CT 183184 IInstructions for Forms Tax NY Gov 2022

Understanding the CT 184 Instructions for Forms

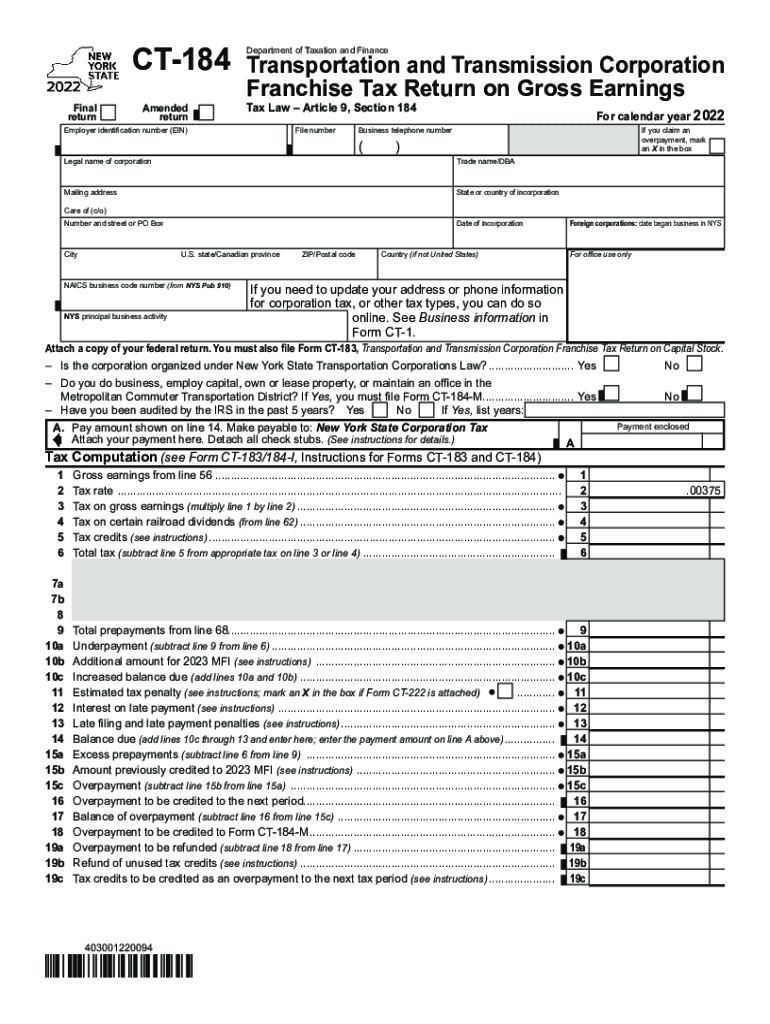

The CT 184 form is an essential document used in the state of New York for tax purposes. It provides specific instructions for taxpayers to accurately complete their tax filings. This form is particularly relevant for individuals and businesses who need to report their income and calculate their tax obligations. Understanding the details of the CT 184 is crucial for ensuring compliance with state tax laws and avoiding potential penalties.

Steps to Complete the CT 184 Form

Completing the CT 184 form involves several key steps that ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, follow the instructions provided on the form carefully, filling out each section with the required information. Be sure to double-check your entries for accuracy. Once completed, review the form to ensure that all calculations are correct and that you have signed where necessary. Finally, submit the form by the designated deadline to avoid any late fees or penalties.

Legal Use of the CT 184 Form

The CT 184 form is legally binding when completed correctly and submitted on time. It adheres to the legal requirements set forth by New York state tax laws. To ensure that the form is recognized as valid, it must be signed by the appropriate parties and submitted through the proper channels. Utilizing a reliable eSignature solution can enhance the legal standing of your submission, as it provides an additional layer of authentication and compliance with electronic signature laws.

Filing Deadlines for the CT 184 Form

Timely filing of the CT 184 form is crucial to avoid penalties. The specific deadlines can vary based on the taxpayer's situation, such as whether they are filing as an individual or a business entity. Generally, the form must be filed by the tax deadline, which is typically April 15 for individuals. Businesses may have different deadlines depending on their fiscal year. It is advisable to check the New York State Department of Taxation and Finance website for the most current filing dates and any extensions that may apply.

Required Documents for Filing the CT 184

When preparing to file the CT 184 form, it is important to gather all required documents. These may include W-2 forms, 1099 forms, and any other income documentation. Additionally, you may need records of deductions, credits, and prior year tax returns. Having all necessary documents at hand will facilitate a smoother completion process and ensure that all information reported is accurate.

Examples of Using the CT 184 Form

The CT 184 form can be utilized in various scenarios, such as for self-employed individuals reporting their income or for businesses filing their annual tax returns. For example, a freelance graphic designer would use the CT 184 to report income earned from multiple clients, while a small business owner would fill out the form to declare their business income and expenses. Each scenario requires careful attention to detail to ensure compliance with tax regulations.

Quick guide on how to complete ct 183184 iinstructions for forms taxnygov

Fill out CT 183184 IInstructions For Forms Tax NY gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage CT 183184 IInstructions For Forms Tax NY gov on any platform with the airSlate SignNow apps available for Android and iOS, and simplify any document-related process today.

How to modify and electronically sign CT 183184 IInstructions For Forms Tax NY gov without breaking a sweat

- Locate CT 183184 IInstructions For Forms Tax NY gov and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign CT 183184 IInstructions For Forms Tax NY gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 183184 iinstructions for forms taxnygov

Create this form in 5 minutes!

How to create an eSignature for the ct 183184 iinstructions for forms taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 184 and how does it relate to airSlate SignNow?

CT 184 is a document outlining the authorization for tax purposes, and airSlate SignNow streamlines the process of signing such documents electronically. With airSlate SignNow, you can effortlessly eSign your CT 184 form and ensure it is securely stored for your records.

-

How much does airSlate SignNow cost for signing documents like the CT 184?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including features built specifically for signing documents like CT 184. You can choose from monthly or annual plans, allowing you to select the option that best fits your budget and usage requirements.

-

What features does airSlate SignNow offer for eSigning CT 184 forms?

airSlate SignNow provides a range of features for eSigning CT 184 forms, including customizable templates and advanced security measures. Users can easily create, send, and track their documents, ensuring a seamless signing experience.

-

Can I integrate airSlate SignNow with other software for handling CT 184 documents?

Yes, airSlate SignNow supports integration with various popular applications, enabling you to manage your CT 184 documents alongside your existing workflows. This flexibility allows for improved efficiency and better document management.

-

Is airSlate SignNow legally compliant for signing documents like CT 184?

Absolutely! airSlate SignNow adheres to stringent legal standards, ensuring that your eSignatures for documents like CT 184 are valid and enforceable. This compliance gives you peace of mind when handling sensitive tax-related documents.

-

What are the benefits of using airSlate SignNow for eSigning CT 184 forms?

Using airSlate SignNow for eSigning CT 184 forms provides numerous benefits, including increased efficiency and reduced paper waste. The platform's user-friendly interface makes it easy for all parties to sign documents promptly, accelerating your business processes.

-

How does airSlate SignNow ensure the security of CT 184 eSigned documents?

Security is a top priority for airSlate SignNow; they utilize advanced encryption and secure servers to protect your data, including CT 184 documents. This robust security framework ensures that your eSigned forms remain confidential and safe from unauthorized access.

Get more for CT 183184 IInstructions For Forms Tax NY gov

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497310798 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497310799 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497310800 form

- Me letter landlord tenant form

- Me landlord lease form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497310803 form

- Letter from tenant to landlord about insufficient notice of rent increase maine form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease maine form

Find out other CT 183184 IInstructions For Forms Tax NY gov

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe