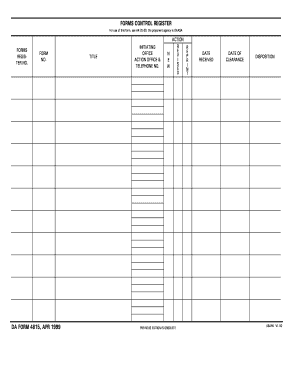

Cbp 4815 Fillable Form

What is the IRS Form 4815?

The IRS Form 4815, also known as the "Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns," is a crucial document for businesses seeking to extend their filing deadline for various tax returns. This form is particularly relevant for corporations, partnerships, and certain other business entities in the United States. By submitting Form 4815, businesses can request an automatic extension, allowing them additional time to prepare their tax documents without incurring penalties for late filing.

Steps to Complete the IRS Form 4815

Completing the IRS Form 4815 involves several key steps to ensure accuracy and compliance with IRS regulations. Here’s a straightforward guide:

- Gather Required Information: Collect all necessary financial data, including income, deductions, and any other relevant tax documents.

- Fill Out the Form: Enter your business information, including the name, address, and Employer Identification Number (EIN).

- Specify the Type of Return: Indicate the specific type of return for which you are requesting an extension.

- Sign and Date: Ensure the form is signed by an authorized person within the business and include the date of signing.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

How to Obtain the IRS Form 4815

The IRS Form 4815 can be obtained directly from the IRS website or through various tax preparation software platforms. Businesses can download a fillable PDF version of the form, making it easy to complete and submit electronically. Additionally, tax professionals can provide assistance in obtaining and filling out the form accurately.

Legal Use of the IRS Form 4815

Using the IRS Form 4815 is legally binding and must be done in accordance with IRS guidelines. The form allows businesses to extend their filing deadline without incurring penalties, provided it is submitted on time. It is important to understand that an extension does not extend the time to pay any taxes owed; businesses are still required to estimate and pay their tax liability by the original due date to avoid interest and penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IRS Form 4815 is essential for compliance. Generally, the form must be filed by the due date of the original return. For most businesses, this is typically the fifteenth day of the fourth month following the end of their tax year. However, specific deadlines may vary based on the type of business entity and fiscal year. It is advisable to check the IRS website for the most current deadlines and any changes to filing requirements.

Form Submission Methods

The IRS Form 4815 can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online Submission: Many tax software programs allow for electronic filing of Form 4815, making the process quick and efficient.

- Mail: Businesses can print the completed form and send it to the appropriate IRS address based on their location and type of business.

- In-Person: Some businesses may choose to submit the form in person at their local IRS office, though this is less common.

Quick guide on how to complete cbp 4815 fillable

Effortlessly prepare Cbp 4815 Fillable on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, edit, and eSign your documents swiftly without delays. Manage Cbp 4815 Fillable on any gadget using airSlate SignNow’s applications for Android or iOS and streamline any document-related task today.

How to edit and eSign Cbp 4815 Fillable with ease

- Find Cbp 4815 Fillable and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize signNow sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any gadget you choose. Edit and eSign Cbp 4815 Fillable while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cbp 4815 fillable

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is IRS Form 4815 and why do I need it?

IRS Form 4815 is used by businesses to report the disposition of certain assets. Understanding how to properly complete IRS Form 4815 is crucial for accurate tax reporting and compliance. Using airSlate SignNow, you can easily eSign and submit this form, ensuring that your documentation is processed swiftly.

-

How can airSlate SignNow help me with IRS Form 4815?

AirSlate SignNow simplifies the process of managing IRS Form 4815 by allowing you to eSign documents securely. With our platform, you can easily fill out and send IRS Form 4815 electronically, improving efficiency and ensuring your forms are processed accurately.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4815?

Yes, airSlate SignNow offers various pricing plans, tailored to fit different business needs. Each plan provides the necessary features to manage documents like IRS Form 4815 efficiently, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for IRS Form 4815?

AirSlate SignNow provides robust features such as customizable templates, document tracking, and secure eSigning to help you manage IRS Form 4815 efficiently. These features streamline the completion and submission process, making it easier for businesses to remain compliant.

-

Can I integrate airSlate SignNow with other software to assist with IRS Form 4815?

Yes, airSlate SignNow offers seamless integrations with various business applications, enhancing your workflow when handling IRS Form 4815. By connecting with your existing tools, you can automate document management and ensure timely submissions.

-

How secure is the eSigning process for IRS Form 4815 using airSlate SignNow?

The eSigning process for IRS Form 4815 using airSlate SignNow is highly secure, employing encryption and secure servers to protect your data. You can confidently complete and send IRS Form 4815 knowing that your information is safe and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for IRS Form 4815 compared to traditional methods?

Using airSlate SignNow for IRS Form 4815 offers signNow benefits over traditional methods, including faster processing times, reduced paperwork, and enhanced accuracy in submissions. Plus, the platform is user-friendly, making it easy for anyone to effortlessly manage their tax documents.

Get more for Cbp 4815 Fillable

- Factor evaluation system position gsa form

- Than 23660 form

- Federal wage system employees the employee is in a non supervisory form

- Hours of work in a given workweek in one or more exempt areas regardless of where form

- General schedule supervisory guide opm form

- Positions or teacher positions form

- Or duties that are not consistent with the employees primary duties for an extended form

- Overseas employment agreement assignment to a gsa form

Find out other Cbp 4815 Fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors