CT 184 Transportation and Transmission Corporation New York State Department of Taxation and Finance Staple Forms Here Final Ret 2010

What is the CT 184 Transportation And Transmission Corporation?

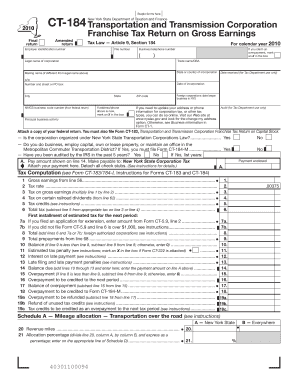

The CT 184 Transportation And Transmission Corporation form is a crucial document required by the New York State Department of Taxation and Finance. This form is specifically designed for transportation and transmission corporations operating within New York State. It encompasses various tax obligations, including the final return, amended return, and franchise tax return on gross earnings as stipulated under Article 9, Section 184 of the New York Tax Law. Understanding this form is essential for compliance and accurate reporting of gross earnings taxes for businesses in this sector.

How to use the CT 184 Transportation And Transmission Corporation Form

Using the CT 184 form involves several steps to ensure accurate completion and submission. First, businesses must gather all necessary financial records and documentation related to their gross earnings. Next, the form should be filled out with precise information regarding the business's financial performance during the tax year. It is important to review all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail to the appropriate tax authority, ensuring that all deadlines are met to avoid penalties.

Steps to complete the CT 184 Form

Completing the CT 184 form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather financial records, including income statements and expense reports.

- Fill out the form with accurate information regarding gross earnings and deductions.

- Ensure all required signatures are included to validate the submission.

- Review the completed form for any errors or omissions.

- Submit the form either electronically through a secure platform or by mailing it to the designated address.

Legal use of the CT 184 Form

The CT 184 form is legally binding when completed and submitted in accordance with New York State laws. To ensure its legal validity, businesses must comply with all relevant regulations, including those governing electronic signatures and document submissions. Using a reliable e-signature platform can enhance the legitimacy of the form, as it provides a digital certificate and ensures compliance with laws such as ESIGN and UETA. This legal framework supports the enforceability of electronic documents in the context of tax filings.

Filing Deadlines for the CT 184 Form

Filing deadlines for the CT 184 form are critical to avoid penalties and ensure compliance with tax regulations. Typically, the final return must be filed by the due date specified by the New York State Department of Taxation and Finance, which is often aligned with the end of the fiscal year for the business. Amended returns should be submitted as soon as discrepancies are identified, ideally before the original filing deadline. Staying informed about these deadlines helps businesses maintain good standing with tax authorities.

Required Documents for the CT 184 Form

To complete the CT 184 form accurately, several documents are required. These include:

- Financial statements detailing gross earnings for the reporting period.

- Records of allowable deductions and expenses.

- Previous tax returns, if applicable, for reference.

- Any supporting documentation that substantiates reported figures.

Having these documents readily available streamlines the completion process and ensures accurate reporting.

Quick guide on how to complete ct 184 transportation and transmission corporation new york state department of taxation and finance staple forms here final

Effortlessly Prepare CT 184 Transportation And Transmission Corporation New York State Department Of Taxation And Finance Staple Forms Here Final Ret on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can obtain the appropriate template and safely store it online. airSlate SignNow provides you with all the features you require to create, modify, and eSign your documents quickly without interruption. Manage CT 184 Transportation And Transmission Corporation New York State Department Of Taxation And Finance Staple Forms Here Final Ret on any system with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign CT 184 Transportation And Transmission Corporation New York State Department Of Taxation And Finance Staple Forms Here Final Ret without any hassle

- Locate CT 184 Transportation And Transmission Corporation New York State Department Of Taxation And Finance Staple Forms Here Final Ret and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign CT 184 Transportation And Transmission Corporation New York State Department Of Taxation And Finance Staple Forms Here Final Ret and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 184 transportation and transmission corporation new york state department of taxation and finance staple forms here final

Create this form in 5 minutes!

People also ask

-

What is the CT 184 form in relation to New York State Department Of Taxation And Finance?

The CT 184 form is specifically related to the filing requirements for the Transportation and Transmission Corporation under the New York State Department Of Taxation And Finance. It encompasses the final return, amended return, and franchise tax return as stated in Article 9, Section 184 of the Tax Law, which governs gross earnings tax.

-

How can I obtain the CT 184 Transportation And Transmission Corporation forms?

You can obtain the CT 184 Transportation And Transmission Corporation forms directly from the New York State Department Of Taxation And Finance's official website. The forms are available online for download, ensuring you can easily access the necessary staple forms for your final return and amended return.

-

What are the benefits of using airSlate SignNow for filing CT 184 forms?

Using airSlate SignNow to file your CT 184 forms allows for a streamlined and efficient document signing process. The platform's easy-to-use interface empowers businesses to eSign documents securely, ensuring compliance with the New York State Department Of Taxation And Finance requirements for franchise tax returns on gross earnings.

-

Is there a cost associated with using airSlate SignNow for CT 184 form submissions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there may be a nominal fee for access to premium features, the overall solution provides signNow cost-effectiveness and efficiency when submitting your CT 184 forms.

-

Can airSlate SignNow integrate with other systems for managing CT 184 filings?

Absolutely! airSlate SignNow can integrate seamlessly with various business systems and software. This integration capability makes it easier to manage your CT 184 Transportation And Transmission Corporation documents alongside other essential business processes.

-

What types of returns can be filed using the CT 184 form?

The CT 184 form is used to file various return types, including final returns, amended returns, and franchise tax returns pertaining to gross earnings under Article 9, Section 184. It's crucial to accurately complete these forms to stay compliant with New York State regulations.

-

How can airSlate SignNow ensure the security of my CT 184 document submissions?

airSlate SignNow employs advanced security protocols to protect your documents during transmission and storage. This includes encryption and secure access controls, ensuring your CT 184 Transportation And Transmission Corporation forms remain confidential and secure.

Get more for CT 184 Transportation And Transmission Corporation New York State Department Of Taxation And Finance Staple Forms Here Final Ret

- Nationstates view topic yls thoughts on the als form

- Butcher billy on twitter ampquotbandersnatch blackmirror netflix ampquot form

- California inv dmv form

- Form mv 4st vehicle sales and use tax returnapplication motorvehicleforms penndot driver ampamp vehicle servicesinstructions

- Idaho full registration online form

- Notice of motor vehicle tow form

- Acknowledged before me this date form

- Department of revenue division of motor coloradogov form

Find out other CT 184 Transportation And Transmission Corporation New York State Department Of Taxation And Finance Staple Forms Here Final Ret

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word