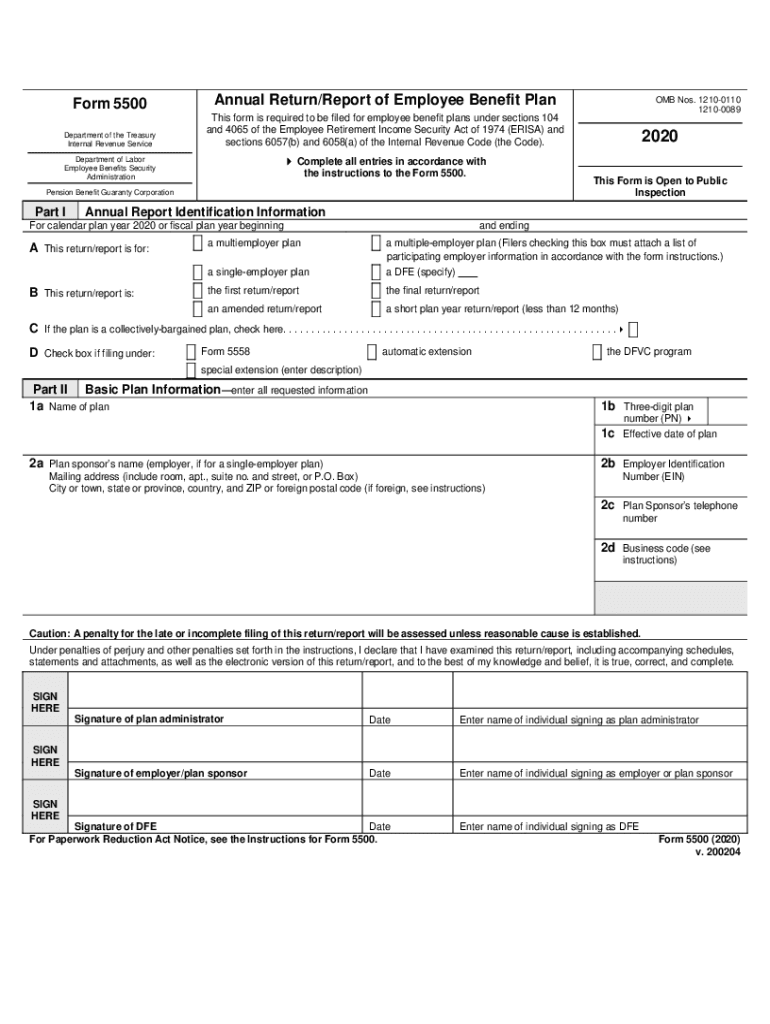

Form 5500 2020

What is the Form 5500

The Form 5500 is an annual report required by the Employee Retirement Income Security Act (ERISA) for employee benefit plans in the United States. It provides the federal government with information about the plan's financial condition, investments, and operations. This form is essential for ensuring compliance with federal regulations and maintaining transparency regarding employee benefits.

How to use the Form 5500

Using the Form 5500 involves several steps. First, determine the specific version of the form required for your plan, as there are different variants based on the type of benefits offered. Next, gather all necessary information, including plan details, financial statements, and participant data. Once you have compiled this information, you can complete the form either online or by using paper forms. After filling out the form, it must be filed with the Department of Labor (DOL) and the Internal Revenue Service (IRS) by the specified deadline.

Steps to complete the Form 5500

Completing the Form 5500 requires careful attention to detail. Follow these steps:

- Identify the correct version of the Form 5500 based on your plan type.

- Collect all relevant documentation, including financial statements and participant information.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically via the DOL's EFAST2 system or by mail, if necessary.

Legal use of the Form 5500

The legal use of the Form 5500 is critical for compliance with ERISA and IRS regulations. This form must be filed annually for most employee benefit plans, including health and retirement plans. Failure to file can result in penalties and legal repercussions. It is important to ensure that all information provided is accurate and complete to avoid issues with regulatory authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5500 vary based on the plan year. Generally, the form must be filed within seven months after the end of the plan year. If an extension is needed, a request can be submitted, allowing for an additional two and a half months. It is essential to keep track of these deadlines to ensure timely compliance and avoid penalties.

Penalties for Non-Compliance

Non-compliance with Form 5500 filing requirements can lead to significant penalties. The DOL imposes fines for late filings, which can accumulate daily. Additionally, failure to provide accurate information can result in further legal consequences. It is crucial for plan sponsors to understand these penalties and ensure timely and accurate submissions to avoid financial repercussions.

Quick guide on how to complete 2020 form 5500

Prepare Form 5500 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 5500 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 5500 with ease

- Locate Form 5500 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Disregard concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 5500 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 5500

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 5500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

How does airSlate SignNow streamline labor management?

airSlate SignNow simplifies labor management by allowing businesses to easily send, sign, and manage documents electronically. This reduces the time and effort spent on manual paperwork, enabling teams to focus more on their core tasks. With its intuitive interface, users can efficiently manage labor documents, ensuring compliance and reducing errors.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring that managing labor documentation is both affordable and cost-effective. Each plan provides access to essential features, aimed at enhancing productivity and minimizing labor costs associated with paper-based processes. You can choose a plan that best fits your team's size and usage frequency.

-

Can airSlate SignNow integrate with other tools for labor tracking?

Yes, airSlate SignNow integrates seamlessly with popular productivity and labor tracking tools, enhancing your workflow efficiency. This allows for better organization and tracking of labor-related documents, making it easier to manage employee agreements, contracts, and time sheets. Integration not only saves time but also ensures that all labor data is synchronized across platforms.

-

What are the security features for labor documents in airSlate SignNow?

airSlate SignNow prioritizes the security of your labor documents by employing top-notch encryption and secure storage solutions. This ensures that sensitive information related to labor contracts and agreements is protected from unauthorized access. Additionally, features like audit trails and access controls give you peace of mind when managing your labor-related documentation.

-

How can airSlate SignNow enhance collaboration within labor teams?

By using airSlate SignNow, labor teams can collaborate in real-time on documents, making it easier to draft, review, and finalize agreements. The platform allows users to send documents for review and eSigning, streamlining communication and reducing turnaround time. The collaborative features contribute to a more efficient workflow, ultimately improving team productivity.

-

Is airSlate SignNow compliant with labor regulations?

airSlate SignNow is designed to comply with relevant labor regulations, ensuring that your eSigning processes remain legal and secure. The platform adheres to industry standards and offers features that help businesses to maintain compliance with labor laws and regulations. This aspect helps mitigate risk and provides assurance for organizations managing labor-related documents.

-

What benefits does airSlate SignNow offer for freelance labor agreements?

For freelancers, airSlate SignNow provides a convenient and professional way to manage labor agreements. The platform allows for quick generation and signing of contracts, eliminating delays and streamlining the onboarding process. Additionally, it enhances the professionalism of freelance interactions by ensuring that all documents are handled securely and efficiently.

Get more for Form 5500

- Student accident claim packet barnegat township school form

- Transcript requests eastern form

- Formsoffice of the registraruniversity of alaska

- Marion florence usd 408 form

- Sciencespot form

- Exchange student application form

- Fillable online model release form minorrev fax email print

- Uco tuition waiver form

Find out other Form 5500

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors