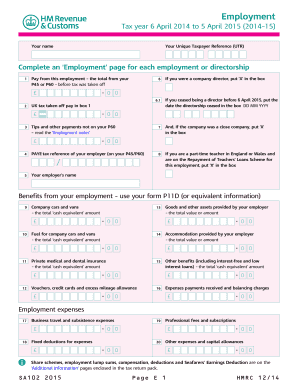

Sa102 Form 2015

What is the SA102 Form

The SA102 form is a supplementary document used for reporting income from self-employment or other sources on an individual’s tax return in the United States. It is primarily utilized by self-employed individuals who need to declare their earnings and expenses to the Internal Revenue Service (IRS). This form allows taxpayers to provide detailed information about their business income and associated costs, ensuring accurate tax calculations.

How to Use the SA102 Form

Using the SA102 form involves several steps to ensure compliance with IRS regulations. Taxpayers should first gather all relevant financial documents, including records of income and expenses. Once the necessary information is compiled, individuals can fill out the SA102 form, detailing their income sources and any allowable deductions. It is essential to review the completed form for accuracy before submission, as errors can lead to penalties or delays in processing.

Steps to Complete the SA102 Form

Completing the SA102 form requires careful attention to detail. Here are the key steps:

- Gather Information: Collect all income and expense records related to your self-employment.

- Fill Out the Form: Enter your personal information, income details, and any applicable deductions.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the Form: Follow the appropriate submission method, whether electronically or via mail.

Legal Use of the SA102 Form

The SA102 form must be completed accurately to be considered legally valid. It is essential to comply with IRS guidelines regarding income reporting and deductions. Failure to provide truthful information can result in penalties, including fines or audits. Utilizing a reliable electronic signature solution can enhance the legal standing of the submitted document, ensuring it meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the SA102 form are crucial for compliance. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which can provide additional time for filing.

Examples of Using the SA102 Form

Examples of scenarios where the SA102 form is applicable include self-employed individuals such as freelancers, consultants, or small business owners. For instance, a graphic designer who operates as a sole proprietor would use the SA102 form to report income earned from various clients, along with any business-related expenses incurred throughout the year. This ensures that the designer accurately reflects their financial situation to the IRS.

Quick guide on how to complete sa102 form

Easily Prepare Sa102 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Sa102 Form on any device using the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

The Simplest Method to Modify and Electronically Sign Sa102 Form

- Find Sa102 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and press the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, monotonous form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sa102 Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa102 form

Create this form in 5 minutes!

People also ask

-

What is the sa102 2015 form and why is it important?

The sa102 2015 form is a key document for self-assessment tax purposes in the UK. It allows individuals to declare additional income that isn't covered by regular tax codes, such as freelance earnings. Accurately completing the sa102 2015 ensures compliance with tax regulations and can help avoid penalties.

-

How can airSlate SignNow help with the sa102 2015 process?

airSlate SignNow simplifies the process of preparing, signing, and sending the sa102 2015 form. With its intuitive interface, users can quickly fill out the required information and easily eSign the document. This streamlining reduces the time spent on paperwork, allowing users to focus on their financial management.

-

What are the primary features of airSlate SignNow for handling documents like the sa102 2015?

airSlate SignNow offers essential features like document templates, eSignature capabilities, and secure cloud storage. These tools ensure that your sa102 2015 form is not only filled out accurately but also securely stored and easily accessible. Integration with other applications also enhances workflow efficiency.

-

Is airSlate SignNow cost-effective for managing forms like sa102 2015?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing various forms, including the sa102 2015. With competitive pricing tiers and a range of features included, it provides excellent value for the streamlined document management process. This affordability makes it a popular choice among small and medium-sized businesses.

-

Can airSlate SignNow integrate with other platforms for sa102 2015 forms?

Absolutely! airSlate SignNow offers integrations with numerous third-party platforms, from CRM systems to accounting software. This capability enhances productivity by allowing users to manage their sa102 2015 forms and other documents within their existing workflows, without much hassle.

-

What are the benefits of using airSlate SignNow over traditional methods for sa102 2015?

Using airSlate SignNow for your sa102 2015 forms provides several benefits over traditional paper methods. It ensures faster document turnaround through eSignatures, reduces the risk of lost paperwork, and enhances document security with encryption. Additionally, it contributes to a more eco-friendly approach by minimizing paper use.

-

How secure is airSlate SignNow when dealing with documents like sa102 2015?

airSlate SignNow prioritizes security, employing industry-standard encryption to protect your documents, including the sa102 2015 forms. Features such as audit trails and role-based access add layers of security, ensuring only authorized personnel can view or modify sensitive information. This commitment to security enhances user confidence.

Get more for Sa102 Form

- Form ss 5 10 2021 uf

- Family doctor services registration nhs form

- Forms for the affordable child care benefit province of

- Ci windcrest tx pdffiller on line pdf form filler

- Direct credit authorisation form only original and completed

- Wwwjudctgov webforms formsexemption claim form connecticut judicial branch

- 2022 students of the year application packet pdf louisiana form

- Imm 5444e form 2020 2021

Find out other Sa102 Form

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself