Form CT 184Transportation and Transmission Corporation Tax Ny 2017

What is the Form CT 184 Transportation And Transmission Corporation Tax Ny

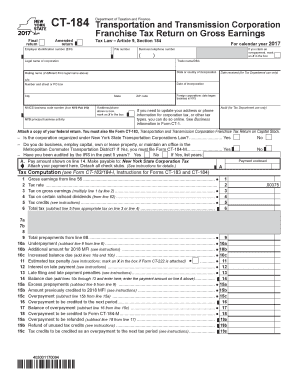

The Form CT 184 is a tax document specifically designed for transportation and transmission corporations operating within New York State. This form is essential for reporting and calculating the tax obligations of corporations engaged in transportation and transmission activities. It ensures compliance with state tax regulations and allows businesses to accurately report their income and expenses related to these operations.

How to use the Form CT 184 Transportation And Transmission Corporation Tax Ny

Using the Form CT 184 involves several steps that ensure accurate reporting of tax information. First, gather all necessary financial records, including income statements and expense reports related to transportation and transmission activities. Next, fill out the form by providing details such as gross income, allowable deductions, and any applicable credits. Finally, review the completed form for accuracy before submission to the New York State Department of Taxation and Finance.

Steps to complete the Form CT 184 Transportation And Transmission Corporation Tax Ny

Completing the Form CT 184 requires careful attention to detail. Begin by entering the corporation's name, address, and identification number at the top of the form. Then, proceed to report gross income from transportation and transmission activities in the designated section. Following this, list any allowable deductions, such as operating expenses and depreciation. Ensure that all calculations are accurate, and double-check the totals before signing and dating the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form CT 184 to avoid penalties. Generally, the form must be filed on or before the 15th day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this typically means a deadline of March 15. Keeping track of these dates helps ensure timely compliance with state tax regulations.

Penalties for Non-Compliance

Failure to file the Form CT 184 on time or inaccuracies in reporting can result in significant penalties. The New York State Department of Taxation and Finance may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden on the corporation. It is essential to understand these consequences to maintain compliance and avoid unnecessary costs.

Digital vs. Paper Version

When it comes to submitting the Form CT 184, corporations have the option of using either a digital or paper version. The digital version allows for easier completion and submission, often with built-in error-checking features. Conversely, the paper version requires manual completion and mailing to the appropriate tax authority. Choosing the digital option can streamline the process and enhance accuracy, making it a preferred choice for many businesses.

Quick guide on how to complete form ct 1842015transportation and transmission corporation tax ny

Prepare Form CT 184Transportation And Transmission Corporation Tax Ny effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed forms, as you can access the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without any holdups. Handle Form CT 184Transportation And Transmission Corporation Tax Ny on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Form CT 184Transportation And Transmission Corporation Tax Ny with ease

- Locate Form CT 184Transportation And Transmission Corporation Tax Ny and then click Get Form to begin.

- Make use of the features we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details thoroughly and then hit the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tedious form navigation, or mistakes requiring new document prints. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Modify and eSign Form CT 184Transportation And Transmission Corporation Tax Ny and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1842015transportation and transmission corporation tax ny

Create this form in 5 minutes!

People also ask

-

What is Form CT 184Transportation And Transmission Corporation Tax Ny?

Form CT 184Transportation And Transmission Corporation Tax Ny is a specific tax form required for transportation and transmission corporations operating in New York. It is used to report income and ensure compliance with state tax laws. Using this form correctly is crucial for businesses in this sector.

-

How can airSlate SignNow assist with Form CT 184Transportation And Transmission Corporation Tax Ny?

airSlate SignNow offers a streamlined platform to fill out and eSign the Form CT 184Transportation And Transmission Corporation Tax Ny. Our solution simplifies the document management process, ensuring that your submissions are both compliant and easily retrievable.

-

Are there any costs associated with using airSlate SignNow for Form CT 184Transportation And Transmission Corporation Tax Ny?

Yes, airSlate SignNow offers different pricing plans to cater to various business needs. You can choose a plan that best fits your budget while providing features necessary for managing Form CT 184Transportation And Transmission Corporation Tax Ny efficiently.

-

What features does airSlate SignNow offer for managing tax documents like Form CT 184Transportation And Transmission Corporation Tax Ny?

airSlate SignNow includes features such as template creation, automated workflows, and secure eSignature capabilities. These features are designed to streamline the process of managing tax documents, including Form CT 184Transportation And Transmission Corporation Tax Ny, making it easy and efficient.

-

Can I integrate airSlate SignNow with other software for Form CT 184Transportation And Transmission Corporation Tax Ny?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software and tools, facilitating the easy management of Form CT 184Transportation And Transmission Corporation Tax Ny alongside your existing systems. This integration enhances productivity and ensures you remain organized.

-

What are the benefits of using airSlate SignNow for tax forms like Form CT 184Transportation And Transmission Corporation Tax Ny?

Using airSlate SignNow for forms like Form CT 184Transportation And Transmission Corporation Tax Ny offers increased efficiency, reduced paper usage, and enhanced security. The platform allows for quick eSigning, ensuring that your submissions are processed promptly.

-

How secure is airSlate SignNow when handling Form CT 184Transportation And Transmission Corporation Tax Ny?

airSlate SignNow prioritizes security, implementing advanced encryption and compliance measures to protect sensitive tax information, including Form CT 184Transportation And Transmission Corporation Tax Ny. Your data is safe and secure throughout the document management process.

Get more for Form CT 184Transportation And Transmission Corporation Tax Ny

- Psychiatricsubstance abuse form

- North carolina safety and emission vehicle inspectionrevolvy form

- Request for division of form

- Department of transportation division of motor vehicles form

- Hsmv 96440 form

- Fl change address form 470476113

- Flhsmv e filing form

- Apportioned license plate andor cab card form

Find out other Form CT 184Transportation And Transmission Corporation Tax Ny

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe