Form 568 EO Pass through Entity Ownership Ftb Ca 2016

What is the Form 568 EO Pass Through Entity Ownership Ftb Ca

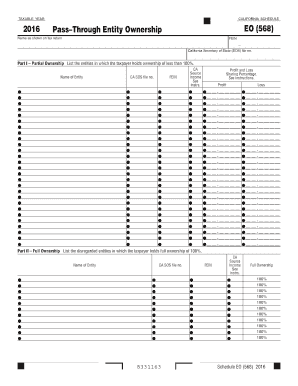

The Form 568 EO Pass Through Entity Ownership is a tax document used in California for reporting the income and ownership of pass-through entities, such as partnerships and limited liability companies (LLCs). This form is essential for ensuring that the income generated by these entities is accurately reported to the California Franchise Tax Board (FTB). The form captures vital information regarding the entity's structure, ownership percentages, and the income distributed to each owner, which is crucial for tax compliance in the state.

Steps to complete the Form 568 EO Pass Through Entity Ownership Ftb Ca

Completing the Form 568 EO requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the entity, including its name, address, and federal employer identification number (EIN).

- Identify all owners of the entity and their respective ownership percentages.

- Report the income allocated to each owner based on their ownership share.

- Ensure that all required signatures are included to validate the form.

- Review the completed form for accuracy before submission.

Legal use of the Form 568 EO Pass Through Entity Ownership Ftb Ca

The legal use of the Form 568 EO is defined by California tax law. This form must be filed annually by pass-through entities to report income and ownership details to the FTB. Compliance with the filing requirements is crucial, as failure to submit the form can result in penalties. The information provided on the form is used to determine each owner's tax liability, making accurate reporting essential for legal compliance.

Filing Deadlines / Important Dates

Timely filing of the Form 568 EO is critical to avoid penalties. The deadline for submitting the form typically aligns with the due date for the entity's tax return. Generally, this is the 15th day of the third month after the end of the tax year. For entities operating on a calendar year, this means the form is due by March 15. Extensions may be available, but it is important to check the specific guidelines provided by the FTB.

Key elements of the Form 568 EO Pass Through Entity Ownership Ftb Ca

The Form 568 EO includes several key elements that must be accurately completed:

- Entity Information: Name, address, and EIN of the pass-through entity.

- Owner Information: Names, addresses, and ownership percentages of all owners.

- Income Reporting: Allocation of income to each owner based on their ownership percentage.

- Signatures: Required signatures from authorized representatives of the entity.

Form Submission Methods (Online / Mail / In-Person)

The Form 568 EO can be submitted through various methods. Entities have the option to file online through the California Franchise Tax Board's website, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address provided by the FTB. For those who prefer in-person submission, visiting a local FTB office may be an option, although it is advisable to check ahead for any specific requirements or hours of operation.

Quick guide on how to complete 2016 form 568 eo pass through entity ownership ftb ca

Effortlessly prepare Form 568 EO Pass Through Entity Ownership Ftb Ca on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents swiftly and without delays. Handle Form 568 EO Pass Through Entity Ownership Ftb Ca on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Form 568 EO Pass Through Entity Ownership Ftb Ca with ease

- Locate Form 568 EO Pass Through Entity Ownership Ftb Ca and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a standard handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 568 EO Pass Through Entity Ownership Ftb Ca and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 568 eo pass through entity ownership ftb ca

Create this form in 5 minutes!

People also ask

-

What is Form 568 EO Pass Through Entity Ownership Ftb Ca?

Form 568 EO Pass Through Entity Ownership Ftb Ca is a tax form required by the California Franchise Tax Board for entities that pass income through to their owners. Understanding this form is essential for businesses operating in California to ensure compliance and avoid penalties. Using airSlate SignNow can streamline the process of signing and submitting this important document.

-

How can airSlate SignNow assist with Form 568 EO Pass Through Entity Ownership Ftb Ca?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing documents like Form 568 EO Pass Through Entity Ownership Ftb Ca. By digitizing the process, businesses can save time, reduce errors, and enhance their efficiency when handling tax forms. Our solution ensures secure storage and easy retrieval of signed documents.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs, ranging from individual users to larger enterprises. Each plan includes essential features that support the signing and management of documents, including Form 568 EO Pass Through Entity Ownership Ftb Ca. You can easily choose a plan based on your volume of transactions and required features.

-

What features does airSlate SignNow provide for managing tax documents?

With airSlate SignNow, users benefit from features such as document templates, bulk sending, and custom workflows that help manage tax documents like Form 568 EO Pass Through Entity Ownership Ftb Ca efficiently. The platform also includes advanced tracking capabilities so you can monitor the status of your documents in real-time. These features simplify tax season and enhance organizational efficiency.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures in the U.S., including eSignature laws such as ESIGN and UETA. This compliance ensures that documents such as Form 568 EO Pass Through Entity Ownership Ftb Ca are legally valid and enforceable. This gives businesses confidence while handling sensitive tax documents.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business applications, such as CRMs and document management systems. This means you can efficiently manage your workflows related to Form 568 EO Pass Through Entity Ownership Ftb Ca alongside your existing tools. Integration helps maintain a smooth operation without disrupting your current processes.

-

What benefits does airSlate SignNow offer for small businesses?

For small businesses, airSlate SignNow provides a cost-effective solution that simplifies document management, including forms like Form 568 EO Pass Through Entity Ownership Ftb Ca. The user-friendly interface allows for quick onboarding, maximizing efficiency without heavy training costs. Additionally, the savings in time and resources make it an invaluable tool for managing growing business needs.

Get more for Form 568 EO Pass Through Entity Ownership Ftb Ca

Find out other Form 568 EO Pass Through Entity Ownership Ftb Ca

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple