Income Tax Forms Grandrapidsmi Gov 2019

Understanding the gr 1040nr Form

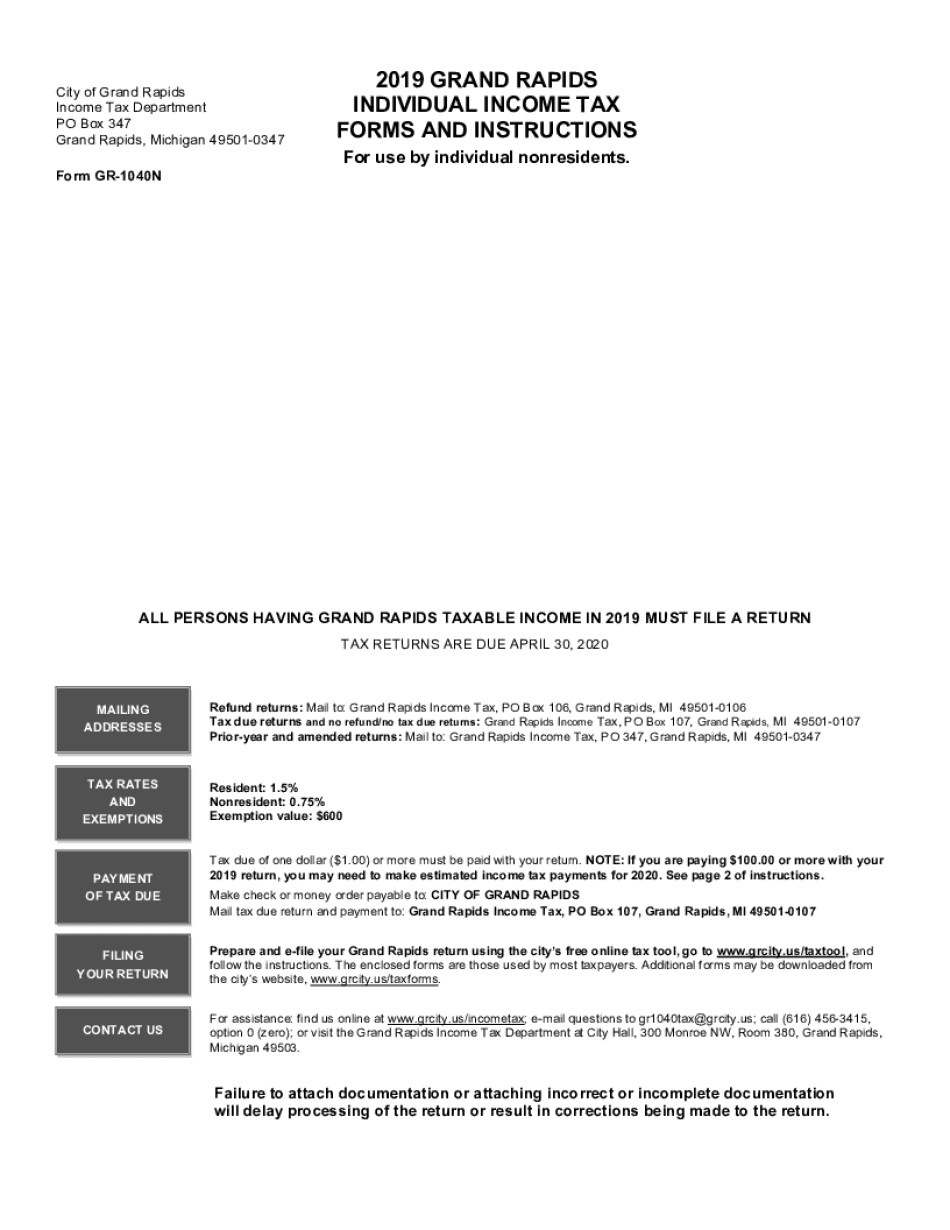

The gr 1040nr form is a crucial document for non-resident individuals who earn income in Grand Rapids, Michigan. This form allows these individuals to report their income and calculate the corresponding tax obligations. It is essential for maintaining compliance with local tax laws and ensuring that all income is accurately reported to the authorities.

Steps to Complete the gr 1040nr Form

Completing the gr 1040nr form involves several key steps:

- Gather necessary documentation, such as W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income earned in Grand Rapids, ensuring accuracy in amounts.

- Calculate deductions and credits that may apply to your situation.

- Review the completed form for accuracy before submission.

Legal Use of the gr 1040nr Form

The gr 1040nr form must be filled out accurately to be considered legally valid. It is essential to comply with all local tax regulations to avoid penalties. The form serves as a formal declaration of income, and submitting it electronically through a trusted platform ensures that it meets all legal requirements. Proper eSignature solutions can further enhance the legal standing of the submitted document.

Filing Deadlines for the gr 1040nr Form

Timely filing of the gr 1040nr form is crucial to avoid late fees and penalties. Generally, the deadline for submitting this form aligns with federal tax deadlines, typically falling on April fifteenth. However, non-residents may have different deadlines depending on their specific circumstances, so it is important to verify the exact dates each tax year.

Form Submission Methods

The gr 1040nr form can be submitted through various methods:

- Online submission via secure e-filing platforms that ensure data protection.

- Mailing the completed form to the appropriate tax authority address.

- In-person submission at designated tax offices for those who prefer face-to-face interactions.

Required Documents for the gr 1040nr Form

To successfully complete the gr 1040nr form, certain documents are necessary:

- Income statements such as W-2s and 1099s.

- Proof of residency or non-residency status.

- Any relevant tax documents that support deductions or credits claimed.

IRS Guidelines for Non-Residents

Understanding IRS guidelines is vital for those filling out the gr 1040nr form. Non-residents must adhere to specific rules regarding income reporting and tax obligations. Familiarizing oneself with these guidelines helps ensure compliance and minimizes the risk of errors during the filing process.

Quick guide on how to complete income tax forms grandrapidsmigov

Effortlessly prepare Income Tax Forms Grandrapidsmi gov on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Income Tax Forms Grandrapidsmi gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Income Tax Forms Grandrapidsmi gov with ease

- Find Income Tax Forms Grandrapidsmi gov and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Income Tax Forms Grandrapidsmi gov and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax forms grandrapidsmigov

Create this form in 5 minutes!

How to create an eSignature for the income tax forms grandrapidsmigov

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the GR 1040NR form and who needs it?

The GR 1040NR form is a federal tax return specifically for non-resident aliens who earn income in the United States. If you are in this category, filing the GR 1040NR is essential for meeting your legal tax obligations. It helps ensure that you correctly report any income and claim any eligible deductions or credits.

-

How can airSlate SignNow help me with my GR 1040NR filing?

airSlate SignNow streamlines the process of gathering signatures on your GR 1040NR forms, making it easy to collect necessary approvals from all parties involved. With its user-friendly interface, you can send and eSign your GR 1040NR documents quickly, ensuring compliance while saving time and effort.

-

What are the costs associated with using airSlate SignNow for my GR 1040NR documents?

airSlate SignNow offers pricing plans that cater to various business needs, making it a cost-effective solution for handling your GR 1040NR forms. With flexible subscription options, you can choose a plan that suits your usage, ensuring you only pay for what you need while enjoying all the features necessary for efficient eSigning.

-

What features does airSlate SignNow provide for GR 1040NR forms?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking, all of which enhance the management of your GR 1040NR documents. These features ensure that you can create, send, and monitor your forms efficiently, providing peace of mind throughout the process.

-

Is airSlate SignNow compliant with federal regulations for the GR 1040NR?

Yes, airSlate SignNow is fully compliant with federal regulations, including those relevant to the GR 1040NR form. This compliance ensures that your eSigned documents are legally binding and that you can confidently submit them to the IRS, minimizing the risk of rejection or audit.

-

Can I integrate airSlate SignNow with other applications to manage my GR 1040NR?

Absolutely! airSlate SignNow offers seamless integrations with various applications, which allows you to manage your GR 1040NR forms alongside your existing workflow tools. Whether you use accounting software or document management systems, you can enhance your productivity by integrating SignNow.

-

What benefits does airSlate SignNow provide for businesses dealing with GR 1040NR forms?

Using airSlate SignNow to handle your GR 1040NR forms brings numerous benefits such as increased efficiency, reduced processing times, and enhanced collaboration among team members. The platform's ease of use and accessibility means you can focus on core business activities while knowing your tax documents are efficiently managed.

Get more for Income Tax Forms Grandrapidsmi gov

- Warranty deed four grantors to two individuals husband and wife as grantees wisconsin form

- Wi discovery form

- Discovery interrogatories from defendant to plaintiff with production requests wisconsin form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant wisconsin form

- Quitclaim deed one individual to two individuals wisconsin form

- Warranty deed from an individual to two individuals wisconsin form

- Transfer death deed 497430527 form

- Warranty deed from individual to three individuals wisconsin form

Find out other Income Tax Forms Grandrapidsmi gov

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online