offers a cost-effective solution for managing the IHT400 form and other important documents. Our pricing plans cater to various business needs, allowing you to leverage electronic signatures without breaking the bank. This affordability helps businesses save time and reduce costs associated with document management.

-

What features does airSlate SignNow offer for eSigning the IHT400 form?

AirSlate SignNow provides a range of features designed to enhance the eSigning experience for the IHT400 form. Key features include user-friendly templates, customizable workflows, and secure cloud storage. These tools make it simple for users to manage documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software for handling the IHT400 form?

Absolutely! AirSlate SignNow seamlessly integrates with various software, allowing users to manage the IHT400 form alongside their existing tools. This integration ensures a smooth workflow, helping you keep track of your documents and eSignatures without disrupting your current processes.

-

What are the benefits of using airSlate SignNow for the IHT400 form?

Using airSlate SignNow for the IHT400 form brings numerous benefits, including enhanced efficiency, improved accuracy, and secure document management. The platform's intuitive interface makes it easy to eSign and send documents, reducing the potential for delays or errors. With airSlate SignNow, you can manage your inheritance tax documentation with confidence.

-

Is there a mobile app available for managing the IHT400 form?

Yes, airSlate SignNow offers a mobile app that allows users to manage the IHT400 form on the go. The app provides all the essential features for eSigning and document management, enabling you to handle your inheritance tax forms anytime, anywhere. This flexibility is perfect for busy professionals who need to stay organized.

Get more for Fill In This Form If The Deceased Died On Or After 18 March 1986,

Find out other Fill In This Form If The Deceased Died On Or After 18 March 1986,

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free