T2011 Form

What is the T2011

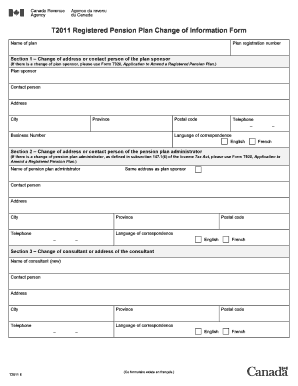

The T2011 form is a specific document used within the U.S. tax system, primarily for reporting certain types of income or deductions. It is essential for individuals and businesses to accurately complete this form to ensure compliance with tax regulations. Understanding the purpose and requirements of the T2011 is crucial for effective tax management.

How to use the T2011

Using the T2011 form involves several key steps. First, gather all necessary financial documents and information relevant to the income or deductions being reported. Next, carefully fill out each section of the form, ensuring accuracy to avoid delays or penalties. Once completed, review the form for any errors before submission. Utilizing electronic solutions can streamline this process, making it easier to fill out and submit the T2011.

Steps to complete the T2011

Completing the T2011 form requires attention to detail. Follow these steps for successful completion:

- Collect all relevant financial records, such as income statements and deduction receipts.

- Begin filling out the form, starting with personal identification information.

- Provide detailed entries for income and deductions as required.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the T2011

The legal use of the T2011 form is governed by U.S. tax laws. It must be completed accurately and submitted by the appropriate deadlines to avoid penalties. The form serves as a formal declaration of income or deductions, and any discrepancies can lead to audits or legal issues. Therefore, understanding the legal implications of the T2011 is vital for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the T2011 form vary depending on the type of taxpayer and the specific circumstances. Generally, individuals must submit their forms by April 15 of the following tax year. Businesses may have different deadlines based on their fiscal year. Staying informed about these dates is essential to avoid late fees and ensure timely processing.

Required Documents

To complete the T2011 form, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation requested by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The T2011 form can be submitted through various methods. Taxpayers have the option to file online using electronic filing services, which can expedite the process. Alternatively, the form can be mailed to the appropriate IRS office or submitted in person at designated locations. Each method has its advantages, so choosing the one that best fits your needs is important.

Quick guide on how to complete t2011

Effortlessly Prepare T2011 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Handle T2011 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and Electronically Sign T2011 with Ease

- Find T2011 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign T2011 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2011

Create this form in 5 minutes!

How to create an eSignature for the t2011

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the t2011 and how does it work?

The t2011 is a powerful feature within airSlate SignNow that allows users to electronically sign and send documents with ease. It simplifies the signing process, making it efficient for both senders and recipients. With t2011, businesses can streamline their document workflows, ensuring faster turnaround times.

-

What are the pricing options for using t2011?

airSlate SignNow offers several pricing plans tailored to different business needs, including options that incorporate the t2011 feature. These plans are designed to be cost-effective, ensuring that companies of all sizes can access the t2011 functionality without straining their budgets. Visit our pricing page to find the plan that suits your requirements best.

-

What benefits does the t2011 provide for businesses?

The t2011 enhances efficiency by allowing for quick document signing and management, which can lead to improved productivity. Additionally, it reduces the need for physical paperwork, resulting in cost savings and a smaller environmental footprint. Many businesses see faster transaction times and higher customer satisfaction by utilizing the t2011 feature.

-

Are there any integrations available for t2011?

Yes, the t2011 feature seamlessly integrates with various third-party applications to enhance your workflow. This means you can connect it with CRM systems, cloud storage, and more, providing a unified document management experience. These integrations help to further optimize your business processes, making the t2011 even more valuable.

-

Is the t2011 secure for sensitive documents?

Absolutely! The t2011 includes robust security features, such as encryption and secure access controls, to protect sensitive documents. airSlate SignNow complies with industry standards and regulations ensuring that your data is secure during the signing process. Users can trust that their important documents are handled with the utmost confidentiality.

-

Can I use the t2011 feature on mobile devices?

Yes, the t2011 is fully optimized for mobile devices, allowing users to sign and send documents on the go. This mobile accessibility means you can manage your document workflows anytime, anywhere. Whether you're in the office or working remotely, the t2011 feature provides flexibility and convenience.

-

What types of documents can I manage with t2011?

The t2011 allows you to manage a wide array of document types, including contracts, agreements, and forms. This versatility makes it suitable for various industries and business scenarios. Whether you need to sign a simple document or a complex agreement, the t2011 can handle it efficiently.

Get more for T2011

Find out other T2011

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document