Tax Information Authorization Checking This Box Allows the Department to Disclose Your Confidential Tax Information to Your 2010

What is the Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your

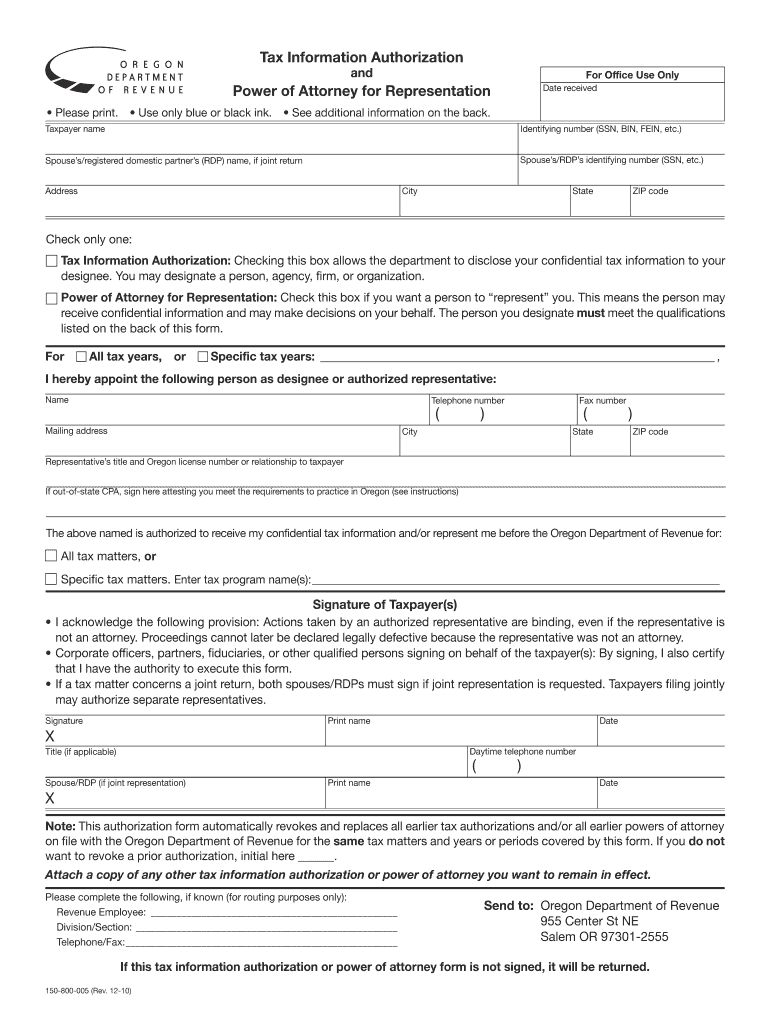

The Tax Information Authorization is a crucial form that enables the relevant department to share your confidential tax information with designated individuals or entities. By checking the box on this form, you grant permission for the disclosure of sensitive tax details, which is essential for various processes, such as loan applications or financial assessments. This authorization ensures that your information is handled in accordance with legal standards, protecting your privacy while allowing necessary access.

Steps to Complete the Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your

Completing the Tax Information Authorization involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and any relevant tax identification numbers. Next, clearly identify the individuals or entities to whom you are authorizing disclosure. After filling out the form, review it carefully to confirm that all information is correct. Finally, sign and date the form, ensuring that it is submitted according to the specified guidelines, whether electronically or via mail.

Legal Use of the Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your

This form is legally binding, provided that it meets specific requirements outlined by federal and state laws. The authorization allows the department to share your tax information with authorized parties, ensuring compliance with regulations such as the Internal Revenue Code. It is important to understand that misuse of this authorization can lead to legal consequences, so it should only be used for legitimate purposes, such as securing loans or fulfilling legal obligations.

Key Elements of the Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your

Several key elements define the Tax Information Authorization. These include the specific tax information being disclosed, the identity of the authorized recipient, and the scope of the authorization. Additionally, the form must include your signature and the date to validate the request. Understanding these elements is essential for ensuring that the authorization is properly executed and legally enforceable.

IRS Guidelines

The IRS provides clear guidelines regarding the use of the Tax Information Authorization. These guidelines outline the responsibilities of both the taxpayer and the authorized recipient. It is crucial to adhere to these guidelines to avoid potential issues with tax compliance. Familiarizing yourself with IRS requirements can help ensure that your authorization is accepted and that your confidential information is handled appropriately.

Disclosure Requirements

Disclosure requirements for the Tax Information Authorization are designed to protect your privacy while allowing necessary access to your tax information. The form specifies who can receive your information and under what circumstances. It is vital to understand these requirements to ensure that you are not inadvertently granting access to unauthorized parties. This understanding helps maintain the confidentiality of your sensitive tax details.

Eligibility Criteria

Eligibility criteria for completing the Tax Information Authorization vary based on the purpose of the disclosure. Generally, any individual or entity seeking to access your tax information must be clearly identified in the form. In some cases, additional documentation may be required to verify the identity of the requester. Understanding these criteria is essential to ensure that the authorization process is smooth and compliant with legal standards.

Quick guide on how to complete tax information authorization checking this box allows the department to disclose your confidential tax information to your

Complete Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your effortlessly on any device

Online document administration has become favored among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any delays. Manage Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your with ease

- Obtain Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax information authorization checking this box allows the department to disclose your confidential tax information to your

Create this form in 5 minutes!

How to create an eSignature for the tax information authorization checking this box allows the department to disclose your confidential tax information to your

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the purpose of 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your'?

The 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your' feature enables users to grant permission for the Department to share their tax information with authorized individuals. This is crucial for compliance and ensures that all parties are up-to-date with financial obligations.

-

How does airSlate SignNow help with tax documentation?

airSlate SignNow provides a streamlined process for sending and eSigning tax documents. By utilizing our platform, you ensure that important information, such as 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your', is handled securely and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. With competitive pricing, you can leverage features like 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your' without breaking the bank, ensuring you have access to vital functionalities at an affordable rate.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with a variety of applications including CRMs and cloud storage solutions. This means you can manage documents and features like 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your' alongside your existing workflows and tools.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes security with robust encryption standards to protect your data. This includes safeguarding sensitive information related to 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your', ensuring that only authorized individuals can access your confidential tax documents.

-

How can I track the status of my eSigned documents?

With airSlate SignNow, you can easily track the status of your eSigned documents in real-time. This feature allows you to monitor the progress of documents that include 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your', giving you peace of mind and accountability.

-

What are the benefits of using airSlate SignNow for tax-related documents?

The benefits of using airSlate SignNow for tax-related documents include increased efficiency, reduced turnaround time, and enhanced compliance. Features like 'Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your' simplify user permissions, making tax processes smoother.

Get more for Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your

- Horse transport contract form

- Mortals character sheet form

- Statutory declaration royal canadian mounted police superannuation act supporting statement cf fc 2467 1e tpsgc pwgsc gc form

- Dhec refrigerator temperature log form

- Https gcbger nv gov regapp form

- Gc 399 form

- Primary source verification form ccs4uorg

- Martial arts waiver form

Find out other Tax Information Authorization Checking This Box Allows The Department To Disclose Your Confidential Tax Information To Your

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free