06 710 End User Agricultural Signed Statement for Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement Form

Understanding the 06 710 End User Agricultural Signed Statement

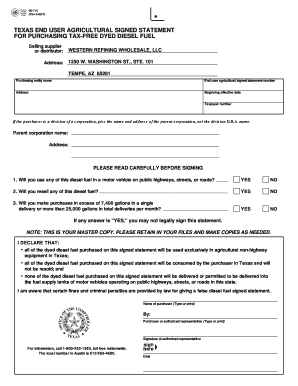

The 06 710 End User Agricultural Signed Statement is a crucial document for individuals or businesses purchasing tax-dyed diesel fuel in the United States. This form certifies that the fuel will be used for agricultural purposes, allowing buyers to avoid certain taxes. By accurately completing this statement, purchasers can ensure compliance with state and federal regulations, which helps prevent potential legal issues related to tax evasion.

Steps to Complete the 06 710 End User Agricultural Signed Statement

Completing the 06 710 End User Agricultural Signed Statement involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Clearly state the intended use of the diesel fuel, confirming it is for agricultural purposes.

- Provide details about the supplier from whom you are purchasing the fuel.

- Sign and date the statement to validate your claims.

Ensuring that all information is accurate and complete is essential for the statement to be accepted by suppliers and regulatory bodies.

Legal Use of the 06 710 End User Agricultural Signed Statement

The legal use of the 06 710 End User Agricultural Signed Statement is governed by both state and federal laws. This document serves as a declaration that the user is entitled to purchase tax-exempt fuel for agricultural use. Misuse of the statement, such as using it for non-qualifying purposes, can lead to severe penalties, including fines and back taxes. It is important to understand the legal implications of this statement and ensure compliance with all relevant regulations.

Key Elements of the 06 710 End User Agricultural Signed Statement

Several key elements must be included in the 06 710 End User Agricultural Signed Statement:

- Purchaser Information: Full name, address, and tax identification number.

- Supplier Information: Name and address of the fuel supplier.

- Intended Use: A clear statement confirming that the fuel will be used for agricultural purposes.

- Signature: The signature of the purchaser or an authorized representative, along with the date.

Including all these elements is vital for the statement's validity and acceptance.

How to Obtain the 06 710 End User Agricultural Signed Statement

Obtaining the 06 710 End User Agricultural Signed Statement is straightforward. It can typically be acquired from state tax authorities or agricultural departments. Many states provide the form online, allowing users to download and print it for completion. Additionally, consulting with a tax professional can provide guidance on obtaining the form and ensuring it is filled out correctly.

IRS Guidelines for the 06 710 End User Agricultural Signed Statement

The IRS provides specific guidelines regarding the use of the 06 710 End User Agricultural Signed Statement. It is essential for users to familiarize themselves with these guidelines to ensure compliance. The IRS stipulates that the statement must be completed accurately and retained for record-keeping purposes. Additionally, users should be aware of any updates or changes in IRS regulations that may affect the use of this form.

Quick guide on how to complete 06 710 end user agricultural signed statement for purchasing tax free dyed diesel fuel 06 710 end user agricultural signed

Effortlessly Prepare 06 710 End User Agricultural Signed Statement For Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling easy access to the necessary forms and secure online storage. airSlate SignNow equips you with all the features you require to create, modify, and electronically sign your documents quickly without any delays. Manage 06 710 End User Agricultural Signed Statement For Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign 06 710 End User Agricultural Signed Statement For Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement with Ease

- Find 06 710 End User Agricultural Signed Statement For Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to finalize your changes.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to missing documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 06 710 End User Agricultural Signed Statement For Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an end user statement template?

An end user statement template is a standardized document used to summarize and convey essential information regarding a user's account or services. This template can be customized to fit the specific needs of your business, ensuring clear communication and compliance with regulations.

-

How can airSlate SignNow help me with my end user statement template?

airSlate SignNow provides an intuitive platform to easily create, customize, and distribute your end user statement template. With our eSignature capabilities, you can streamline the signing process, making it simple for users to authorize documents electronically.

-

Is there a cost associated with using the end user statement template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include features for creating and managing your end user statement template. Our plans are designed to be cost-effective and scalable, catering to businesses of all sizes.

-

What features does airSlate SignNow offer for end user statement templates?

Our platform offers several features for end user statement templates, including customizable fields, automated workflows, and real-time tracking. You can also access templates from anywhere and on any device, ensuring flexibility and efficiency in document management.

-

Can I integrate airSlate SignNow with other software for my end user statement template?

Absolutely! airSlate SignNow offers a range of integrations with popular software applications, which can enhance your end user statement template process. These integrations allow for seamless data transfer and improved workflow efficiency across platforms.

-

What are the benefits of using an end user statement template?

Using an end user statement template can signNowly reduce administrative workload and ensure consistency in communication. It also enhances compliance and record-keeping, providing a clear summary of user activities or transactions for accountability.

-

Can I customize my end user statement template within airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize your end user statement template to meet your specific business requirements. You can modify the content, format, and design to ensure it aligns with your branding and information needs.

Get more for 06 710 End User Agricultural Signed Statement For Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement

Find out other 06 710 End User Agricultural Signed Statement For Purchasing Tax Dyed Diesel Fuel 06 710 End User Agricultural Signed Statement

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter