About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F 2022

Understanding Form 5695 and Residential Energy Credits

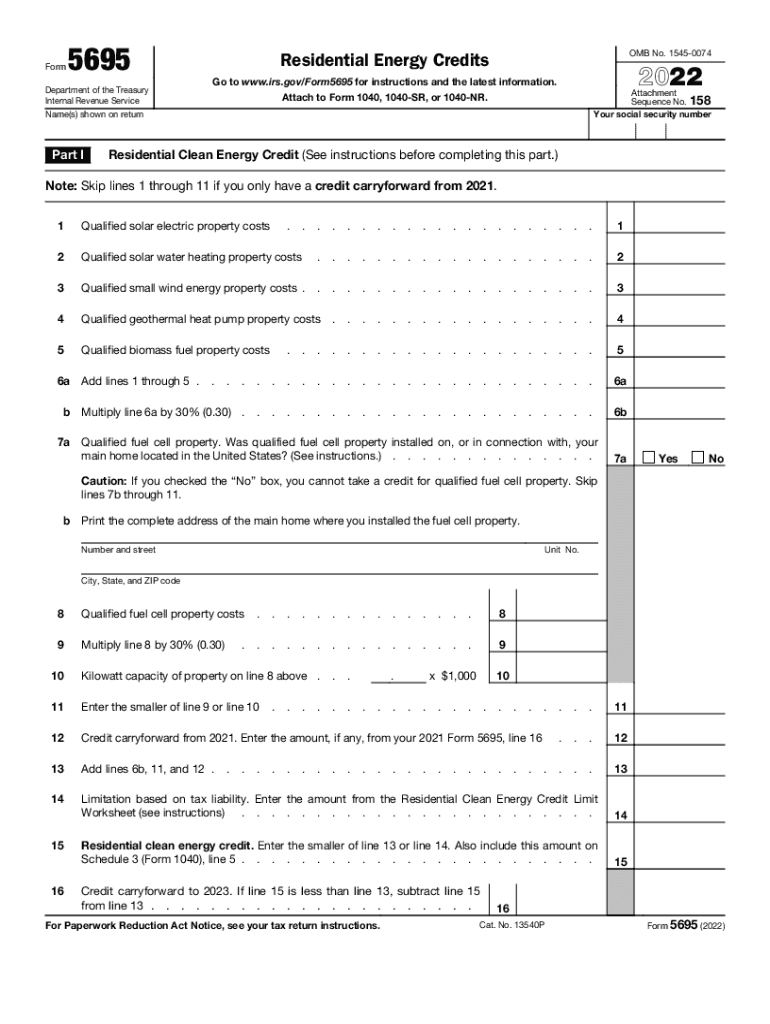

Form 5695, also known as the Residential Energy Credits form, is used by taxpayers in the United States to claim energy efficiency credits on their federal income tax return. These credits are designed to encourage homeowners to invest in renewable energy sources and energy-efficient improvements. The form allows taxpayers to report the cost of qualified energy-efficient property, such as solar panels, solar water heaters, and energy-efficient windows, among others. By completing this form, taxpayers can reduce their overall tax liability, making it an important tool for those looking to benefit from energy credits.

Steps to Complete Form 5695

Completing Form 5695 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documentation, including receipts for energy-efficient purchases and installation. Next, fill out the form by providing personal information and detailing the specific energy-efficient improvements made to your home. Ensure that you calculate the credits accurately based on the costs incurred. Finally, review the completed form for any errors before submitting it along with your tax return. Following these steps can help streamline the process and maximize your potential credits.

Eligibility Criteria for Residential Energy Credits

To qualify for the credits claimed on Form 5695, certain eligibility criteria must be met. The improvements must be made to your primary residence located in the United States. Additionally, the property must meet specific energy efficiency standards set by the IRS. For example, solar energy systems must be certified by the manufacturer to ensure they meet the required performance criteria. Taxpayers should also be aware of the maximum credit limits and any phase-out provisions that may apply based on their income levels.

Required Documents for Filing Form 5695

When filing Form 5695, it is essential to have the appropriate documentation to support your claims. Required documents typically include receipts for the purchase and installation of energy-efficient products, manufacturer certifications, and any relevant energy audit reports. Keeping detailed records will not only help in completing the form accurately but also provide necessary evidence in case of an IRS audit. It is advisable to retain these documents for at least three years after filing your tax return.

IRS Guidelines for Form 5695

The IRS provides specific guidelines for completing Form 5695, including detailed instructions on eligible expenses and how to calculate the credits. Taxpayers should refer to the latest IRS publications and instructions associated with Form 5695 to ensure compliance with current tax laws. Understanding these guidelines is crucial, as they outline the types of improvements that qualify for credits and any limitations that may apply. Staying informed about changes in tax regulations can help taxpayers maximize their benefits.

Filing Deadlines for Form 5695

Form 5695 must be filed along with your annual federal income tax return, which is typically due on April fifteenth of each year. If you require additional time to prepare your return, you may file for an extension, but it is important to note that any taxes owed must still be paid by the original due date to avoid penalties and interest. Being aware of these deadlines can help taxpayers avoid complications and ensure they receive their credits in a timely manner.

Quick guide on how to complete about form 5695 residential energy credits irs tax formsabout form 5695 residential energy credits irs tax formsinstructions

Complete About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F effortlessly on every gadget

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate template and securely keep it online. airSlate SignNow equips you with all the resources necessary to generate, edit, and eSign your documents swiftly without any holdups. Manage About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest method to edit and eSign About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F with ease

- Find About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F and then click Get Form to initiate the process.

- Utilize the features we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it onto your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 5695 residential energy credits irs tax formsabout form 5695 residential energy credits irs tax formsinstructions

Create this form in 5 minutes!

People also ask

-

What is Form 5695 and why is it important?

Form 5695 is a tax form used to claim residential energy efficient property credits on your tax return. Understanding how to fill out Form 5695 can help you benefit from potential savings on your taxes while promoting eco-friendly upgrades to your home.

-

How can airSlate SignNow help with Form 5695?

airSlate SignNow simplifies the process of preparing and signing Form 5695. With our eSignature capabilities, you can quickly send the form to clients or stakeholders, ensuring they can review and sign it without delay, all while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for Form 5695?

Yes, airSlate SignNow offers affordable pricing plans designed to fit various business needs. Our plans provide access to all the necessary features for managing Form 5695, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow provide for Form 5695 processing?

airSlate SignNow includes features such as customizable templates, in-app document editing, secure storage, and advanced tracking options for Form 5695. These features allow users to efficiently manage the form's workflow and ensure accuracy.

-

Can I integrate airSlate SignNow with other applications for processing Form 5695?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including accounting and tax software, to streamline the processing of Form 5695. This ensures that you can maintain all your documents and processes in one place.

-

What are the benefits of using airSlate SignNow for Form 5695?

Using airSlate SignNow for Form 5695 allows for increased efficiency and reduced errors during the signing process. Our platform ensures that you can quickly manage and send the form while remaining compliant with IRS regulations.

-

How secure is the process of signing Form 5695 with airSlate SignNow?

airSlate SignNow prioritizes security by utilizing advanced encryption methods and secure cloud storage for all documents, including Form 5695. This means your sensitive information is protected at all times throughout the signing process.

Get more for About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F

- Ny permanent form

- New york guardian form

- Quitclaim deed from husband and wife to an individual new york form

- New york warranty 497321165 form

- Demand for terms of contract by corporation or llc new york form

- New york living will and health care proxy new york form

- Ny property 497321168 form

- New york contract 497321170 form

Find out other About Form 5695, Residential Energy Credits IRS Tax FormsAbout Form 5695, Residential Energy Credits IRS Tax FormsInstructions F

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT