T2011 Registered Pension Plan Change of Information Form 2019-2026

What is the T2011 Registered Pension Plan Change Of Information Form

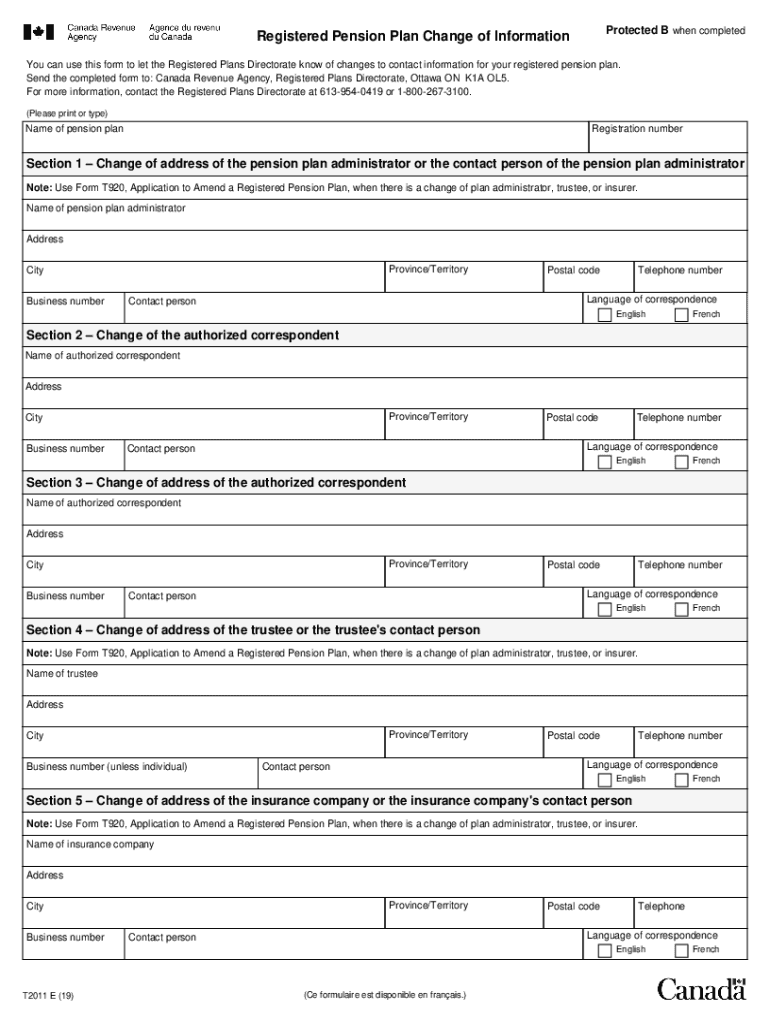

The T2011 form is a crucial document used in the context of registered pension plans in Canada. It serves to notify the Canada Revenue Agency (CRA) of any changes to the information related to a registered pension plan. This form is essential for maintaining compliance with regulations governing pension plans, ensuring that all details are up-to-date and accurate. The T2011 form is particularly important for plan administrators, as it helps manage contributions, benefits, and other critical aspects of pension plan administration.

How to use the T2011 Registered Pension Plan Change Of Information Form

Using the T2011 form involves several key steps. First, ensure that you have the correct version of the form, which can typically be obtained from the CRA’s website or through authorized sources. Next, fill out the form with the necessary information, including details about the pension plan and the specific changes being reported. It is important to provide accurate and complete information to avoid delays or issues with processing. Once completed, the form can be submitted electronically or by mail, depending on the requirements set by the CRA.

Steps to complete the T2011 Registered Pension Plan Change Of Information Form

Completing the T2011 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary information regarding the pension plan, including the plan number, name, and details of the changes.

- Access the T2011 form from the CRA’s official resources.

- Fill in the required fields, ensuring that all information is accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Submit the form according to the CRA’s guidelines, either electronically or via mail.

Legal use of the T2011 Registered Pension Plan Change Of Information Form

The T2011 form is legally recognized as a valid method for reporting changes to registered pension plans. To ensure its legal validity, it must be completed accurately and submitted in accordance with the CRA's regulations. Compliance with the relevant laws and guidelines is essential, as failure to do so may result in penalties or complications with the pension plan's status. Utilizing a reliable electronic signature solution can further enhance the legal standing of the submitted form.

Key elements of the T2011 Registered Pension Plan Change Of Information Form

Several key elements must be included when filling out the T2011 form. These include:

- The registered pension plan's identification number.

- The name of the pension plan and the plan administrator.

- A detailed description of the changes being reported.

- The date on which the changes take effect.

- Contact information for the plan administrator for follow-up inquiries.

Form Submission Methods (Online / Mail / In-Person)

The T2011 form can be submitted through various methods, depending on the preferences of the plan administrator and the guidelines set by the CRA. Options include:

- Online Submission: Many administrators prefer to submit the form electronically through the CRA's online portal, which can expedite processing times.

- Mail Submission: The completed form can also be printed and mailed to the appropriate CRA address.

- In-Person Submission: In certain cases, administrators may choose to deliver the form in person at a local CRA office, although this method is less common.

Quick guide on how to complete t2011 registered pension plan change of information form

Effortlessly Prepare T2011 Registered Pension Plan Change Of Information Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle T2011 Registered Pension Plan Change Of Information Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Modify and eSign T2011 Registered Pension Plan Change Of Information Form Seamlessly

- Obtain T2011 Registered Pension Plan Change Of Information Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, exhausting document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign T2011 Registered Pension Plan Change Of Information Form while ensuring excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2011 registered pension plan change of information form

Create this form in 5 minutes!

How to create an eSignature for the t2011 registered pension plan change of information form

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the t2011 form?

The t2011 form is a tax document used by Canadians to report income and claim certain credits or deductions. Understanding this form is essential for ensuring accurate tax filings and maximizing potential returns. With airSlate SignNow, you can securely send and eSign your t2011 form directly, simplifying your tax preparation process.

-

How can I use airSlate SignNow to complete the t2011 form?

You can easily upload your t2011 form to airSlate SignNow and fill it out electronically. The platform allows you to add signatures, initials, and necessary annotations to ensure that your form is completed accurately. Our user-friendly interface streamlines the process, making it easy to manage your tax documents.

-

Is airSlate SignNow suitable for small businesses needing to file the t2011 form?

Yes, airSlate SignNow is ideal for small businesses that need to manage tax documents like the t2011 form. Our solution is cost-effective and designed to enhance productivity through easy document management and eSigning functions. This means you can focus on your business while we handle your paperwork.

-

What are the security features for signing the t2011 form on airSlate SignNow?

AirSlate SignNow employs top-grade encryption and secure servers to protect documents like the t2011 form. We also provide an audit trail for every signed document, ensuring that your tax information remains confidential and secure. You can trust us to keep your sensitive data safe during the signing process.

-

Can airSlate SignNow integrate with other software I use for tax preparation?

Yes, airSlate SignNow offers integrations with popular accounting and tax preparation software. This means you can seamlessly import and export your t2011 form and other related documents, streamlining your overall workflow. Our platform is designed to enhance compatibility and improve efficiency with your existing tools.

-

What are the pricing options for using airSlate SignNow to manage the t2011 form?

AirSlate SignNow provides a range of pricing plans that cater to different business needs. Each plan includes features that help you manage documents like the t2011 form effectively and affordably. You can choose a plan that aligns with your budget while enjoying the benefits of our comprehensive electronic signature solution.

-

How does airSlate SignNow improve my efficiency when handling the t2011 form?

Our platform enhances efficiency by allowing you to complete and send the t2011 form quickly and digitally. With templates and automation features, you can reduce time spent on paperwork, enabling faster turnaround for your tax filings. AirSlate SignNow makes document management straightforward, ensuring you stay organized and compliant.

Get more for T2011 Registered Pension Plan Change Of Information Form

- Instructions for form 2553 122020internal revenue

- 2020 schedule k 1 form 1120 s shareholders share of income deductions credits etc

- 2020 instructions for form 940 internal revenue service

- 2020 schedule d form 1040 capital gains and losses

- Form 5227

- 2020 instructions for form 944 instructions for form 944 employers annual federal tax return

- Form 4506 rev 11 2020 request for copy of tax return

- 2020 form 4684 casualties and thefts

Find out other T2011 Registered Pension Plan Change Of Information Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free