California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership 2018

What is the California Schedule EO 568 PassThrough Entity Ownership?

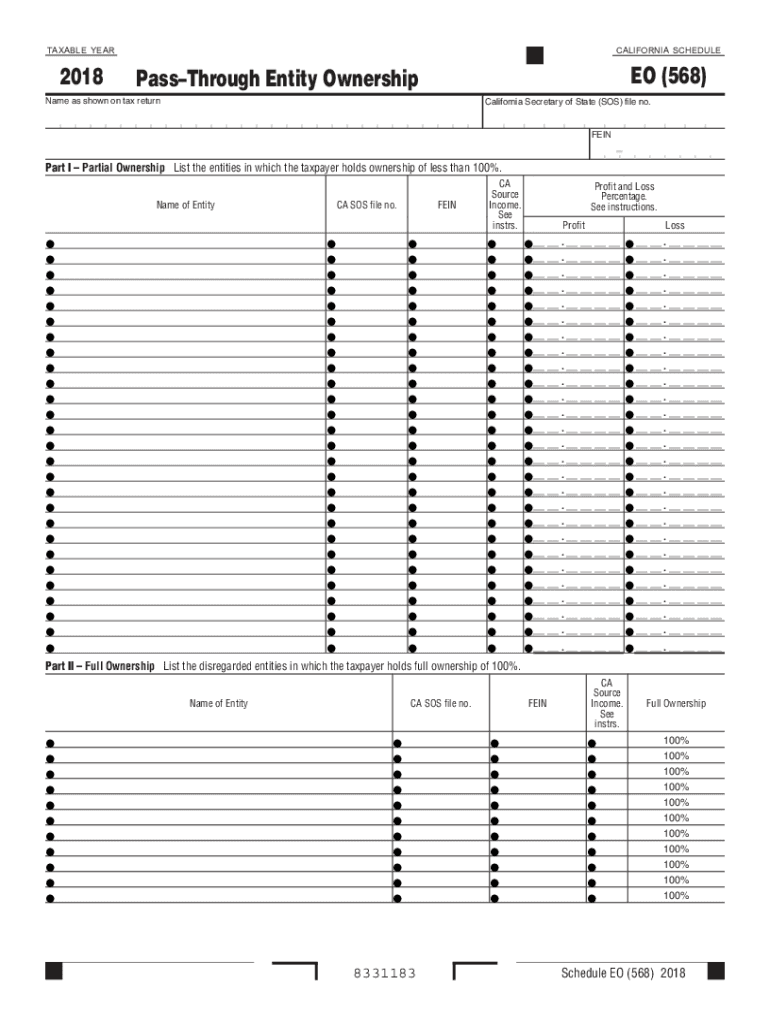

The California Schedule EO 568 is a tax form used specifically for reporting ownership interests in pass-through entities such as partnerships, S corporations, and limited liability companies (LLCs). This form is essential for individuals and entities that receive income from these types of organizations, as it helps to ensure proper tax reporting and compliance with state regulations. By detailing ownership stakes, the Schedule EO 568 allows the California Franchise Tax Board to accurately assess tax liabilities for pass-through entities and their owners.

Steps to complete the California Schedule EO 568 PassThrough Entity Ownership

Completing the California Schedule EO 568 involves several key steps. First, gather all necessary information regarding your ownership in pass-through entities, including the entity's name, identification number, and your percentage of ownership. Next, accurately fill out the form, ensuring that all sections are completed, including any required disclosures about income and deductions associated with your ownership. Lastly, review the form for accuracy before submitting it to the California Franchise Tax Board, either electronically or via mail.

Legal use of the California Schedule EO 568 PassThrough Entity Ownership

The California Schedule EO 568 serves a crucial legal function in tax compliance. It is legally binding and must be filled out accurately to avoid penalties. The information provided on this form is used by the California Franchise Tax Board to determine tax obligations for individuals and entities involved in pass-through ownership. Failing to file or inaccurately reporting ownership interests can lead to legal consequences, including fines and increased scrutiny from tax authorities.

Required Documents for the California Schedule EO 568 PassThrough Entity Ownership

To complete the California Schedule EO 568, you will need several documents. These include your personal identification information, details about the pass-through entities in which you have ownership, and any relevant financial documents that outline income and deductions related to your ownership. Having these documents ready will streamline the process and help ensure that the information reported is accurate and complete.

Filing Deadlines / Important Dates for the California Schedule EO 568 PassThrough Entity Ownership

It is important to be aware of the filing deadlines associated with the California Schedule EO 568. Typically, the form must be submitted by the due date of your individual income tax return, which is usually April 15 for most taxpayers. However, if you are filing for an extension, ensure that the Schedule EO 568 is submitted by the extended deadline to avoid penalties. Keeping track of these dates is crucial for maintaining compliance.

Examples of using the California Schedule EO 568 PassThrough Entity Ownership

Individuals and businesses use the California Schedule EO 568 in various scenarios. For example, a partner in a limited partnership must report their ownership interest and share of income on this form. Similarly, shareholders of an S corporation need to disclose their ownership stakes to ensure proper tax reporting. Each of these examples highlights the importance of the Schedule EO 568 in facilitating accurate tax reporting for diverse ownership structures.

Quick guide on how to complete 2018 california schedule eo 568 passthrough entity ownership 2018 california schedule eo 568 passthrough entity ownership

Easily Prepare California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly, without any hold-ups. Manage California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The optimal method to modify and electronically sign California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership effortlessly

- Locate California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your method of sharing your form, whether through email, text message (SMS), an invite link, or download it to your computer.

Put an end to lost or misplaced files, annoying form navigation, or errors that warrant reprinting new document copies. airSlate SignNow takes care of your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 california schedule eo 568 passthrough entity ownership 2018 california schedule eo 568 passthrough entity ownership

Create this form in 5 minutes!

People also ask

-

What is California Schedule EO 568 PassThrough Entity Ownership, and why is it important?

California Schedule EO 568 PassThrough Entity Ownership is a tax form that reports the ownership structure of pass-through entities in California. It is important for ensuring compliance with state tax regulations and providing clarity on how income and losses are distributed among partners, shareholders or members.

-

How can airSlate SignNow help with California Schedule EO 568?

airSlate SignNow simplifies the process of completing and submitting California Schedule EO 568 by allowing users to eSign and send documents securely. Our platform is designed to streamline workflows, making it easier for businesses to manage their pass-through entity ownership and compliance with state regulations.

-

Is airSlate SignNow cost-effective for managing California Schedule EO 568?

Yes, airSlate SignNow offers a cost-effective solution for managing California Schedule EO 568 PassThrough Entity Ownership. With competitive pricing plans, businesses can access powerful eSigning tools that save time and reduce paper waste, making it a smart investment for compliance needs.

-

What features does airSlate SignNow offer for California Schedule EO 568?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for California Schedule EO 568 PassThrough Entity Ownership. These features ensure that your documents are prepared accurately and efficiently, enhancing overall productivity.

-

Can airSlate SignNow integrate with other accounting software for managing California Schedule EO 568?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software and tools that help manage California Schedule EO 568 and other financial documents. This integration ensures that your financial data synchronizes smoothly, reducing errors and improving workflow.

-

What are the benefits of using airSlate SignNow for California Schedule EO 568?

Using airSlate SignNow for California Schedule EO 568 PassThrough Entity Ownership means enhanced efficiency, better compliance, and improved document security. Our platform empowers businesses to reduce turnaround times and fully manage their signing and document processes in one place.

-

How secure is airSlate SignNow when handling California Schedule EO 568?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards to protect your California Schedule EO 568 documents. Our platform ensures that all sensitive information remains confidential and secure throughout the signing process.

Get more for California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership

- Grade 7 english textbook pdf download form

- Solution of fundamentals of electrical drives by gk dubey pdf form

- Bill nye light and color worksheet form

- Jsc 2a application form

- Oklahoma paper tag template form

- Undertaking application for migration certificate form

- Gde 0001 form pdf

- Jv 101a additional children attachment juvenile dependency petition form

Find out other California Schedule EO 568 PassThrough Entity Ownership , California Schedule EO 568, PassThrough Entity Ownership

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple