Form 5695 Residential Energy Credits 2023

What is the Form 5695 Residential Energy Credits

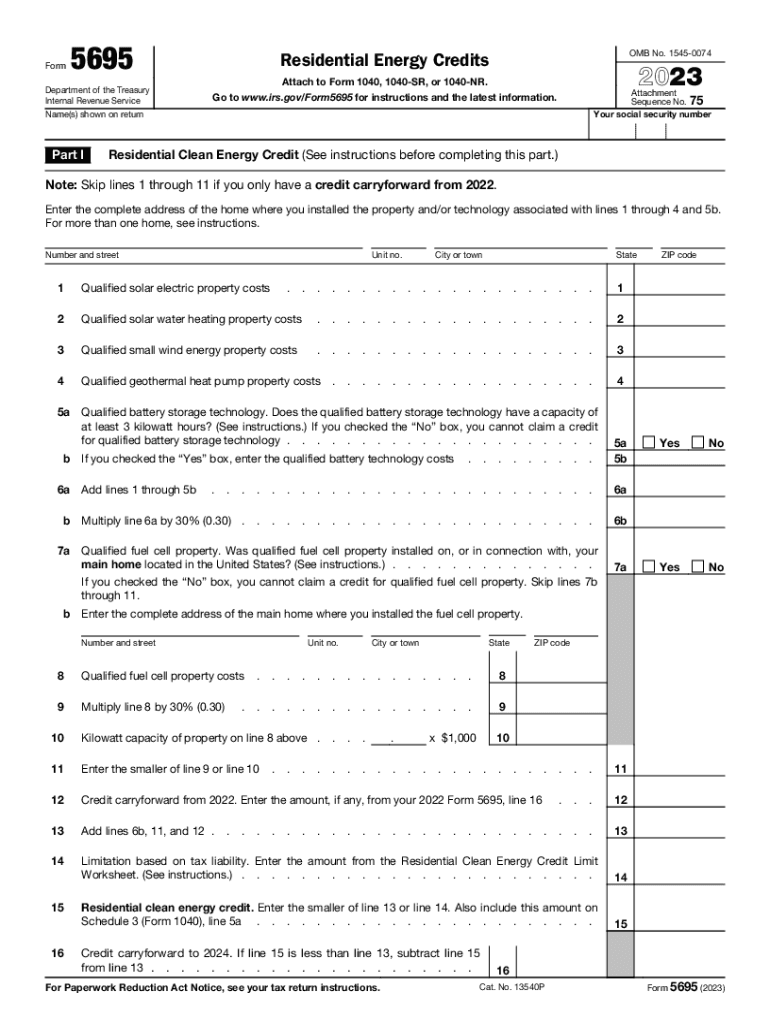

The Form 5695 is an IRS document used to claim residential energy credits. These credits are designed to encourage homeowners to invest in energy-efficient improvements to their residences. By filling out this form, taxpayers can potentially reduce their tax liability based on qualified energy-saving upgrades, such as solar panels, energy-efficient windows, and insulation. Understanding the purpose of this form is essential for homeowners looking to benefit from available tax incentives.

How to use the Form 5695 Residential Energy Credits

Using the Form 5695 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary documentation related to their energy-efficient improvements. This includes receipts, invoices, and any relevant certifications. Once the required information is compiled, individuals can fill out the form, detailing the specific improvements made and calculating the applicable credits. It is crucial to follow IRS guidelines closely to maximize potential benefits.

Steps to complete the Form 5695 Residential Energy Credits

Completing the Form 5695 requires careful attention to detail. Here are the steps to follow:

- Gather all documentation for energy-efficient improvements.

- Download the latest version of Form 5695 from the IRS website.

- Fill out Part I, which covers the residential energy efficient property credit.

- Complete Part II for the nonbusiness energy property credit.

- Calculate the total credits and ensure all calculations are accurate.

- Attach the completed form to your tax return when filing.

Eligibility Criteria

To qualify for the credits on Form 5695, taxpayers must meet specific eligibility criteria. The improvements must be made to a primary residence located in the United States. Additionally, the upgrades must meet the energy efficiency standards set by the IRS. Homeowners should verify that the products used qualify for the credits and ensure that they are installed correctly. Understanding these criteria is vital for successfully claiming the credits.

Filing Deadlines / Important Dates

Filing deadlines for Form 5695 align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If taxpayers need additional time, they can file for an extension, but the form must still be submitted by the extended deadline. It is important to stay informed about any changes to deadlines or tax regulations that may affect the filing of this form.

Required Documents

When completing Form 5695, certain documents are necessary to support the claims made. These include:

- Receipts for all energy-efficient products purchased.

- Invoices from contractors for installation services.

- Manufacturer certifications for qualifying products.

- Any additional documentation required by the IRS to validate claims.

Having these documents ready can streamline the filing process and help ensure that all claims are substantiated.

Quick guide on how to complete form 5695 residential energy credits

Prepare Form 5695 Residential Energy Credits effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form 5695 Residential Energy Credits on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The simplest way to alter and eSign Form 5695 Residential Energy Credits without hassle

- Find Form 5695 Residential Energy Credits and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign Form 5695 Residential Energy Credits and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5695 residential energy credits

Create this form in 5 minutes!

How to create an eSignature for the form 5695 residential energy credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5695 and who should use it?

Form 5695 is a tax document used to claim residential energy credits. Homeowners who have made energy-efficient upgrades to their homes can benefit from this form. Using Form 5695 can help you reduce your tax liability while promoting sustainable living.

-

How can airSlate SignNow help with Form 5695?

airSlate SignNow simplifies the process of filling out and electronically signing Form 5695. With our platform, you can easily upload, edit, and eSign the document securely. This makes your tax filing process faster and more efficient.

-

Is there a fee to use airSlate SignNow for Form 5695?

airSlate SignNow offers a cost-effective solution with a variety of pricing plans tailored to your needs. You can use our platform for free for a limited time, and various subscription options are available for those who require regular access to Form 5695 and other documents.

-

What features does airSlate SignNow offer for managing Form 5695?

Features include document sharing, customizable templates, and secure eSigning capabilities. With airSlate SignNow, you can track the status of Form 5695 and receive notifications when it has been signed. These tools streamline the documentation process signNowly.

-

Can I integrate airSlate SignNow with other applications for Form 5695?

Yes, airSlate SignNow supports integrations with popular applications like Google Drive, Dropbox, and various CRM systems. This flexibility allows you to easily manage your Form 5695 alongside other important documents without switching platforms.

-

What are the benefits of using airSlate SignNow for Form 5695?

By using airSlate SignNow for Form 5695, you gain increased efficiency and accuracy in managing your tax documents. The platform ensures that all your signatures are legally binding and securely stored, reducing the risk of errors and saving you time during tax season.

-

How secure is airSlate SignNow when handling Form 5695?

airSlate SignNow prioritizes the security and confidentiality of your documents, including Form 5695. Our platform utilizes bank-level encryption and secure servers to protect your information, ensuring that your data remains safe at all times.

Get more for Form 5695 Residential Energy Credits

- Clean hands selfcertification form abra dc

- Mcs 90 example form

- Chemistry form ws10 1 1a

- Jugendarbeitsschutz nachuntersuchung form

- Konut n biriktirim fonundan aada belirttiim sebepten dolay ayrlmak istiyorum form

- Railway concession form 1 45 pdf 422275943

- How to amend a new mexico tax return form

- Vulnerability assessment agreement template form

Find out other Form 5695 Residential Energy Credits

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT