Chapter 2 Persons Subject to Tax and ExemptionsTN Gov 2022

Understanding the CA EO 568 Form

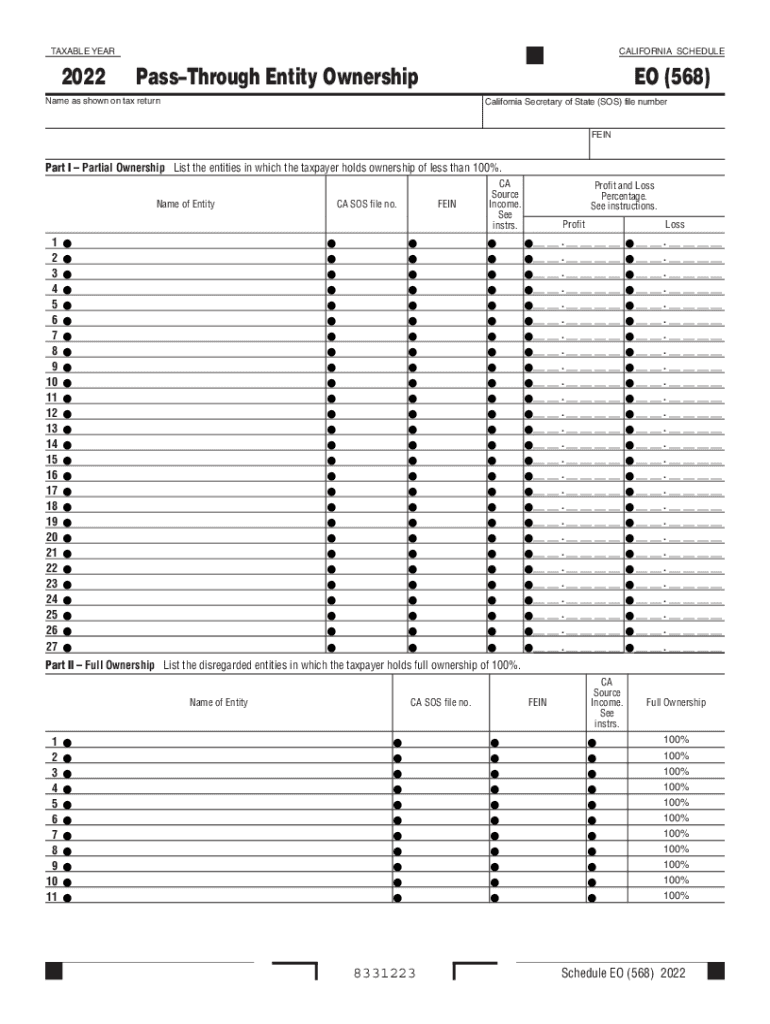

The CA EO 568 form, also known as the California Ownership Schedule, is crucial for reporting the ownership interests of pass-through entities in California. This form is specifically designed for entities such as partnerships and limited liability companies (LLCs) to disclose their ownership structure. It ensures compliance with California tax laws and helps in the accurate assessment of tax obligations. Understanding the requirements and implications of this form is essential for both individual owners and the entity as a whole.

Steps to Complete the CA EO 568 Form

Filling out the CA EO 568 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding ownership interests, including names, addresses, and taxpayer identification numbers of all owners. Next, accurately report the percentage of ownership for each individual or entity. It is vital to double-check all entries for accuracy, as errors can lead to compliance issues. Finally, submit the completed form along with any required tax documents to the California Franchise Tax Board by the specified deadline.

Required Documents for the CA EO 568 Form

To successfully complete the CA EO 568 form, certain documents are essential. These include the entity's operating agreement, which outlines ownership percentages and roles, as well as any previous tax returns that may provide relevant information. Additionally, owners should have their individual tax identification numbers and any supporting documentation that verifies their ownership interests. Having these documents ready will streamline the completion process and help ensure compliance with tax regulations.

Filing Deadlines for the CA EO 568 Form

Timely submission of the CA EO 568 form is critical to avoid penalties. The form is typically due on the 15th day of the fourth month following the close of the entity's taxable year. For most entities operating on a calendar year basis, this means the deadline is April 15. It is advisable to mark this date on your calendar and prepare the form in advance to ensure all information is accurate and complete by the due date.

Legal Use of the CA EO 568 Form

The CA EO 568 form serves a legal purpose in the context of California tax law. It is used to report ownership interests in pass-through entities, which are subject to specific tax regulations. Ensuring that this form is filled out correctly not only aids in compliance but also protects the rights and interests of the owners involved. Misreporting or failing to file the form can lead to legal repercussions, including fines and penalties from the California Franchise Tax Board.

Common Scenarios for Filing the CA EO 568 Form

Various scenarios may necessitate the filing of the CA EO 568 form. For instance, newly formed partnerships or LLCs must file the form to report their initial ownership structure. Additionally, changes in ownership, such as the sale or transfer of interests, require an updated filing to reflect the new ownership percentages. Understanding these scenarios helps ensure that entities remain compliant with California tax laws and avoid potential issues.

Quick guide on how to complete chapter 2 persons subject to tax and exemptionstngov

Complete Chapter 2 Persons Subject To Tax And ExemptionsTN gov effortlessly on any device

Online document management has grown increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents promptly without any delays. Handle Chapter 2 Persons Subject To Tax And ExemptionsTN gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Chapter 2 Persons Subject To Tax And ExemptionsTN gov with ease

- Obtain Chapter 2 Persons Subject To Tax And ExemptionsTN gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Chapter 2 Persons Subject To Tax And ExemptionsTN gov and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct chapter 2 persons subject to tax and exemptionstngov

Create this form in 5 minutes!

How to create an eSignature for the chapter 2 persons subject to tax and exemptionstngov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA EO 568 and how does it relate to airSlate SignNow?

CA EO 568 refers to a specific electronic signature regulation in California that supports the validity of eSignatures. airSlate SignNow complies with CA EO 568, ensuring that your digitally signed documents are legally binding. With our platform, businesses can easily navigate the requirements set forth in CA EO 568.

-

How much does airSlate SignNow cost in relation to CA EO 568 compliance?

Pricing for airSlate SignNow is competitive and designed to meet the needs of businesses requiring CA EO 568 compliance. Our plans start at an affordable monthly rate that includes all necessary features for eSigning in accordance with CA EO 568. Additionally, the cost-effectiveness of our solution helps businesses save on operational expenses.

-

What features does airSlate SignNow offer for CA EO 568 compliance?

airSlate SignNow provides a range of features that support CA EO 568 compliance, including audit trails, secure storage, and customizable signing workflows. These features ensure that your documents remain legally compliant while enhancing the signing experience. With our platform, users can confidently handle their eSignatures and document management.

-

How can airSlate SignNow improve my business's efficiency while complying with CA EO 568?

By using airSlate SignNow, businesses can signNowly streamline their document signing processes, hence enhancing overall efficiency. The platform allows for quick document preparation, easy tracking of signatures, and automated reminders, all while ensuring compliance with CA EO 568. This means your team can focus on core activities instead of getting bogged down by paperwork.

-

Does airSlate SignNow integrate with other applications while adhering to CA EO 568?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms, enabling businesses to maintain compliance with CA EO 568. Whether it's CRM systems, document management tools, or cloud storage services, our solution can easily connect with your existing workflow. This flexibility allows you to maximize productivity and maintain compliance.

-

What are the benefits of using airSlate SignNow for CA EO 568 eSignatures?

Using airSlate SignNow for CA EO 568 eSignatures brings numerous benefits, including enhanced security, improved turnaround times, and cost-effectiveness. Our platform ensures that all eSignatures are compliant with California regulations, giving you peace of mind. As a result, businesses can build trust with clients while expediting their document processes.

-

Is airSlate SignNow suitable for small businesses needing CA EO 568 compliance?

Absolutely! airSlate SignNow is an excellent solution for small businesses looking for CA EO 568 compliance. The service is designed to be user-friendly and offers pricing plans suited for businesses of all sizes, providing the necessary tools to manage eSignatures effectively. Small businesses can leverage our platform to remain compliant without excessive investment.

Get more for Chapter 2 Persons Subject To Tax And ExemptionsTN gov

- Employment hiring process package south dakota form

- Revocation of anatomical gift donation south dakota form

- Employment or job termination package south dakota form

- Newly widowed individuals package south dakota form

- Employment interview package south dakota form

- Employment employee personnel file package south dakota form

- Assignment of mortgage package south dakota form

- Assignment of lease package south dakota form

Find out other Chapter 2 Persons Subject To Tax And ExemptionsTN gov

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy