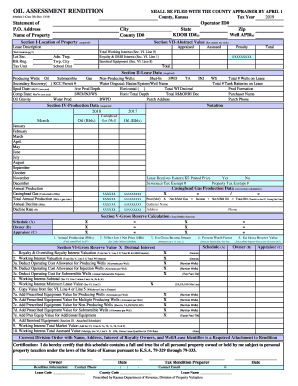

Oil Assessment Rendition Kansas Department of Revenue 2018

What is the Oil Assessment Rendition Kansas Department Of Revenue

The Oil Assessment Rendition is a form required by the Kansas Department of Revenue for assessing the value of oil properties within the state. This form is essential for property tax purposes and must be completed accurately to ensure compliance with state tax regulations. It is designed to provide the department with necessary information regarding the production and valuation of oil resources, which directly impacts local taxation.

How to use the Oil Assessment Rendition Kansas Department Of Revenue

To use the Oil Assessment Rendition, individuals or businesses involved in oil production must fill out the form with precise details about their oil properties. This includes information such as production volumes, property location, and ownership details. The completed form must then be submitted to the Kansas Department of Revenue by the specified deadline to ensure proper assessment and avoid penalties.

Steps to complete the Oil Assessment Rendition Kansas Department Of Revenue

Completing the Oil Assessment Rendition involves several key steps:

- Gather necessary information about your oil properties, including production data and property descriptions.

- Obtain the form from the Kansas Department of Revenue website or through local offices.

- Fill out the form with accurate and complete information.

- Review the form for any errors or omissions before submission.

- Submit the form by the deadline, either online or via mail, as per the department's guidelines.

Legal use of the Oil Assessment Rendition Kansas Department Of Revenue

The Oil Assessment Rendition is a legally binding document that must be completed in accordance with Kansas state law. Accurate completion of this form ensures compliance with property tax regulations and helps avoid legal repercussions. It is crucial to provide truthful information, as any discrepancies may lead to audits or penalties from the Kansas Department of Revenue.

Required Documents

When completing the Oil Assessment Rendition, certain documents may be required to support the information provided. These can include:

- Production reports for the oil properties.

- Ownership documentation, such as deeds or titles.

- Previous assessment notices, if applicable.

- Any additional records that substantiate the valuation of the oil properties.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Oil Assessment Rendition. Typically, the form must be submitted annually by a specific date set by the Kansas Department of Revenue. Missing this deadline can result in penalties or additional fees, so keeping track of these important dates is essential for compliance.

Quick guide on how to complete oil assessment rendition kansas department of revenue

Facilitate Oil Assessment Rendition Kansas Department Of Revenue effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to generate, adjust, and electronically sign your paperwork promptly with no hold-ups. Manage Oil Assessment Rendition Kansas Department Of Revenue on any gadget using airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

Steps to modify and electronically sign Oil Assessment Rendition Kansas Department Of Revenue with ease

- Find Oil Assessment Rendition Kansas Department Of Revenue and click Acquire Form to commence.

- Utilize the tools provided to complete your documentation.

- Highlight pertinent sections of your files or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Finish button to preserve your changes.

- Select your preferred method of delivering your document, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate new document prints. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Oil Assessment Rendition Kansas Department Of Revenue to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oil assessment rendition kansas department of revenue

Create this form in 5 minutes!

How to create an eSignature for the oil assessment rendition kansas department of revenue

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the Oil Assessment Rendition Kansas Department Of Revenue?

The Oil Assessment Rendition Kansas Department Of Revenue is a document required for reporting oil production and assessments to ensure compliance with state regulations. This process helps businesses accurately report their oil-related revenues and pay appropriate taxes, thus avoiding penalties.

-

How can airSlate SignNow help with the Oil Assessment Rendition Kansas Department Of Revenue?

airSlate SignNow offers a streamlined process for preparing, signing, and submitting your Oil Assessment Rendition Kansas Department Of Revenue. Our platform's easy-to-use interface allows businesses to handle documentation efficiently, ensuring they meet all state requirements with minimal hassle.

-

Is there a cost associated with using airSlate SignNow for the Oil Assessment Rendition Kansas Department Of Revenue?

Yes, using airSlate SignNow involves a subscription fee, but it is a cost-effective solution compared to traditional methods. The pricing is competitive, making it a valuable investment for businesses needing to manage their Oil Assessment Rendition Kansas Department Of Revenue efficiently.

-

What features does airSlate SignNow provide for the Oil Assessment Rendition Kansas Department Of Revenue?

AirSlate SignNow provides features such as customizable templates, secure eSigning, automated reminders, and collaboration tools tailored for the Oil Assessment Rendition Kansas Department Of Revenue. These features simplify document management and ensure compliance with state laws.

-

Can I integrate airSlate SignNow with other platforms for my Oil Assessment Rendition Kansas Department Of Revenue?

Absolutely! airSlate SignNow offers integrations with various business applications, enabling seamless data transfer and document management for your Oil Assessment Rendition Kansas Department Of Revenue. This connectivity enhances productivity and ensures data accuracy.

-

What are the benefits of using airSlate SignNow for my Oil Assessment Rendition Kansas Department Of Revenue?

Using airSlate SignNow for your Oil Assessment Rendition Kansas Department Of Revenue streamlines workflows, reduces turnaround time, and ensures compliance with Kansas regulations. Its secure eSigning and document tracking features provide peace of mind and optimize business processes.

-

How does airSlate SignNow ensure the security of my Oil Assessment Rendition Kansas Department Of Revenue?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Oil Assessment Rendition Kansas Department Of Revenue. These protocols help safeguard sensitive information, ensuring that your data remains private and secure.

Get more for Oil Assessment Rendition Kansas Department Of Revenue

Find out other Oil Assessment Rendition Kansas Department Of Revenue

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast