Maryland Rad Form 2018

What is the Maryland Rad Form

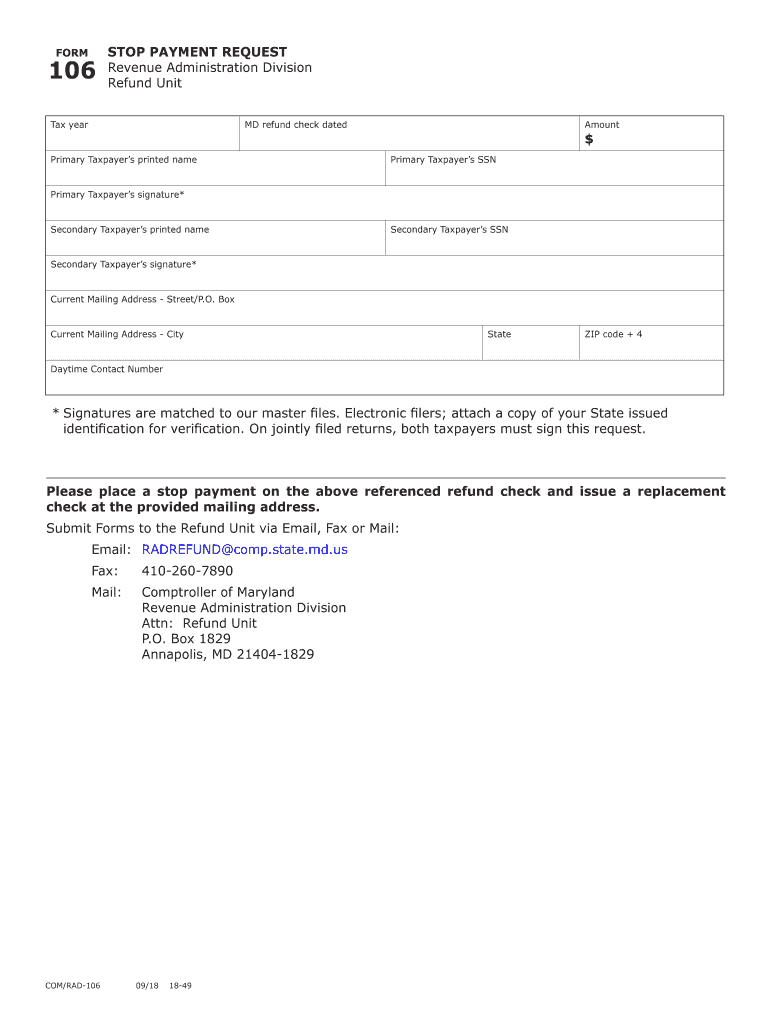

The Maryland Rad Form, officially known as Form Request 106, is a document used in the state of Maryland for specific tax-related purposes. This form is essential for individuals and businesses to report certain financial information accurately. It is particularly relevant for those who need to address tax obligations or request adjustments related to their tax filings. Understanding the purpose and requirements of this form is crucial for compliance with Maryland tax laws.

How to Obtain the Maryland Rad Form

To obtain the Maryland Rad Form, individuals can visit the official Maryland State Department of Assessments and Taxation website. The form is typically available for download in PDF format, allowing users to print and fill it out. Additionally, physical copies may be accessible at local tax offices or public libraries throughout Maryland. Ensuring that you have the most current version of the form is important for accurate filing.

Steps to Complete the Maryland Rad Form

Completing the Maryland Rad Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details and any relevant financial data. Follow these steps:

- Download the form from the official website or obtain a physical copy.

- Carefully read the instructions provided with the form to understand each section.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before signing.

- Submit the completed form according to the specified submission methods.

Legal Use of the Maryland Rad Form

The Maryland Rad Form is legally recognized as a valid document for tax reporting and adjustments. It must be completed in accordance with Maryland state laws and regulations. Failure to use the form correctly can result in penalties or delays in processing. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Rad Form are crucial for taxpayers to avoid penalties. Typically, the form must be submitted by the established state tax deadlines, which may vary based on individual circumstances. It is important to stay informed about these dates, especially during tax season, to ensure timely compliance. Marking these deadlines on a calendar can help in managing tax obligations effectively.

Form Submission Methods

The Maryland Rad Form can be submitted through various methods, providing flexibility for taxpayers. The available submission options include:

- Online submission through the Maryland state tax portal.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices.

Choosing the right submission method can depend on personal preference and urgency.

Quick guide on how to complete put a stop payment on a tax refund for maryland 2018 2019 form

Your assistance manual on how to prepare your Maryland Rad Form

If you’re wondering how to finalize and submit your Maryland Rad Form, here are a few quick guidelines to facilitate tax filing.

To begin, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to edit, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit information to make adjustments as necessary. Optimize your tax workflow with sophisticated PDF editing, eSigning, and convenient sharing options.

Complete the steps below to finalize your Maryland Rad Form in just a few minutes:

- Create your account and start working with PDFs within minutes.

- Access our library to obtain any IRS tax form; explore various versions and schedules.

- Click Obtain form to launch your Maryland Rad Form in our editor.

- Populate the necessary fillable sections with your details (text, numbers, check marks).

- Utilize the Signature Tool to insert your legally-binding eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Refer to this manual to electronically submit your taxes using airSlate SignNow. Be aware that submitting on paper can lead to increased errors and delays in refunds. Before e-filing your taxes, be sure to review the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct put a stop payment on a tax refund for maryland 2018 2019 form

FAQs

-

I made a wrong payment to IRS from their website for taxes before sending tax forms, but later I e-filed and made correct payment. How can I contact them for a refund of my wrong payment?

I'm not sure what you did here - you paid online an estimated tax, and then e-filed paying a different amount of tax without claiming your estimated tax already paid? In that case you need to file a 1040X to correct your estimated tax payments made. You will then show an overpayment and should get back a refund eventually.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

Can an NRI file a tax return for AY 2018–2019 with an ITR1 form, as there is no column on the ITR1 form to mark residential status?

Yes, there is no column in the ITR 1 For Mark The residential status, therefore, you should furnishred the Form No.2.

-

IRS has approved, processed, and sent my tax refund as a direct deposit on February 27, 2019, how long does it take to get it if I choose to have it put on the H&R Block card?

This answer likely irrelevant now, as I'm sure you have received the Emerald card funds shortly after your post….however, I will answer for any of those that question this themselvesIn order, the IRS:ReceivesAccepts/denies returnProcesses return (if accepted)If preparation fees are being withheld from refund (and not paid up front), they send refund to H&R Block (or TurboTax/Jackson Hewitt, etc.) to deduct their feesRemainder of refund is sent to your bankYour bank processes deposit and then makes funds available after their own particular pending period (some have the funds available to you that day, some banks have a longer pending period)The Emerald card follows the same process. Even though it's through H&R Block itself (no additional bank after fees are deducted), a deposit still needs to be processed (with pending time). It may take a day or 2 for funds to be made available/show up on your end. No real difference between bank accounts and card.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What are the needed forms to be filled out for paying tax on capital gains as a US citizen?

If you have Shares in Common Stock:Schedule D- Summary Of Capital Gains Flowing from Forms 8949 (6x8949)Forms 8949 - Discloses all Capital Gains Transactions which you will include from the for 1099-B and Realized Gain and Loss Statements sent to you by February 1st containing all your Capital Transaction. They require denoting whether the cost basis was reported to the IRS, The Sales Price was reported to the IRS, or whether were reported to the IRS, and there are Short Term and Long Term forms 8949 as well)Schedule D compiles the information also found on form 4797 if you have a Home business and have sold Section 1231 Assets, 1245 Assets and 1251 Assets)Form 8694 which is used to calculate if you are above the threshold for filing Net Investment Income (Obamacare tax).Schedule D also compiles Capital Gains flowing from Schedule K-1 Lines 8, 9A, 9B, &9C, plus Box 10 if you have partnership

-

What is the procedure to book a slot for the JEE Mains 2019? I have filled out the application form and completed the payment, but I did not find any option for booking the time and date slot.

Hi,Well, you can not book slots in JEE Main 2019.About the time: The time for appearing in JEE Main 2019 paper 1 will be either 9:30 AM to 12:30 PM or 2:30 PM to 5:30 PM. There will be 2 shifts. NTA will allot any one shift to you.About the date: JEE Main 2019 will be conducted on Saturdays and Sundays between 6 to 20 Jan 2019. NTA will select one day for you.Rounding up, NTA will allot the day and shift of exam to you. The exam center will be also allotted by NTA, however, you can provide 4 preference of exam center in the application form.For more clarification read this[1].Read the official notice below:Footnotes[1] Allotment of Shift In JEE Main 2019 - How To Select Exam Shift, Day And Centre | AglaSem

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the put a stop payment on a tax refund for maryland 2018 2019 form

How to create an eSignature for the Put A Stop Payment On A Tax Refund For Maryland 2018 2019 Form online

How to create an electronic signature for your Put A Stop Payment On A Tax Refund For Maryland 2018 2019 Form in Chrome

How to make an electronic signature for signing the Put A Stop Payment On A Tax Refund For Maryland 2018 2019 Form in Gmail

How to make an electronic signature for the Put A Stop Payment On A Tax Refund For Maryland 2018 2019 Form straight from your smart phone

How to generate an eSignature for the Put A Stop Payment On A Tax Refund For Maryland 2018 2019 Form on iOS

How to create an electronic signature for the Put A Stop Payment On A Tax Refund For Maryland 2018 2019 Form on Android OS

People also ask

-

What is a form request 106?

A form request 106 is a specific document format used for various purposes, often related to regulatory compliance. With airSlate SignNow, you can easily create, send, and eSign a form request 106 efficiently, ensuring all necessary information is captured and processed correctly.

-

How can airSlate SignNow assist me with form request 106?

airSlate SignNow offers a user-friendly platform that simplifies the creation and management of form request 106. Our solution enables you to quickly generate, sign, and send these forms electronically, saving time and reducing the risk of errors.

-

What are the key features of airSlate SignNow for managing form request 106?

Key features of airSlate SignNow include easy document creation, customizable templates, and secure eSigning capabilities specifically designed for form request 106. Additionally, our platform offers tracking and auditing functionalities to ensure compliance and oversight.

-

Is there a cost associated with using airSlate SignNow for form request 106?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, including options for managing form request 106. Pricing is transparent with no hidden fees, and we provide a variety of plans to accommodate organizations of all sizes.

-

Can I integrate airSlate SignNow with other software for form request 106?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, allowing you to streamline the process of creating and sending form request 106. Popular integrations include CRM systems, cloud storage services, and productivity tools, enhancing your workflow efficiency.

-

What are the benefits of using airSlate SignNow for form request 106 over traditional methods?

Using airSlate SignNow for your form request 106 offers several benefits, including reduced processing time, enhanced document security, and improved user experience. Electronic signatures also provide legal validity, making your submission process faster and more reliable than traditional paper methods.

-

How can I ensure compliance when using airSlate SignNow for form request 106?

airSlate SignNow ensures compliance through robust security measures and adherence to legal regulations for form request 106. Our platform provides a detailed audit trail, enabling users to track document history and verify the signing process for legal assurance.

Get more for Maryland Rad Form

- Rabbit population by season gizmo answer key pdf form

- Dr2643 form

- Online personal auto policy change request 71 form

- Form t2042

- Report of sale form

- Referral form download pdf tri county mental health services tcmhs

- Letter of authorization to transfer funds or securities wells fargo form

- Open outpatient episode la county department of mental health dmh lacounty form

Find out other Maryland Rad Form

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document