Property TaxesReno County, KS Official Website 2022-2026

What is the Property Taxes Reno County, KS Official Website

The Property Taxes Reno County, KS Official Website serves as a central resource for residents to access information related to property taxes in Reno County, Kansas. This platform provides essential details such as tax rates, assessment processes, and payment options. Users can navigate through various sections to find specific information tailored to their property tax inquiries, making it a vital tool for homeowners and property owners alike.

How to Use the Property Taxes Reno County, KS Official Website

Utilizing the Property Taxes Reno County, KS Official Website is straightforward. Users can start by visiting the homepage, where they will find links to key sections, including tax assessments, payment options, and frequently asked questions. The website is designed to be user-friendly, allowing residents to easily locate the information they need. For more complex inquiries, users may access contact information for local tax officials who can provide further assistance.

Steps to Complete the Property Taxes Reno County, KS Official Website Form

Completing forms related to property taxes on the Reno County, KS Official Website involves several steps:

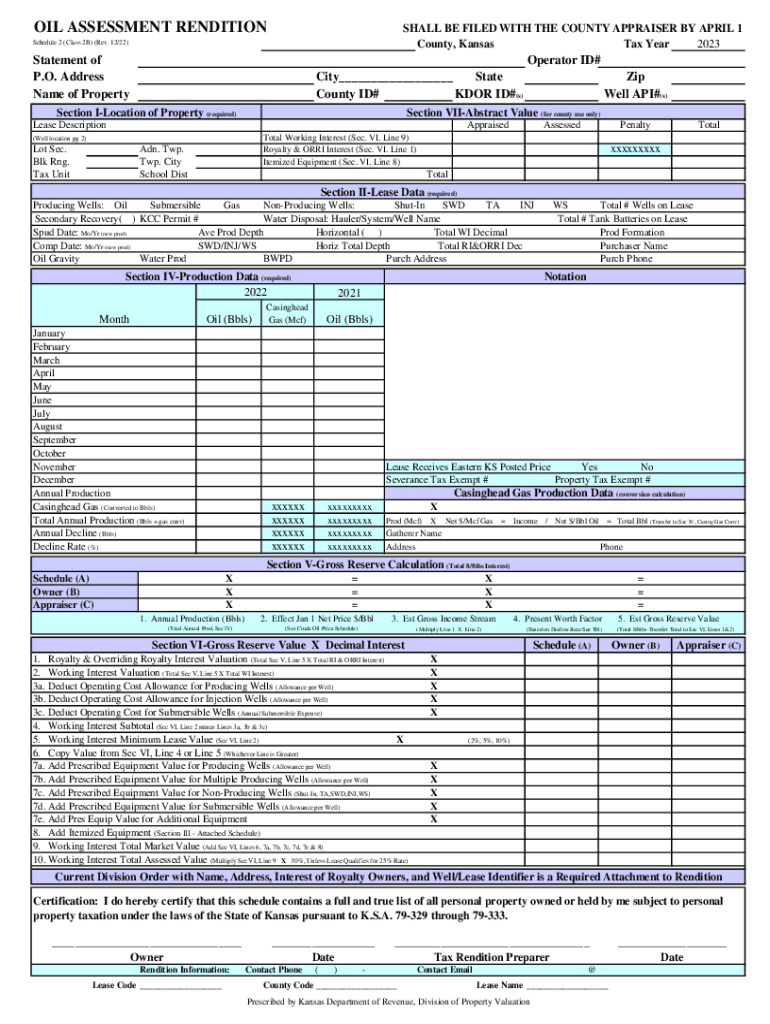

- Access the appropriate form from the website's forms section.

- Fill out the required fields with accurate information regarding your property.

- Review the completed form for any errors or omissions.

- Submit the form electronically, if applicable, or print it for mailing.

- Keep a copy of the submitted form for your records.

Legal Use of the Property Taxes Reno County, KS Official Website

The Property Taxes Reno County, KS Official Website is legally recognized as a valid source for property tax information and forms. Users can rely on the data provided for compliance with local tax regulations. It is essential for residents to ensure that all submitted information aligns with the legal requirements set forth by the Reno County tax authorities to avoid penalties or issues with their property tax assessments.

Required Documents for Property Taxes Reno County, KS

When dealing with property taxes in Reno County, specific documents may be required to complete forms accurately. These documents typically include:

- Proof of ownership, such as a deed or title.

- Previous tax statements for reference.

- Identification documents, such as a driver's license or state ID.

- Any relevant appraisal documents if applicable.

Filing Deadlines / Important Dates for Property Taxes Reno County, KS

Staying informed about filing deadlines and important dates is crucial for property owners in Reno County. Typically, property tax assessments are conducted annually, with deadlines for filing appeals and payments clearly outlined on the official website. Residents are encouraged to check the website regularly for updates on specific dates to ensure compliance and avoid late fees.

Quick guide on how to complete property taxesreno county ks official website

Complete Property TaxesReno County, KS Official Website seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without delays. Manage Property TaxesReno County, KS Official Website on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Property TaxesReno County, KS Official Website effortlessly

- Locate Property TaxesReno County, KS Official Website and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Property TaxesReno County, KS Official Website and maintain excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property taxesreno county ks official website

Create this form in 5 minutes!

How to create an eSignature for the property taxesreno county ks official website

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using the Property Taxes Reno County, KS Official Website for managing property tax documents?

The Property Taxes Reno County, KS Official Website offers an efficient way to manage your property tax documents. With airSlate SignNow, you can electronically sign and send all necessary paperwork seamlessly, avoiding delays and ensuring compliance with local regulations. This provides peace of mind and helps streamline your property tax processes.

-

How can I access the Property Taxes Reno County, KS Official Website for eSigning my documents?

You can easily access the Property Taxes Reno County, KS Official Website by visiting their official portal. Once there, use airSlate SignNow to upload your documents for eSigning. The user-friendly interface ensures you can complete the process quickly and efficiently.

-

Is there a cost associated with using the Property Taxes Reno County, KS Official Website for signing documents?

Using the Property Taxes Reno County, KS Official Website does involve some potential costs related to property tax filings and document handling. However, airSlate SignNow provides a cost-effective solution for electronic signatures that can save you time and reduce printing costs, making it a beneficial investment.

-

What features does airSlate SignNow offer for the Property Taxes Reno County, KS Official Website?

airSlate SignNow provides features such as customizable templates, secure storage, and real-time tracking for documents related to the Property Taxes Reno County, KS Official Website. These tools facilitate a hassle-free signing experience and promote effective communication between all parties involved.

-

Can I integrate airSlate SignNow with other tools while using the Property Taxes Reno County, KS Official Website?

Yes, airSlate SignNow offers extensive integration options that work seamlessly with other tools you might be using, enhancing your experience with the Property Taxes Reno County, KS Official Website. This interoperability allows you to manage your document workflows efficiently across different platforms.

-

What should I do if I encounter issues while using the Property Taxes Reno County, KS Official Website?

If you encounter any issues while using the Property Taxes Reno County, KS Official Website, it’s recommended to consult the FAQ section or customer support for assistance. Additionally, airSlate SignNow provides tutorials and customer service that can help resolve issues quickly.

-

How secure is my information when using the Property Taxes Reno County, KS Official Website with airSlate SignNow?

When utilizing the Property Taxes Reno County, KS Official Website with airSlate SignNow, your information is highly secure. The platform employs advanced encryption and security measures to protect your documents and personal data, ensuring compliance with national standards.

Get more for Property TaxesReno County, KS Official Website

- Form st 28b

- Pu101 en form

- Accord 24 form

- Hpcsa complaint form

- Jackson township police reports online form

- After idalia heres how to appeal a fema decision form

- Form i 290b instructions for notice of appeal or motion instructions for notice of appeal or motion

- Division of water qualitypermits application forms njdep

Find out other Property TaxesReno County, KS Official Website

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA