Employment Use the SA102 Supplementary Pages to Record Your Employment Details When Filing a Tax Return for the Tax Year Ended 5 2016

Understanding the 2016 SA102 Employment Form

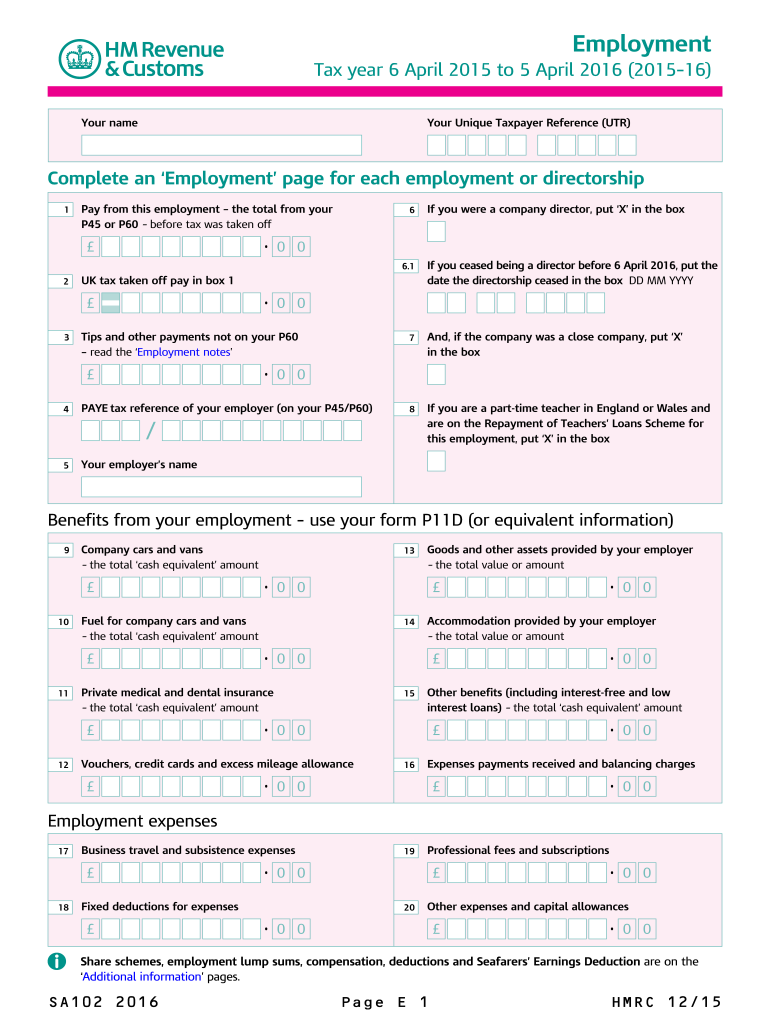

The 2016 SA102 is a supplementary form used in the United Kingdom to report employment income when filing a tax return. This form is essential for individuals who have received income from employment during the tax year ending on April 5. It allows taxpayers to provide detailed information about their earnings, tax deducted, and any benefits received from their employer. Completing the SA102 accurately is crucial for ensuring that you pay the correct amount of tax and receive any applicable tax refunds.

Steps to Complete the 2016 SA102 Employment Form

Filling out the 2016 SA102 involves several steps to ensure accuracy and compliance with tax regulations. Begin by gathering all necessary documents, including your P60 or P45, which outline your earnings and tax deductions. Next, follow these steps:

- Enter your personal details, including your name, National Insurance number, and address.

- Record your employment income as shown on your P60 or P45.

- Include any taxable benefits provided by your employer, such as company cars or health insurance.

- Detail any tax deducted from your income, ensuring this matches your P60 or P45.

- Review all entries for accuracy before submission.

Legal Use of the 2016 SA102 Employment Form

The 2016 SA102 is legally binding when completed and submitted correctly. It is essential to adhere to the guidelines set by HM Revenue and Customs (HMRC) to ensure compliance with UK tax laws. The information provided on this form is used to calculate your tax liability and can be subject to audit. Therefore, it is important to provide truthful and accurate information to avoid potential penalties or legal repercussions.

Required Documents for the 2016 SA102 Employment Form

To complete the 2016 SA102, you will need several key documents:

- P60 or P45: These forms summarize your earnings and tax deductions for the year.

- Details of any additional income: If you have other sources of income, such as rental income or dividends, gather those records.

- Information on any taxable benefits: This includes benefits provided by your employer that may affect your tax calculation.

Filing Deadlines for the 2016 SA102 Employment Form

It is important to be aware of the filing deadlines associated with the 2016 SA102. The completed form must be submitted to HMRC by January 31 of the following tax year if filing online. For paper submissions, the deadline is October 31. Missing these deadlines can result in penalties, so timely submission is crucial.

Form Submission Methods for the 2016 SA102 Employment Form

The 2016 SA102 can be submitted through various methods to accommodate different preferences:

- Online: The most efficient method is to file through HMRC's online services, which allows for instant confirmation of receipt.

- By Mail: You can print the completed form and send it to HMRC via postal service.

- In-Person: Some individuals may choose to deliver their forms directly to HMRC offices, although this is less common.

Quick guide on how to complete employment 2016 use the sa1022016 supplementary pages to record your employment details when filing a tax return for the tax

Effortlessly Prepare Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 on Any Device

The management of documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

Easily Modify and Electronically Sign Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 Without Difficulty

- Obtain Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 and click Get Form to initiate.

- Utilize the provided tools to fill in your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employment 2016 use the sa1022016 supplementary pages to record your employment details when filing a tax return for the tax

Create this form in 5 minutes!

How to create an eSignature for the employment 2016 use the sa1022016 supplementary pages to record your employment details when filing a tax return for the tax

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2016 SA102 form and why is it important?

The 2016 SA102 form is used by self-employed individuals in the UK to report income from their business. It's crucial for accurately declaring earnings to HMRC and ensuring compliance with tax regulations. Completing the 2016 SA102 correctly can help avoid penalties and streamline your tax filing process.

-

How can airSlate SignNow assist with the 2016 SA102 form?

airSlate SignNow offers an efficient way to send, sign, and manage the 2016 SA102 form electronically. With its intuitive platform, you can easily gather eSignatures and track the status of your forms. This eliminates the hassle of paperwork and keeps your tax documents organized.

-

What features does airSlate SignNow provide for managing the 2016 SA102 document?

airSlate SignNow provides features such as customizable templates, secure authentication, and real-time tracking for the 2016 SA102 document. You can also integrate it with other applications to streamline your workflow. These features help ensure that your document management process is efficient and compliant.

-

Is airSlate SignNow a cost-effective solution for filing the 2016 SA102?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing documents like the 2016 SA102. With flexible pricing plans, you can find an option that suits your business needs. This affordability, combined with the platform’s features, maximizes your return on investment.

-

Can I integrate airSlate SignNow with other software for handling the 2016 SA102?

Absolutely! airSlate SignNow integrates seamlessly with various applications to facilitate the handling of the 2016 SA102. Whether you use accounting software or project management tools, these integrations enhance your workflow by allowing you to manage all documents in one place.

-

What are the benefits of using airSlate SignNow for the 2016 SA102?

Using airSlate SignNow for the 2016 SA102 offers numerous benefits, such as faster turnaround times and reduced administrative burdens. The easy-to-use interface allows for quick edits and distribution, while also ensuring that your documents are secure and compliant. This efficiency translates to saving time and resources in your business.

-

How secure is airSlate SignNow when handling documents like the 2016 SA102?

airSlate SignNow prioritizes the security of your documents, including sensitive forms like the 2016 SA102. The platform uses encryption and follows best practices to ensure that your data remains protected. This means you can confidently manage and share your documents without compromising security.

Get more for Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

Find out other Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online