Business Taxes Part of the Expense of Making Money 2023

Understanding the Business Taxes Component of Operating Expenses

The Business Taxes component is a crucial element in the overall expense structure of any business. It encompasses various taxes that a business must pay to local, state, and federal authorities. These taxes can include income taxes, franchise taxes, sales taxes, and payroll taxes. Understanding these taxes is essential for accurate financial planning and compliance with tax laws.

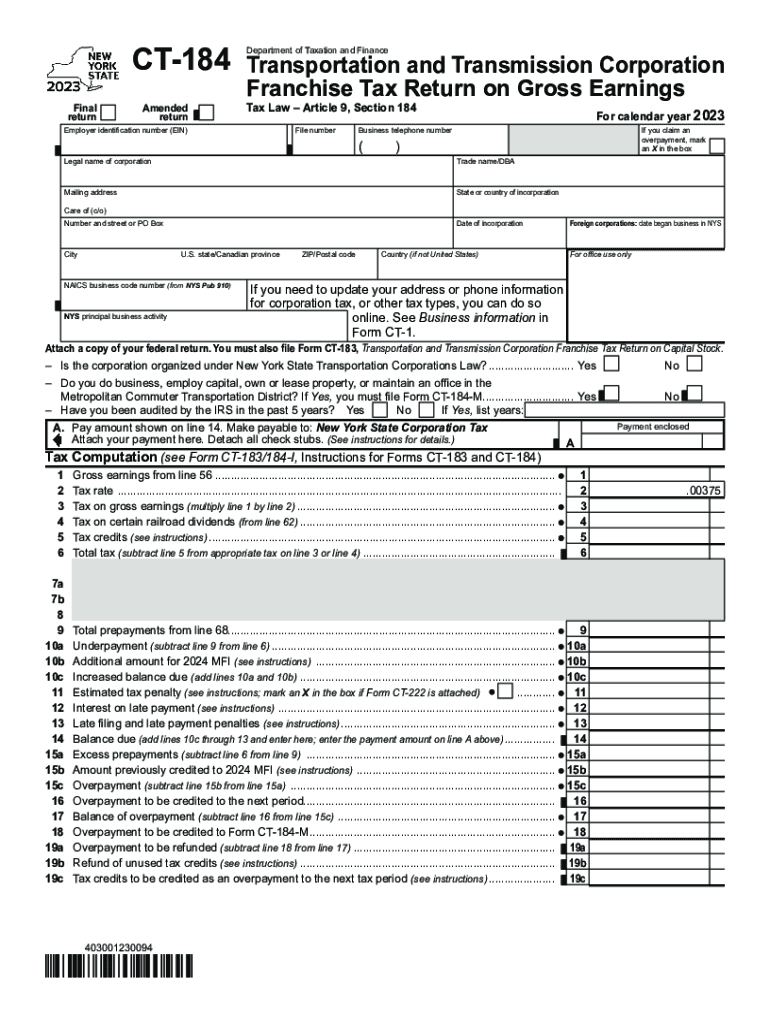

For instance, the NY CT 184 form specifically relates to the franchise tax for corporations operating in New York. This tax is based on the corporation's gross receipts and is an essential consideration for businesses aiming to maintain compliance and avoid penalties.

Steps to Complete the NY CT 184 Form

Completing the NY CT 184 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including gross receipts and any applicable deductions. Next, fill out the form by providing the required details, such as the business name, address, and tax identification number.

After completing the form, review all entries for accuracy. It is advisable to consult with a tax professional if there are any uncertainties. Finally, submit the form by the specified deadline to avoid late fees or penalties.

Required Documents for Filing the NY CT 184

When preparing to file the NY CT 184 form, certain documents are necessary to support the information provided. These may include:

- Financial statements reflecting gross receipts

- Records of any applicable deductions or credits

- Tax identification number

- Previous tax returns, if applicable

Having these documents ready will streamline the filing process and help ensure that all information is accurate and complete.

Filing Deadlines for the NY CT 184

Timely filing of the NY CT 184 form is essential to avoid penalties. The deadline for submission typically aligns with the corporation's fiscal year-end. It is important for businesses to mark their calendars and prepare in advance to meet these deadlines. Late submissions may incur additional fees and interest on unpaid taxes.

Penalties for Non-Compliance with the NY CT 184

Failure to file the NY CT 184 form on time or inaccuracies in the submitted information can lead to significant penalties. These may include:

- Late filing fees

- Interest on unpaid taxes

- Potential audits by tax authorities

Understanding these penalties underscores the importance of timely and accurate filing to maintain compliance and protect the business's financial health.

Legal Use of the NY CT 184 Form

The NY CT 184 form is legally required for corporations operating in New York to report their franchise tax obligations. Proper use of this form ensures compliance with state tax laws and helps businesses avoid legal repercussions. Additionally, accurate reporting can contribute to a positive relationship with tax authorities, fostering trust and reducing the likelihood of audits.

Quick guide on how to complete business taxes part of the expense of making money

Complete Business Taxes Part Of The Expense Of Making Money with ease on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal green alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Business Taxes Part Of The Expense Of Making Money on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign Business Taxes Part Of The Expense Of Making Money effortlessly

- Find Business Taxes Part Of The Expense Of Making Money and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize key sections of the documents or redact sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details carefully and click the Done button to save your modifications.

- Choose your delivery method for the form: via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating new copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Alter and eSign Business Taxes Part Of The Expense Of Making Money to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business taxes part of the expense of making money

Create this form in 5 minutes!

How to create an eSignature for the business taxes part of the expense of making money

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is New York CT184 and how does it relate to airSlate SignNow?

New York CT184 is a tax form that businesses in New York may need to file, particularly regarding e-signatures. airSlate SignNow provides a streamlined approach to completing such documents, allowing users to securely send and eSign the New York CT184 form with ease.

-

What are the pricing plans for airSlate SignNow when handling New York CT184 forms?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for handling New York CT184 forms effectively. You can choose from monthly or annual subscriptions, which provide the flexibility to manage your e-signature needs according to your budget.

-

What features does airSlate SignNow provide for the New York CT184 process?

airSlate SignNow includes features such as customizable templates, advanced security measures, and real-time tracking for documents like the New York CT184. These tools enhance productivity and ensure that all necessary steps are efficiently managed throughout the signing process.

-

How can airSlate SignNow benefit my business when processing New York CT184 forms?

Using airSlate SignNow to process New York CT184 forms can signNowly speed up document turnaround times and reduce manual errors. The platform not only simplifies e-signatures but also provides a secure and compliant way to handle sensitive tax documents.

-

Is it easy to integrate airSlate SignNow with other tools for New York CT184 submissions?

Yes, airSlate SignNow is designed to integrate seamlessly with various business tools, making it easy to handle New York CT184 submissions alongside other workflows. This integration capability helps streamline document management across platforms, enhancing overall efficiency.

-

Are there any legal considerations when using airSlate SignNow for New York CT184?

When using airSlate SignNow for the New York CT184, it's essential to ensure compliance with local laws regarding electronic signatures. Fortunately, airSlate SignNow adheres to legal requirements, providing a compliant solution for e-signing documents in New York.

-

Can I track the status of my New York CT184 forms with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their New York CT184 forms in real time. This feature ensures transparency throughout the signing process, enabling you to keep all stakeholders informed.

Get more for Business Taxes Part Of The Expense Of Making Money

Find out other Business Taxes Part Of The Expense Of Making Money

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online