Put a Stop Payment on a Tax Refund for Maryland Form 2012

What is the Put A Stop Payment On A Tax Refund For Maryland Form

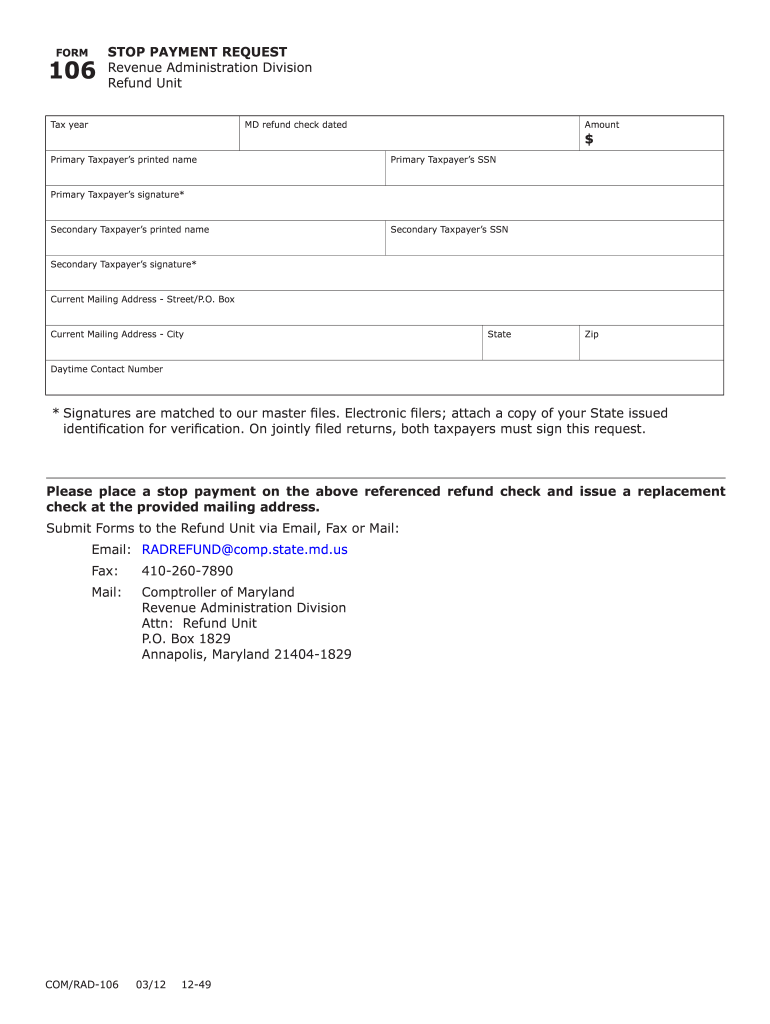

The Put A Stop Payment On A Tax Refund For Maryland Form is a specific document used by taxpayers in Maryland to request the cancellation of a tax refund that may have been issued incorrectly or fraudulently. This form serves as a formal request to the state tax authority to halt the processing of a refund check that has not yet been cashed. It is essential for individuals who suspect that their refund has been compromised or if they have changed their mind about receiving it.

How to use the Put A Stop Payment On A Tax Refund For Maryland Form

Using the Put A Stop Payment On A Tax Refund For Maryland Form involves several key steps. First, ensure you have the correct form, which can typically be obtained from the Maryland State Comptroller's website. Once you have the form, fill it out with accurate information, including your personal details and the specifics of the tax refund in question. After completing the form, submit it to the appropriate state tax authority, either online or via mail, depending on the submission options available.

Steps to complete the Put A Stop Payment On A Tax Refund For Maryland Form

Completing the Put A Stop Payment On A Tax Refund For Maryland Form requires careful attention to detail. Follow these steps:

- Obtain the form from the Maryland State Comptroller's website.

- Fill in your name, address, Social Security number, and any other required personal information.

- Provide details about the tax refund, including the amount and the reason for the stop payment request.

- Review the form for accuracy before signing it.

- Submit the completed form to the Maryland State Comptroller’s office either online or by mail.

Legal use of the Put A Stop Payment On A Tax Refund For Maryland Form

The Put A Stop Payment On A Tax Refund For Maryland Form is legally recognized as a valid request to stop a tax refund payment. It is important to use this form correctly to ensure compliance with state tax regulations. Submitting this form does not guarantee that the refund will be stopped, as the state tax authority will review the request and determine its validity based on the information provided.

State-specific rules for the Put A Stop Payment On A Tax Refund For Maryland Form

Maryland has specific rules governing the use of the Put A Stop Payment On A Tax Refund Form. Taxpayers must be aware of the deadlines for submitting the form, as well as any required documentation that may need to accompany the request. Additionally, the state may impose penalties for submitting false information or failing to follow the proper procedures, so it is crucial to provide accurate and truthful details when completing the form.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Put A Stop Payment On A Tax Refund For Maryland Form. The form can typically be submitted online through the Maryland State Comptroller's website, which offers a secure portal for electronic submissions. Alternatively, taxpayers may choose to print the form and send it via mail to the appropriate office. In some cases, in-person submissions may also be accepted at local tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete put a stop payment on a tax refund for maryland form

Your assistance manual on how to prepare your Put A Stop Payment On A Tax Refund For Maryland Form

If you’re looking to understand how to generate and submit your Put A Stop Payment On A Tax Refund For Maryland Form, here are some brief guidelines to facilitate your tax filing.

To begin, you just need to register your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to adjust information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Complete the following steps to achieve your Put A Stop Payment On A Tax Refund For Maryland Form in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Browse our catalog to locate any IRS tax form; review different versions and schedules.

- Click Get form to access your Put A Stop Payment On A Tax Refund For Maryland Form in our editor.

- Enter the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if needed).

- Review your document and rectify any discrepancies.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may increase the likelihood of errors and prolong refund times. Importantly, before e-filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct put a stop payment on a tax refund for maryland form

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What form does a J1 visa student who worked over the summer need to fill out to get a tax refund from the US government?

You need form 1040NR (or 1040NR-EZ) and form 8843.See Publication 519 (2014), U.S. Tax Guide for Aliens for some help as well as Page on irs.gov. You may have to file a nonresident state tax return as well but that depends on your state.Be careful when using web-based software (such as TurboTax) because not all of them support nonresident forms.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

I made a wrong payment to IRS from their website for taxes before sending tax forms, but later I e-filed and made correct payment. How can I contact them for a refund of my wrong payment?

I'm not sure what you did here - you paid online an estimated tax, and then e-filed paying a different amount of tax without claiming your estimated tax already paid? In that case you need to file a 1040X to correct your estimated tax payments made. You will then show an overpayment and should get back a refund eventually.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

If I publish on Smashwords and tick on the option to take a 30 percent tax, do I still need to fill out the tax form?

If you want to get any of that tax money back in your pocket, you will have to fill out the forms.Are you a US citizen? If not, you will need to obtain an ITIN using IRS form W-7. This will allow you to file the appropriate US tax return forms and claim a refund. Depending on your country of residence, the refund could be up to 100% of the tax collected. With an ITIN, you will usually be exempt from the 30% withholding and will not be required to fill out any US tax returns at the end of the year (unless you actually reside in the US, but that is a far more complicated situation). The ITIN application process can be a royal pain in the behind, especially if you wait until after the taxes have been withheld.If your book only makes a few dollars, the hassle is not worth it. But if you hit the self-publishing lottery, you will definitely want to apply for that refund.

Create this form in 5 minutes!

How to create an eSignature for the put a stop payment on a tax refund for maryland form

How to generate an electronic signature for the Put A Stop Payment On A Tax Refund For Maryland Form in the online mode

How to make an eSignature for your Put A Stop Payment On A Tax Refund For Maryland Form in Google Chrome

How to create an eSignature for putting it on the Put A Stop Payment On A Tax Refund For Maryland Form in Gmail

How to make an eSignature for the Put A Stop Payment On A Tax Refund For Maryland Form from your smart phone

How to generate an eSignature for the Put A Stop Payment On A Tax Refund For Maryland Form on iOS

How to make an electronic signature for the Put A Stop Payment On A Tax Refund For Maryland Form on Android

People also ask

-

What is the process to Put A Stop Payment On A Tax Refund For Maryland Form?

To Put A Stop Payment On A Tax Refund For Maryland Form, you need to contact your bank or financial institution directly. They will guide you through the necessary steps, which typically involve providing specific information regarding your tax refund check. Using airSlate SignNow can simplify the documentation process involved in this request.

-

How much does it cost to use airSlate SignNow for stopping a tax refund payment?

airSlate SignNow offers various pricing plans to accommodate different business needs. While the cost of services to Put A Stop Payment On A Tax Refund For Maryland Form may vary, our plans are designed to be cost-effective. You can choose a subscription that best fits your requirements and budget.

-

Can I use airSlate SignNow to eSign documents related to stopping a tax refund payment?

Yes, you can use airSlate SignNow to eSign all documents related to the process of stopping a tax refund payment. Our platform allows you to securely sign and manage documents electronically, making it easier to complete your request to Put A Stop Payment On A Tax Refund For Maryland Form.

-

What features does airSlate SignNow offer for managing stop payment requests?

airSlate SignNow provides a range of features for managing stop payment requests, including secure eSigning, document templates, and workflow automation. These features streamline the process, allowing you to efficiently Put A Stop Payment On A Tax Refund For Maryland Form without unnecessary delays.

-

Is airSlate SignNow compatible with other financial software for tax management?

Yes, airSlate SignNow integrates seamlessly with various financial software and tax management tools. This compatibility ensures that you can easily Manage Your Documents and Put A Stop Payment On A Tax Refund For Maryland Form while utilizing your preferred financial applications.

-

What benefits does airSlate SignNow provide for tax-related document management?

Using airSlate SignNow for tax-related document management offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can easily Put A Stop Payment On A Tax Refund For Maryland Form while keeping all essential documents organized and accessible in one platform.

-

How secure is the airSlate SignNow platform for sensitive tax documents?

The airSlate SignNow platform is designed with security as a top priority. We employ advanced encryption and compliance measures to ensure that your sensitive tax documents, including those needed to Put A Stop Payment On A Tax Refund For Maryland Form, are protected against unauthorized access.

Get more for Put A Stop Payment On A Tax Refund For Maryland Form

Find out other Put A Stop Payment On A Tax Refund For Maryland Form

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template