Fillable Form 4892 Michigan 2019

What is the Fillable Form 4892 Michigan

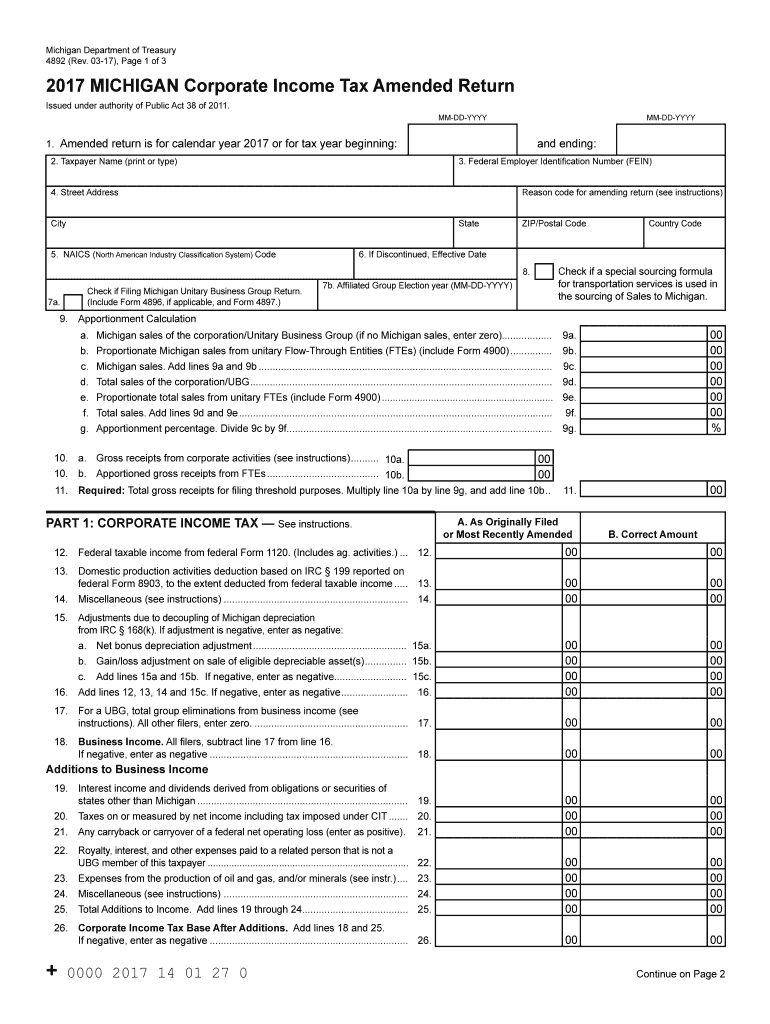

The Fillable Form 4892, also known as the Michigan Amended Individual Income Tax Return, is a document used by taxpayers in Michigan to correct errors on a previously filed state tax return. This form allows individuals to make adjustments to their income, deductions, and credits, ensuring that their tax obligations are accurately reflected. It is essential for taxpayers who need to amend their original tax filings for the years specified, including 2016.

Steps to Complete the Fillable Form 4892 Michigan

Completing the Fillable Form 4892 involves several key steps:

- Gather Documentation: Collect all relevant documents, including your original tax return and any supporting materials that justify the amendments.

- Fill Out the Form: Accurately enter the necessary information, including your name, address, and the changes being made to your original return.

- Provide Explanations: Clearly explain the reasons for the amendments in the designated section of the form.

- Review for Accuracy: Double-check all entries to ensure that there are no mistakes before submitting the form.

- Sign and Date: Ensure that you sign and date the form to validate your submission.

Legal Use of the Fillable Form 4892 Michigan

The Fillable Form 4892 is legally recognized as a valid method for amending a Michigan tax return. To ensure compliance, it must be completed accurately and submitted within the required timeframe. The form must adhere to the regulations set forth by the Michigan Department of Treasury, which governs the use of amended returns. Proper use of this form can help avoid penalties and ensure that any adjustments to your tax obligations are legally binding.

Filing Deadlines / Important Dates

When filing the Fillable Form 4892, it is crucial to be aware of the deadlines associated with amended returns. Generally, taxpayers must file the amended return within three years from the original due date of the return or within one year from the date of the tax payment, whichever is later. Missing these deadlines may result in the inability to claim a refund or address any discrepancies in your tax filings.

Form Submission Methods (Online / Mail / In-Person)

The Fillable Form 4892 can be submitted through various methods:

- Online: Some taxpayers may have the option to file electronically through approved e-filing services.

- Mail: Print the completed form and send it to the appropriate address provided by the Michigan Department of Treasury.

- In-Person: Taxpayers may also choose to deliver the form directly to a local Michigan Department of Treasury office.

Penalties for Non-Compliance

Failure to comply with the requirements for filing the Fillable Form 4892 can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for fraudulent claims. It is essential to ensure that all amendments are made accurately and submitted on time to avoid these consequences.

Quick guide on how to complete 2018 fillable form 4892 michigan

Accomplish Fillable Form 4892 Michigan effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Fillable Form 4892 Michigan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Fillable Form 4892 Michigan with ease

- Find Fillable Form 4892 Michigan and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method for sharing your form, such as email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Fillable Form 4892 Michigan and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 fillable form 4892 michigan

Create this form in 5 minutes!

How to create an eSignature for the 2018 fillable form 4892 michigan

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 2016 mi form, and why is it important?

The 2016 mi form is a document required for certain tax reporting purposes in Michigan. It helps ensure you comply with state regulations while filing your taxes. Utilizing tools like airSlate SignNow makes it easier to fill, sign, and submit the 2016 mi form efficiently.

-

How can airSlate SignNow assist with completing the 2016 mi form?

AirSlate SignNow offers an intuitive platform that allows users to easily complete and e-sign the 2016 mi form. With customizable templates and a user-friendly interface, you can streamline your document workflow and save valuable time.

-

Is there a cost associated with using airSlate SignNow for the 2016 mi form?

Yes, airSlate SignNow has various pricing plans that cater to different business needs. The plans are designed to provide cost-effective solutions for handling documents like the 2016 mi form, depending on your usage and required features.

-

Can I integrate airSlate SignNow with other software when working on the 2016 mi form?

Absolutely! AirSlate SignNow integrates seamlessly with various applications such as CRMs and cloud storage services. This feature enhances your workflow by allowing you to manage the 2016 mi form alongside other business processes in one place.

-

What features does airSlate SignNow offer for managing the 2016 mi form?

AirSlate SignNow includes features such as document templates, electronic signatures, and secure storage, all of which are useful for managing the 2016 mi form. These tools simplify the signing process and ensure that your documents are safe and compliant.

-

How secure is my information when using airSlate SignNow for the 2016 mi form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and measures to protect your personal and financial information, ensuring that your 2016 mi form and related documents are handled securely.

-

Can I track the status of my 2016 mi form submission with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 2016 mi form. You can see when the document has been viewed, signed, and finalized, enabling you to manage your submissions effectively.

Get more for Fillable Form 4892 Michigan

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497427501 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property utah form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential utah form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property utah form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property utah form

- Agreed written termination of lease by landlord and tenant utah form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497427509 form

- Lease with property 497427510 form

Find out other Fillable Form 4892 Michigan

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later