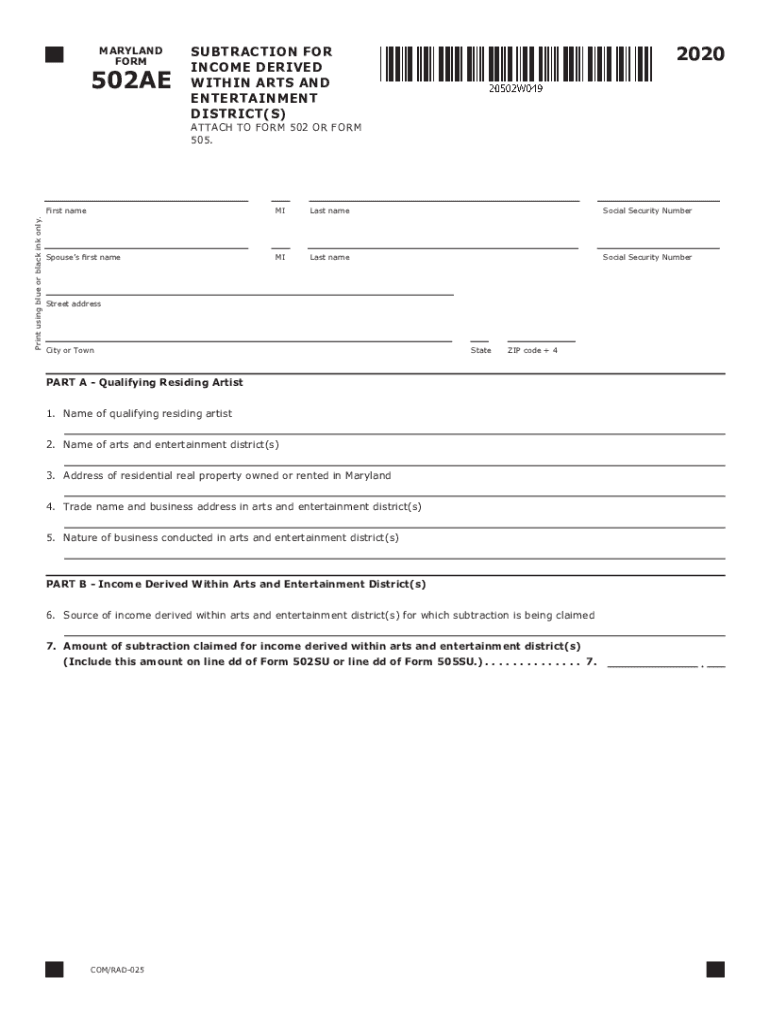

TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM 2020

Understanding the income district form

The income district form is a crucial document used primarily for reporting income and tax information related to specific districts. It is essential for individuals and businesses operating within designated income districts to ensure compliance with local tax regulations. This form typically captures details about income sources, deductions, and applicable tax rates, which may vary by district.

Steps to complete the income district form

Completing the income district form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, receipts for deductions, and previous tax returns. Next, follow these steps:

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, business income, and investment earnings.

- List any deductions you are eligible for, such as business expenses or education credits.

- Double-check the calculations for accuracy, ensuring that all figures align with your supporting documents.

- Sign and date the form, confirming that the information provided is true and complete.

Legal use of the income district form

The income district form must be completed in accordance with local, state, and federal regulations to be considered legally valid. Adhering to the guidelines set forth by tax authorities is essential, as improper use or submission of this form can lead to penalties. It is important to utilize a reliable e-signature solution that complies with the ESIGN Act and UETA, ensuring that your electronic signature holds legal weight.

Obtaining the income district form

The income district form can typically be obtained through local tax offices or online via government websites dedicated to tax administration. It is important to ensure that you are using the most current version of the form, as updates may occur annually. If you are unsure where to find the form, consider reaching out to a tax professional for assistance.

Filing deadlines for the income district form

Filing deadlines for the income district form may vary based on your specific district and the type of income being reported. Generally, forms are due on April fifteenth for individual taxpayers, but it is advisable to check with local tax authorities for any variations. Missing the deadline can result in penalties, so keeping track of important dates is essential for compliance.

Required documents for the income district form

When completing the income district form, it is important to have all necessary documentation ready. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete ty 2020 502ae tax year 2020 502ae individual taxpayer form

Complete TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM effortlessly on any device

Managing documents online has become widely embraced by businesses and individuals alike. It offers an excellent eco-conscious alternative to traditional printed and signed paper forms, allowing you to locate the right document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

The simplest way to edit and eSign TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM without hassle

- Obtain TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize essential parts of your files or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sending your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2020 502ae tax year 2020 502ae individual taxpayer form

Create this form in 5 minutes!

How to create an eSignature for the ty 2020 502ae tax year 2020 502ae individual taxpayer form

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is an income district form?

An income district form is a document used to collect financial information specific to designated income districts. This form helps businesses and organizations streamline their financial reporting processes, ensuring accuracy and compliance with local regulations concerning income allocation.

-

How can airSlate SignNow help me manage my income district forms?

airSlate SignNow offers an intuitive platform for managing your income district forms efficiently. With its eSigning capabilities, you can quickly send, receive, and store completed forms, reducing paperwork and improving overall workflow time.

-

Are there any costs associated with using airSlate SignNow for income district forms?

Yes, airSlate SignNow provides various pricing plans tailored for different business needs. Each plan allows you to manage income district forms with features that scale with your requirements, making it a cost-effective solution for eSigning and document management.

-

What features does airSlate SignNow offer for income district forms?

airSlate SignNow features include customizable templates for income district forms, automated workflows, and real-time tracking of document status. These functionalities enhance efficiency and keep your document processes organized and secure.

-

Can I integrate airSlate SignNow with other tools for managing income district forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This allows for smooth management of income district forms alongside your existing software tools, enhancing your productivity.

-

How secure is the data shared through income district forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. All data shared through income district forms is encrypted following industry-standard protocols, ensuring that your sensitive financial information remains protected at all times.

-

Can I track the status of my income district forms sent via airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including income district forms. You can easily see who has opened, reviewed, and signed the forms, ensuring transparency and accountability in your document management process.

Get more for TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM

- Application for seasonal employment 2015 2 doc form

- 2016 application for seasonal employment 2doc form

- White plains ny official websiteofficial website form

- Vehicular property damage claim form

- Prevocational services attendance sheet with signature form

- Instructions for filing complete both pages of this application and return to form

- Public vessel license new york form

- Voter registration form new york

Find out other TY 502AE TAX YEAR 502AE INDIVIDUAL TAXPAYER FORM

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT