Pag Ibig Co Borrower Form 2012

What is the Pag Ibig Co Borrower Form

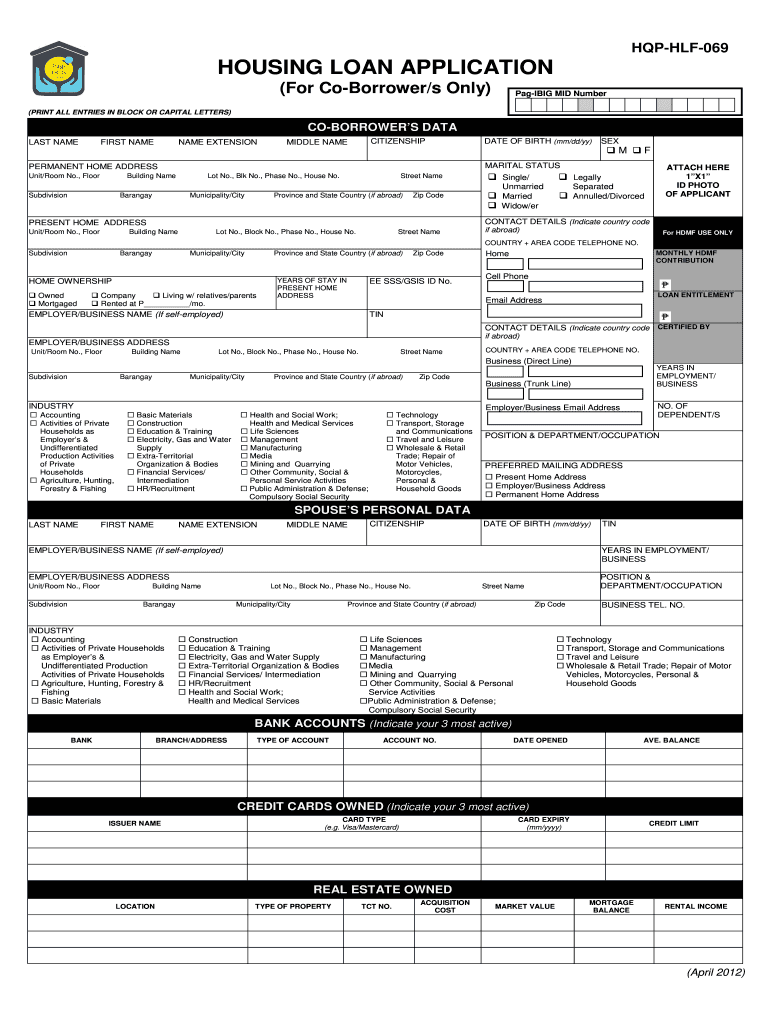

The Pag Ibig Co Borrower Form is a crucial document for individuals applying for a housing loan through the Pag Ibig Fund, specifically designed for co-borrowers. This form allows multiple parties to jointly apply for a loan, sharing the financial responsibility and benefits. It is essential for those who may not qualify for a loan individually or wish to increase their borrowing capacity by including a co-borrower. The form outlines the roles and obligations of each party involved in the loan agreement, ensuring transparency and understanding among all applicants.

How to Obtain the Pag Ibig Co Borrower Form

To obtain the Pag Ibig Co Borrower Form, individuals can visit the official Pag Ibig Fund website or their local Pag Ibig branch. The form is typically available for download in a printable format, allowing applicants to fill it out at their convenience. Additionally, physical copies can be requested directly from Pag Ibig offices. It is advisable to check for any updates or changes to the form on the official site to ensure compliance with current requirements.

Steps to Complete the Pag Ibig Co Borrower Form

Completing the Pag Ibig Co Borrower Form involves several key steps:

- Gather necessary personal information for all borrowers, including full names, addresses, and identification details.

- Provide financial information, such as income, employment details, and existing liabilities.

- Clearly outline the relationship between the primary borrower and the co-borrower.

- Review the form for accuracy and completeness before submission.

It is important to ensure all information is truthful and up to date, as inaccuracies may delay the loan approval process.

Key Elements of the Pag Ibig Co Borrower Form

The Pag Ibig Co Borrower Form contains several critical elements that must be accurately filled out:

- Personal Information: Names, addresses, and contact details of all borrowers.

- Financial Information: Details about income, assets, and liabilities.

- Loan Details: Information regarding the requested loan amount and purpose.

- Signatures: Both borrowers must sign the form to validate their agreement and consent.

Each section must be completed carefully to ensure a smooth application process.

Legal Use of the Pag Ibig Co Borrower Form

The Pag Ibig Co Borrower Form is legally binding once completed and signed by all parties involved. It serves as an official record of the agreement between the primary borrower and the co-borrower regarding their shared responsibilities for the loan. Compliance with all legal requirements, including providing accurate information and obtaining necessary signatures, is essential for the form to be recognized by financial institutions and in legal contexts.

Form Submission Methods

The Pag Ibig Co Borrower Form can be submitted through various methods:

- Online: Some Pag Ibig services allow for online submission through their official website.

- Mail: Completed forms can be sent via postal service to the nearest Pag Ibig branch.

- In-Person: Applicants can also submit the form directly at a Pag Ibig office, where staff can assist with any questions.

Choosing the appropriate submission method can help streamline the application process and ensure timely processing of the loan request.

Quick guide on how to complete pag ibig co borrower form

Effortlessly Prepare Pag Ibig Co Borrower Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents quickly without delays. Manage Pag Ibig Co Borrower Form on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Adjust and Electronically Sign Pag Ibig Co Borrower Form with Ease

- Find Pag Ibig Co Borrower Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Pag Ibig Co Borrower Form to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pag ibig co borrower form

Create this form in 5 minutes!

How to create an eSignature for the pag ibig co borrower form

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the pag ibig housing loan form and how do I use it?

The pag ibig housing loan form is a crucial document required for applying for a housing loan through the Pag-IBIG Fund. You can use it to gain access to affordable financing options for your home. Simply download the form, fill it out with the necessary details, and submit it along with required documents to process your loan application efficiently.

-

Where can I obtain the pag ibig housing loan form?

You can obtain the pag ibig housing loan form directly from the official Pag-IBIG Fund website or at their local branches. Additionally, you may find downloadable versions of the form through various online platforms that provide resources for home loan applications. Make sure to use the latest version to avoid any issues.

-

What are the benefits of using the pag ibig housing loan form?

Using the pag ibig housing loan form streamlines your application process, allowing you to access competitive loan rates and flexible terms offered by the Pag-IBIG Fund. It provides a straightforward way to gather all necessary information, ensuring that your application is complete and reducing the likelihood of delays. By using this form, you can make your homeownership dreams a reality more efficiently.

-

What documents do I need to submit with the pag ibig housing loan form?

When submitting the pag ibig housing loan form, you typically need to include proof of income, a valid ID, and documents pertaining to the property you intend to purchase or build. Additional requirements may vary based on your circumstances, so it’s wise to check the latest guidelines from the Pag-IBIG Fund directly. Ensure all documents are complete to expedite processing.

-

Can I fill out the pag ibig housing loan form online?

While the pag ibig housing loan form is primarily a paper document, some local Pag-IBIG offices now offer online submission options. Check the official Pag-IBIG Fund website for any digital alternatives available for your area to simplify your application process. Even if online forms are not available, preparing your information online can save time.

-

How much does it cost to process the pag ibig housing loan form?

Processing the pag ibig housing loan form generally involves minimal costs, as Pag-IBIG is designed to provide affordable housing solutions. However, you may incur fees related to appraisal, insurance, or documentation. It’s advisable to review the cost structure through Pag-IBIG Fund to fully understand any fees associated with your loan application.

-

How long does it take to process the pag ibig housing loan form?

The processing time for the pag ibig housing loan form varies depending on the completeness of your application and current workload at Pag-IBIG offices. Typically, straightforward applications can be processed within a few weeks, while those requiring additional clarifications may take longer. Staying proactive by providing all necessary information can help speed up the process.

Get more for Pag Ibig Co Borrower Form

Find out other Pag Ibig Co Borrower Form

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form