OIL ASSESSMENT RENDITION SHALL BE FILED with the COUNTY 2021

What is the oil assessment rendition shall be filed with the county

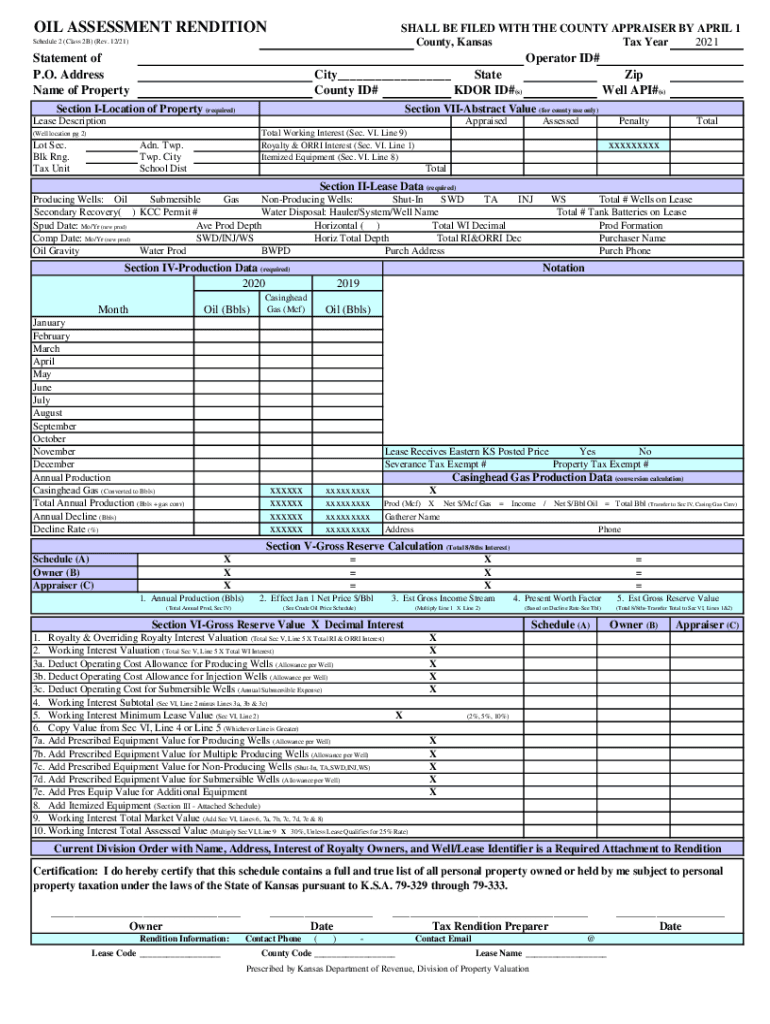

The oil assessment rendition shall be filed with the county is a formal document required by local authorities to assess the value of oil properties for taxation purposes. This form provides essential information about the oil reserves, production levels, and related assets owned by individuals or businesses. Accurate completion of this document is crucial, as it directly impacts the property tax assessments levied by the county. Understanding the specifics of this form helps ensure compliance with local regulations and accurate reporting of oil-related assets.

Steps to complete the oil assessment rendition shall be filed with the county

Completing the oil assessment rendition shall be filed with the county involves several important steps:

- Gather necessary information: Collect all relevant data regarding your oil properties, including production records, property descriptions, and any previous assessments.

- Obtain the form: Access the official oil assessment rendition form from your county's tax assessor's office or website.

- Fill out the form: Carefully complete the form with accurate information, ensuring all sections are addressed to avoid delays.

- Review for accuracy: Double-check all entries for errors or omissions before submission to ensure compliance with county requirements.

- Submit the form: File the completed form with the county by the specified deadline, using your preferred submission method.

Legal use of the oil assessment rendition shall be filed with the county

The oil assessment rendition shall be filed with the county serves a legal purpose by providing a formal declaration of oil property ownership and its assessed value. This document is essential for establishing tax liabilities and ensuring compliance with state and local laws. Failure to file this form accurately and on time can result in penalties, including fines or increased tax assessments. By understanding the legal implications of this form, individuals and businesses can better navigate their responsibilities regarding oil property taxation.

Required documents for the oil assessment rendition shall be filed with the county

When preparing to file the oil assessment rendition shall be filed with the county, several documents may be required to support your submission:

- Production records detailing the volume of oil extracted.

- Previous assessment notices or tax bills related to the property.

- Property descriptions, including maps or diagrams of the oil fields.

- Ownership documents, such as deeds or leases.

Having these documents on hand will facilitate the completion of the form and ensure that all necessary information is provided.

Filing deadlines for the oil assessment rendition shall be filed with the county

Filing deadlines for the oil assessment rendition shall be filed with the county vary by jurisdiction. Typically, counties set specific dates each year by which the form must be submitted to avoid penalties. It is essential to check with your local tax assessor's office for the exact deadlines applicable to your area. Missing these deadlines can lead to complications, including potential fines or increased tax assessments. Staying informed about these dates ensures timely compliance and helps maintain good standing with local authorities.

Penalties for non-compliance with the oil assessment rendition shall be filed with the county

Non-compliance with the requirement to file the oil assessment rendition shall be filed with the county can result in significant penalties. These may include:

- Fines imposed by the county for late or inaccurate submissions.

- Increased tax assessments based on estimated values if the form is not filed.

- Potential legal action for failure to comply with local regulations.

Understanding these consequences emphasizes the importance of timely and accurate filing of the oil assessment rendition.

Quick guide on how to complete oil assessment rendition shall be filed with the county

Effortlessly Prepare OIL ASSESSMENT RENDITION SHALL BE FILED WITH THE COUNTY on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to swiftly create, modify, and electronically sign your documents without delays. Handle OIL ASSESSMENT RENDITION SHALL BE FILED WITH THE COUNTY on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and Electronically Sign OIL ASSESSMENT RENDITION SHALL BE FILED WITH THE COUNTY

- Obtain OIL ASSESSMENT RENDITION SHALL BE FILED WITH THE COUNTY and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with the tools offered by airSlate SignNow designed specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and possesses the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign OIL ASSESSMENT RENDITION SHALL BE FILED WITH THE COUNTY and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oil assessment rendition shall be filed with the county

Create this form in 5 minutes!

How to create an eSignature for the oil assessment rendition shall be filed with the county

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is an oil assessment rendition and why is it important?

An oil assessment rendition is a formal document that outlines the valuation of oil properties for taxation purposes. It is crucial for ensuring compliance with local regulations, stating that the oil assessment rendition shall be filed with the county to avoid penalties and to establish the correct valuation.

-

How can airSlate SignNow assist with filing my oil assessment rendition?

airSlate SignNow simplifies the process of managing documents, including your oil assessment rendition. With our platform, you can quickly prepare, sign, and send your oil assessment rendition so that it shall be filed with the county efficiently and securely.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers features such as customizable templates, eSigning, document tracking, and secure cloud storage. These functionalities ensure that your oil assessment rendition shall be filed with the county seamlessly while maintaining legal compliance.

-

Is airSlate SignNow cost-effective for filing multiple documents?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage multiple documents. Our pricing plans are tailored to fit various needs, allowing you to streamline the filing of your oil assessment rendition which shall be filed with the county without overspending.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow integrates with various applications such as CRM systems and cloud storage services. This means that when filing your oil assessment rendition shall be filed with the county, you can do so directly from your preferred tools, enhancing efficiency.

-

What benefits does electronic filing of my oil assessment rendition provide?

Electronic filing of your oil assessment rendition offers multiple benefits including speed, accuracy, and convenience. By ensuring that your oil assessment rendition shall be filed with the county electronically, you reduce the risk of errors and can receive faster processing.

-

How secure is my data when using airSlate SignNow?

The security of your data is a top priority at airSlate SignNow. We utilize industry-standard encryption and security protocols to protect your documents, ensuring that when your oil assessment rendition shall be filed with the county, your information remains confidential and secure.

Get more for OIL ASSESSMENT RENDITION SHALL BE FILED WITH THE COUNTY

Find out other OIL ASSESSMENT RENDITION SHALL BE FILED WITH THE COUNTY

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors