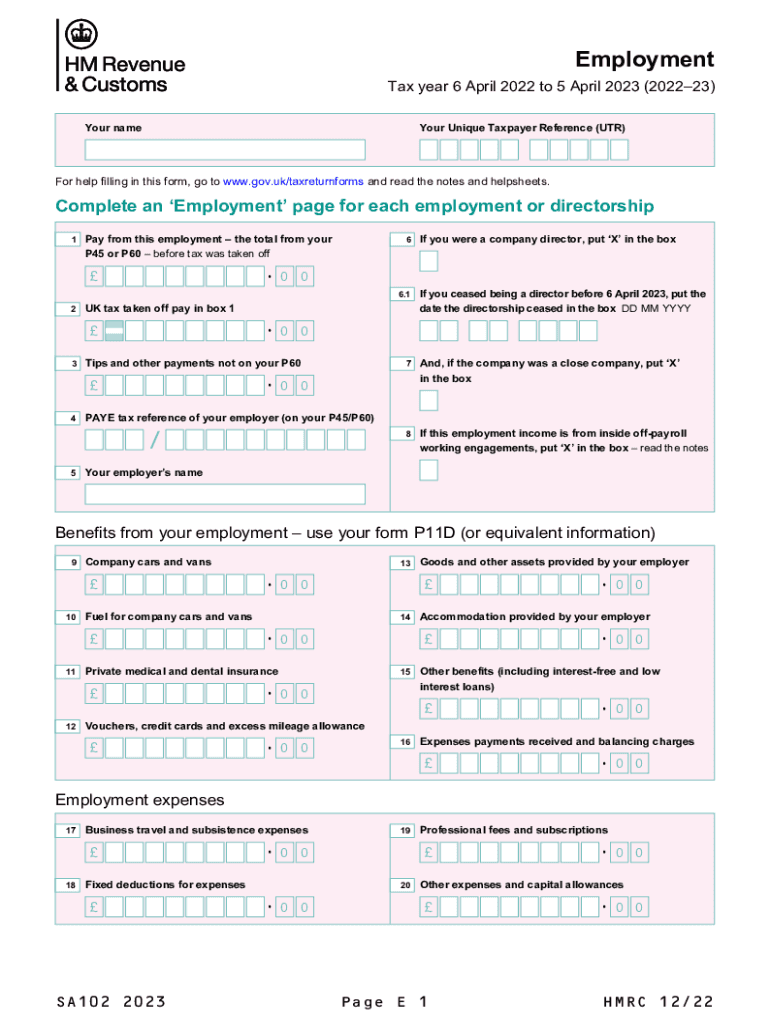

Employment Use the SA102 Supplementary Pages to Record Your Employment Details When Filing a Tax Return for the Tax Year Ended 5 2023

Understanding the Employment Form

The 2016 HMRC employment form, specifically the SA102 supplementary pages, is crucial for individuals filing their tax returns in the United Kingdom. It allows taxpayers to record their employment details accurately for the tax year ending on April 5. This form is essential for ensuring that all income from employment is reported correctly, which is vital for calculating tax liabilities. Understanding how to fill out this form properly can help prevent issues with the tax authorities.

Steps to Complete the Employment Form

Completing the 2016 HMRC SA102 form involves several important steps:

- Gather necessary information, including your employer's details, your job title, and your pay information.

- Fill in personal details, ensuring accuracy in your name and National Insurance number.

- Report your total earnings from employment, including any benefits or bonuses received during the tax year.

- Complete sections related to tax deducted at source, ensuring you include any PAYE deductions.

- Review the completed form for accuracy before submission.

Required Documents for Submission

To complete the 2016 HMRC employment form, you will need several documents:

- Your P60 form, which summarizes your total pay and tax deductions for the year.

- P45 forms if you changed jobs during the tax year.

- Any payslips that provide additional pay information or bonuses.

- Details of any other income that may affect your tax calculations.

Form Submission Methods

The 2016 HMRC SA102 form can be submitted through various methods:

- Online through the HMRC website, which is often the quickest and most efficient method.

- By mail, where you print and send the completed form to HMRC.

- In-person at local HMRC offices, although this option may be less common.

Legal Use of the Employment Form

The 2016 HMRC employment form is legally binding when filled out correctly and submitted on time. It is essential for compliance with tax regulations. Failure to submit accurate information can lead to penalties or audits. Therefore, understanding the legal implications of this form is crucial for taxpayers to ensure they meet their obligations.

Filing Deadlines and Important Dates

Timely submission of the 2016 HMRC SA102 form is critical. The deadline for filing your tax return, including the SA102 supplementary pages, is typically January 31 of the following year. Missing this deadline can result in automatic penalties and interest on any unpaid taxes. Keeping track of these dates is essential for maintaining good standing with tax authorities.

Quick guide on how to complete employment use the sa102 supplementary pages to record your employment details when filing a tax return for the tax year ended

Complete Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 effortlessly on any device

Digital document handling has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents promptly without delays. Manage Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 with ease

- Find Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that task.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 and guarantee outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employment use the sa102 supplementary pages to record your employment details when filing a tax return for the tax year ended

Create this form in 5 minutes!

How to create an eSignature for the employment use the sa102 supplementary pages to record your employment details when filing a tax return for the tax year ended

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 2016 HMRC employment documents?

The 2016 HMRC employment documents are critical for ensuring compliance with tax regulations in the UK. These documents include important information about employee earnings and tax contributions, which are essential for tax filings and employer records.

-

How does airSlate SignNow simplify the handling of 2016 HMRC employment documents?

airSlate SignNow streamlines the process of managing 2016 HMRC employment documents by allowing users to create, edit, and eSign documents quickly and efficiently. Its user-friendly interface ensures that compliance with HMRC requirements is maintained throughout the document lifecycle.

-

What are the pricing options for using airSlate SignNow for 2016 HMRC employment documents?

airSlate SignNow offers flexible pricing plans based on your business needs, ensuring you can manage your 2016 HMRC employment documents cost-effectively. You can choose from monthly or annual subscriptions, with the option to scale up as your document management needs grow.

-

Can I integrate airSlate SignNow with other software for 2016 HMRC employment management?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your 2016 HMRC employment documents alongside your existing systems. This integration capability enhances workflow efficiency and ensures all your data is synchronized across platforms.

-

What are the key features of airSlate SignNow for managing 2016 HMRC employment documents?

Key features of airSlate SignNow include advanced eSignature capabilities, document templates, and secure storage solutions tailored for 2016 HMRC employment documents. These features help ensure that your documents are executed with legal validity and stored securely.

-

Is airSlate SignNow secure for storing 2016 HMRC employment documents?

Absolutely! airSlate SignNow prioritizes the security of your documents. With bank-level encryption and robust security protocols, your 2016 HMRC employment documents are protected from unauthorized access and bsignNowes.

-

How does airSlate SignNow help with compliance regarding 2016 HMRC employment?

By using airSlate SignNow, you can ensure that your 2016 HMRC employment documents meet all regulatory requirements. The platform keeps you updated with the latest legal standards and provides templates designed to meet HMRC guidelines.

Get more for Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

Find out other Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online