Name of Pension Plan 2016

What is the Name Of Pension Plan

The Name Of Pension Plan is a financial arrangement designed to provide individuals with income after retirement. This plan allows employees to contribute a portion of their earnings, often matched by their employer, to a fund that accumulates over time. The funds are typically invested in various assets, aiming to grow the retirement savings. Upon reaching retirement age, participants can withdraw funds or receive regular payments, ensuring financial stability during their retirement years.

How to use the Name Of Pension Plan

Using the Name Of Pension Plan involves several steps. First, individuals must enroll in the plan, which often requires filling out an application form. Next, participants decide on their contribution levels, which can usually be adjusted over time. Regular monitoring of investment performance is also essential to ensure that the plan meets retirement goals. Finally, understanding the withdrawal options and tax implications when accessing funds is crucial for effective management of retirement savings.

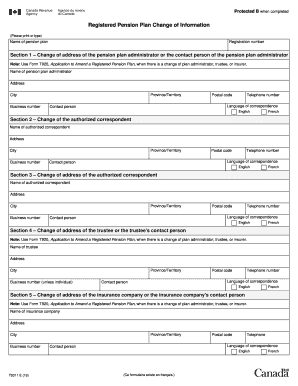

Steps to complete the Name Of Pension Plan

Completing the Name Of Pension Plan involves a few key steps:

- Gather necessary personal and financial information, including Social Security number and employment details.

- Fill out the enrollment form accurately, ensuring all required fields are completed.

- Choose your contribution rate, considering both your financial situation and retirement goals.

- Submit the completed form to your employer or the plan administrator for processing.

- Regularly review your account statements and make adjustments as needed.

Legal use of the Name Of Pension Plan

The Name Of Pension Plan is governed by several legal frameworks that ensure its proper use and compliance. In the United States, the Employee Retirement Income Security Act (ERISA) sets standards for pension plans, protecting participants' rights and ensuring that funds are managed responsibly. Additionally, the plan must adhere to tax regulations outlined by the Internal Revenue Service (IRS), which dictate contribution limits and tax treatment of withdrawals. Understanding these legal requirements is vital for both employers and employees to avoid penalties and ensure compliance.

Key elements of the Name Of Pension Plan

Several key elements define the Name Of Pension Plan:

- Contributions: Regular payments made by employees and employers into the pension fund.

- Investment Strategy: The approach taken to grow the fund, which can include stocks, bonds, and other assets.

- Vesting Schedule: The timeline over which employees earn the right to their employer's contributions.

- Distribution Options: Various methods available for withdrawing funds upon retirement, including lump-sum payments or annuities.

Eligibility Criteria

Eligibility for the Name Of Pension Plan varies based on employer policies and plan specifics. Generally, employees must meet certain criteria, such as:

- Age requirements, often needing to be at least 21 years old.

- Minimum service duration with the employer, which can range from a few months to several years.

- Employment status, as part-time employees may have different eligibility rules compared to full-time staff.

Quick guide on how to complete name of pension plan

Complete Name Of Pension Plan effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without any holdups. Handle Name Of Pension Plan on any device using airSlate SignNow Android or iOS applications and enhance any document-based task today.

The simplest method to edit and eSign Name Of Pension Plan without hassle

- Find Name Of Pension Plan and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Name Of Pension Plan to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct name of pension plan

Create this form in 5 minutes!

How to create an eSignature for the name of pension plan

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Name Of Pension Plan and how does it work?

The Name Of Pension Plan is a structured retirement savings program designed to provide individuals with financial security during their retirement years. It typically involves regular contributions from employees and employers, which accumulate over time and can be accessed upon retirement. Understanding how the Name Of Pension Plan works can help you maximize your retirement benefits.

-

What are the benefits of enrolling in the Name Of Pension Plan?

Enrolling in the Name Of Pension Plan offers several benefits, including tax advantages and potential employer matching contributions. This can signNowly enhance your retirement savings and provide a reliable income stream during retirement. It's an investment in your future that promotes financial stability.

-

How much does it cost to participate in the Name Of Pension Plan?

The cost of participating in the Name Of Pension Plan usually depends on your contribution level and whether your employer matches your contributions. Most plans have low administrative fees, making them a cost-effective way to save for retirement. It's important to review the specific terms of your plan for detailed pricing information.

-

Can I customize my contributions to the Name Of Pension Plan?

Yes, most Name Of Pension Plans allow for flexible contribution options, enabling you to adjust your savings based on your financial situation. You can typically choose a percentage of your salary or a fixed dollar amount to contribute regularly. Customizing your contributions helps align your retirement goals with your current financial capabilities.

-

What features are included with the Name Of Pension Plan?

The Name Of Pension Plan often includes features such as diversified investment options, online account management, and retirement planning tools. Some plans also offer automatic rebalancing and performance tracking to help you stay on track with your retirement goals. Understanding these features can enhance your experience and investment strategy.

-

Is the Name Of Pension Plan compatible with other retirement accounts?

Yes, the Name Of Pension Plan can often be integrated with other retirement accounts, such as IRAs or 401(k)s. This compatibility allows you to consolidate your retirement savings and optimize your investment strategy. Make sure to consult with a financial advisor to understand the best combination for your needs.

-

How can I track the performance of my Name Of Pension Plan?

Most providers of the Name Of Pension Plan offer online portals where you can easily monitor the performance of your investments. You'll typically have access to real-time updates, historical performance data, and analysis tools. Utilizing these resources is key to making informed decisions about your retirement savings.

Get more for Name Of Pension Plan

- College visit evaluation form

- Steps to replace or update your social security id investopedia form

- Ashworth proctor form

- Howard university statement of financial resources yumpu form

- Affiliate authorization form

- Iowa initial care plan form

- Graduate program in genetics tufts university graduate form

- Form no ogc sf 2003 02

Find out other Name Of Pension Plan

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney