Oil Rendition Kansas Department of Revenue 2020

What is the Oil Rendition Kansas Department of Revenue

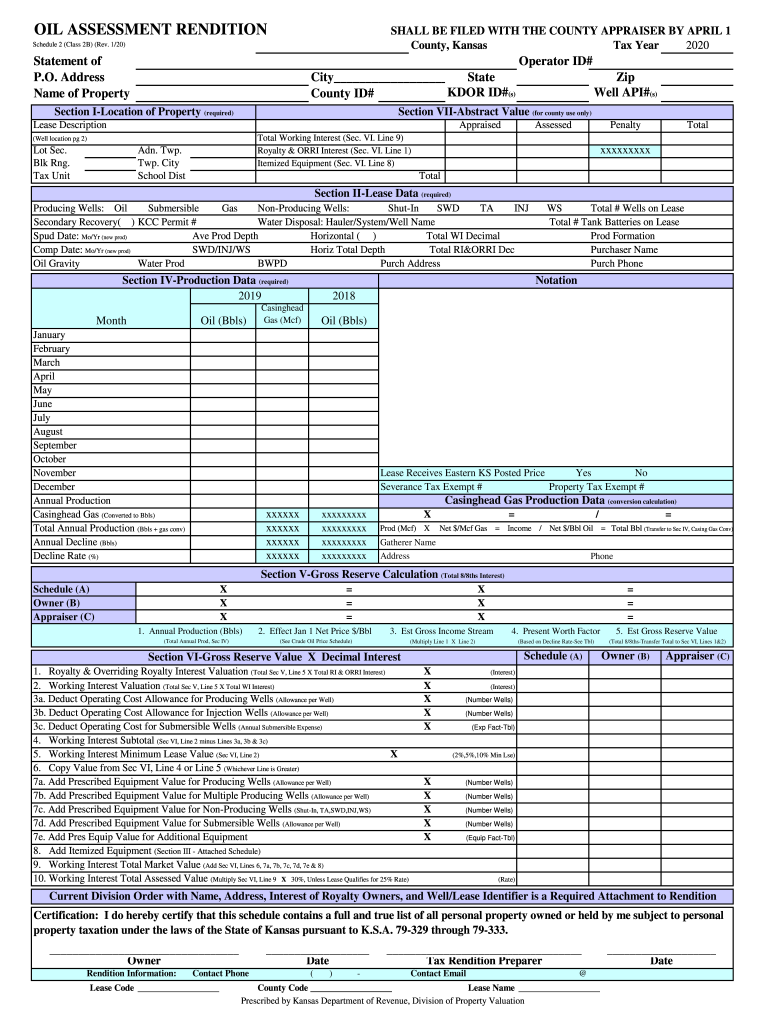

The Oil Rendition Kansas Department of Revenue form is a crucial document used by oil and gas producers in Kansas to report their production and assess property taxes. This form provides the state with necessary information regarding the production levels, types of oil or gas extracted, and the associated value of these resources. Accurate completion of this form is essential for compliance with state tax regulations and ensuring fair assessment of property taxes related to oil and gas operations.

Steps to complete the Oil Rendition Kansas Department of Revenue

Completing the Oil Rendition Kansas Department of Revenue form involves several important steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information about your oil and gas production, including production volumes and types of resources extracted.

- Fill out the form with accurate data, ensuring all sections are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Oil Rendition Kansas Department of Revenue

The legal use of the Oil Rendition Kansas Department of Revenue form is governed by state laws and regulations. This form must be completed accurately to ensure compliance with property tax laws. The information provided is used by the Kansas Department of Revenue to assess taxes on oil and gas production. Failure to submit this form or providing false information can result in penalties, including fines or legal action.

Key elements of the Oil Rendition Kansas Department of Revenue

Key elements of the Oil Rendition Kansas Department of Revenue form include:

- Identification Information: Details about the producer and the specific properties being reported.

- Production Data: Quantities of oil and gas produced during the reporting period.

- Valuation Information: Estimated value of the produced resources for tax assessment purposes.

- Certification: A section for the producer to certify the accuracy of the provided information.

Form Submission Methods

The Oil Rendition Kansas Department of Revenue form can be submitted through various methods, ensuring convenience for producers. Options include:

- Online Submission: Many producers opt to submit the form electronically through the Kansas Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate department for processing.

- In-Person Submission: Producers may also choose to deliver the form in person at designated state offices.

Filing Deadlines / Important Dates

Filing deadlines for the Oil Rendition Kansas Department of Revenue form are critical for compliance. Typically, the form must be submitted by March first of each year. It is important for producers to be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates ensures timely submission and compliance with state regulations.

Quick guide on how to complete oil rendition kansas department of revenue

Effortlessly Manage Oil Rendition Kansas Department Of Revenue on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without any holdups. Manage Oil Rendition Kansas Department Of Revenue on any device with airSlate SignNow for Android or iOS and enhance any document-driven process today.

How to Edit and Electronically Sign Oil Rendition Kansas Department Of Revenue with Ease

- Obtain Oil Rendition Kansas Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Oil Rendition Kansas Department Of Revenue to ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oil rendition kansas department of revenue

Create this form in 5 minutes!

How to create an eSignature for the oil rendition kansas department of revenue

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Oil Rendition process with the Kansas Department Of Revenue?

The Oil Rendition process with the Kansas Department Of Revenue involves reporting the value of oil reserves for tax purposes. It requires accurate documentation and adherence to state regulations, ensuring a smooth filing process. Using airSlate SignNow can simplify this by allowing you to securely eSign and send necessary documents effortlessly.

-

How can airSlate SignNow help with filing Oil Rendition forms?

airSlate SignNow can streamline the process of filing Oil Rendition forms by providing an intuitive platform for eSigning and document management. This reduces the time spent on paperwork and enhances accuracy, which is crucial when dealing with the Kansas Department Of Revenue. By digitizing the workflow, businesses can ensure timely submissions and compliance.

-

What are the costs associated with using airSlate SignNow for Oil Rendition?

The cost of using airSlate SignNow for filing Oil Rendition with the Kansas Department Of Revenue is competitive and designed to suit businesses of all sizes. Pricing varies based on features and user requirements, ensuring you only pay for what you need. Consider the savings on printing and mailing costs when evaluating overall expenses.

-

What features does airSlate SignNow offer for Oil Rendition submissions?

airSlate SignNow provides robust features for Oil Rendition submissions, such as customizable templates, secure eSigning, and audit trails. These tools ensure that your documents are correctly filled and legally binding. Additionally, the platform offers reminders and follow-ups to help you stay on top of filing deadlines for the Kansas Department Of Revenue.

-

Can I integrate airSlate SignNow with other tools for Oil Rendition?

Yes, airSlate SignNow can integrate with various business applications to enhance your Oil Rendition submission process. Whether you use accounting software or project management tools, these integrations allow for seamless data transfer and workflow automation. This connectivity makes it easier to manage all aspects of your filings with the Kansas Department Of Revenue.

-

What are the benefits of using airSlate SignNow for Oil Rendition?

Using airSlate SignNow for Oil Rendition provides numerous benefits, including cost savings, increased efficiency, and improved compliance. The platform simplifies the filing process, reducing human error and ensuring that your submissions to the Kansas Department Of Revenue are accurate and timely. Additionally, eSigning eliminates the delay associated with traditional document handling.

-

Is airSlate SignNow secure for handling sensitive information related to Oil Rendition?

Absolutely, airSlate SignNow employs advanced security measures to protect sensitive information related to Oil Rendition submissions. It includes encryption, secure storage, and compliance with legal standards to ensure that your documents are safe. Trusting your eSignatures and submissions with airSlate SignNow means you are prioritizing the security of your dealings with the Kansas Department Of Revenue.

Get more for Oil Rendition Kansas Department Of Revenue

Find out other Oil Rendition Kansas Department Of Revenue

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile