Instructions for Form CT 183 and CT 184 2024-2026

Understanding the Instructions for Form CT 184

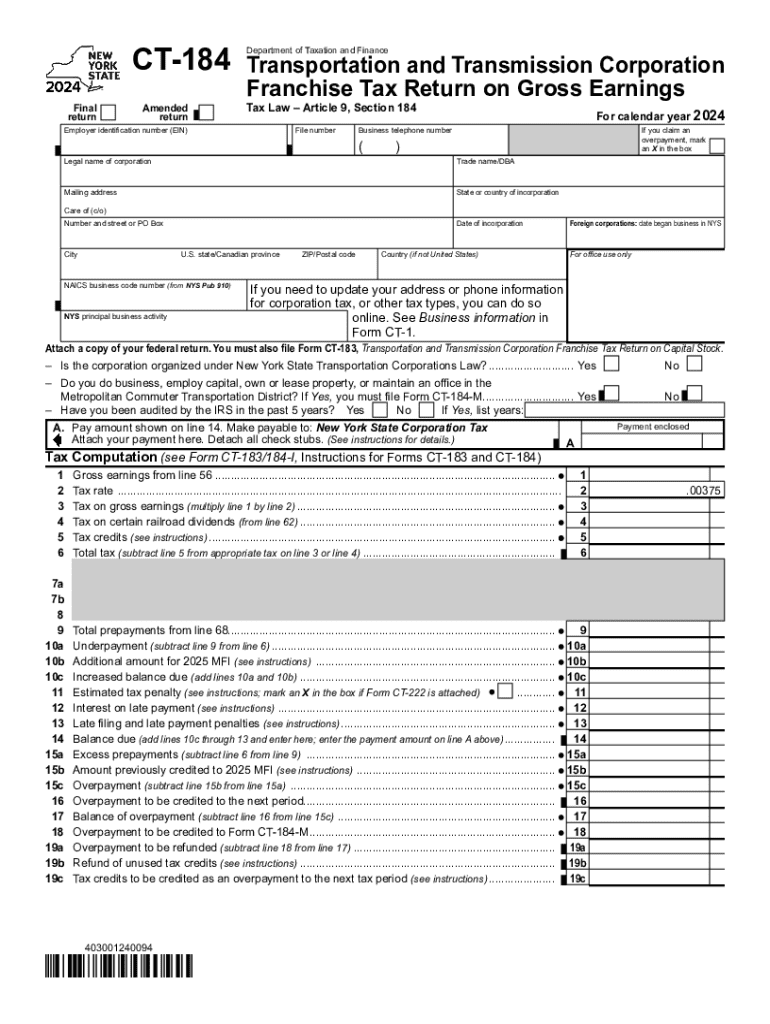

The Instructions for Form CT 184 provide essential guidelines for businesses operating in New York that need to file their franchise tax returns. This form is specifically designed for corporations and certain entities to report their income, deductions, and credits. Understanding these instructions is crucial for ensuring compliance with state tax laws and avoiding potential penalties.

Key components of the instructions include definitions of terms used in the form, eligibility criteria for filing, and detailed explanations of the information required. The instructions also outline how to calculate the franchise tax owed based on the entity's gross income and any applicable deductions.

Steps to Complete Form CT 184

Completing Form CT 184 involves several steps that must be followed carefully to ensure accuracy. First, gather all necessary financial documents, including income statements and records of deductions. Next, fill out the form by entering the required information, such as the corporation's name, address, and taxpayer identification number.

It is important to accurately report gross income and any applicable deductions. After completing the form, review it thoroughly for any errors. Finally, sign and date the form before submission. Following these steps will help ensure that the filing process goes smoothly.

Filing Deadlines for Form CT 184

Timely filing of Form CT 184 is essential to avoid penalties. The due date for filing this form typically aligns with the corporation's tax year end. Corporations must submit the form by the fifteenth day of the fourth month following the end of their fiscal year. For example, if a corporation's tax year ends on December 31, the form is due by April 15 of the following year.

It is advisable to keep track of these deadlines and plan ahead to ensure that all necessary information is gathered and the form is filed on time. Late submissions may incur penalties and interest on the unpaid tax amount.

Required Documents for Form CT 184

When filing Form CT 184, certain documents are required to support the information reported on the form. These documents typically include:

- Financial statements, including income statements and balance sheets

- Records of any deductions claimed

- Proof of payments made for estimated taxes

- Any prior year tax returns, if applicable

Having these documents ready will facilitate a smoother filing process and help ensure that the information provided is accurate and complete.

Form Submission Methods for CT 184

Form CT 184 can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online filing through the New York Department of Taxation and Finance website

- Mailing a paper copy of the completed form to the appropriate state office

- In-person submission at designated tax offices

Choosing the right submission method depends on the preferences of the business and any specific requirements set by the state. Online filing is often the quickest and most efficient way to submit the form.

Penalties for Non-Compliance with Form CT 184

Failure to comply with the filing requirements for Form CT 184 can result in significant penalties. These penalties may include fines for late filing, interest on unpaid taxes, and potential legal action for continued non-compliance. It is important for businesses to understand these consequences and take the necessary steps to file on time and accurately.

Additionally, corporations that consistently fail to meet their tax obligations may face increased scrutiny from tax authorities, leading to audits and further complications. Staying informed about filing requirements and deadlines is crucial for maintaining compliance and avoiding penalties.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 183 and ct 184

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 183 and ct 184

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to new york 184?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents efficiently. In the context of new york 184, it provides a streamlined way to manage document workflows, ensuring compliance and security for businesses operating in New York.

-

How much does airSlate SignNow cost for users in new york 184?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses in new york 184. We offer flexible pricing tiers that cater to different business sizes and needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for businesses in new york 184?

airSlate SignNow includes a variety of features such as document templates, real-time tracking, and secure cloud storage. For businesses in new york 184, these features enhance productivity and ensure that all document transactions are handled efficiently and securely.

-

Can airSlate SignNow integrate with other tools commonly used in new york 184?

Yes, airSlate SignNow offers integrations with popular business tools such as Google Workspace, Salesforce, and Microsoft Office. This makes it an ideal choice for businesses in new york 184 looking to streamline their operations and improve collaboration across platforms.

-

What are the benefits of using airSlate SignNow for companies in new york 184?

Using airSlate SignNow provides numerous benefits, including faster document turnaround times and reduced paper usage. For companies in new york 184, this translates to increased efficiency and lower operational costs, allowing you to focus on growing your business.

-

Is airSlate SignNow compliant with regulations in new york 184?

Absolutely, airSlate SignNow is designed to comply with various legal standards, including those specific to new york 184. This ensures that your eSignatures and document management practices meet all necessary legal requirements, providing peace of mind for your business.

-

How can I get started with airSlate SignNow in new york 184?

Getting started with airSlate SignNow is simple. You can sign up for a free trial on our website, where you can explore all the features tailored for businesses in new york 184. Our user-friendly interface makes it easy to begin sending and signing documents right away.

Get more for Instructions For Form CT 183 And CT 184

- Ds application for title new york state department of motor vehicles mv 82ton 722 form

- Fmcsa form op 1

- Revenuesexpendituresexpenses schedule 01 form

- 145 kelsey drive form

- City of zip code form

- Certified firefighter wv division of motor vehicles wv gov form

- Amended and restated articles of incorporation form dc 5

- How to apply for a 4361 online form

Find out other Instructions For Form CT 183 And CT 184

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template