Employment Use the SA102 Supplementary Pages to Record Your Employment Details When Filing a Tax Return for the Tax Year Ended 5 2024-2026

Understanding the Employment Use The SA102 Supplementary Pages

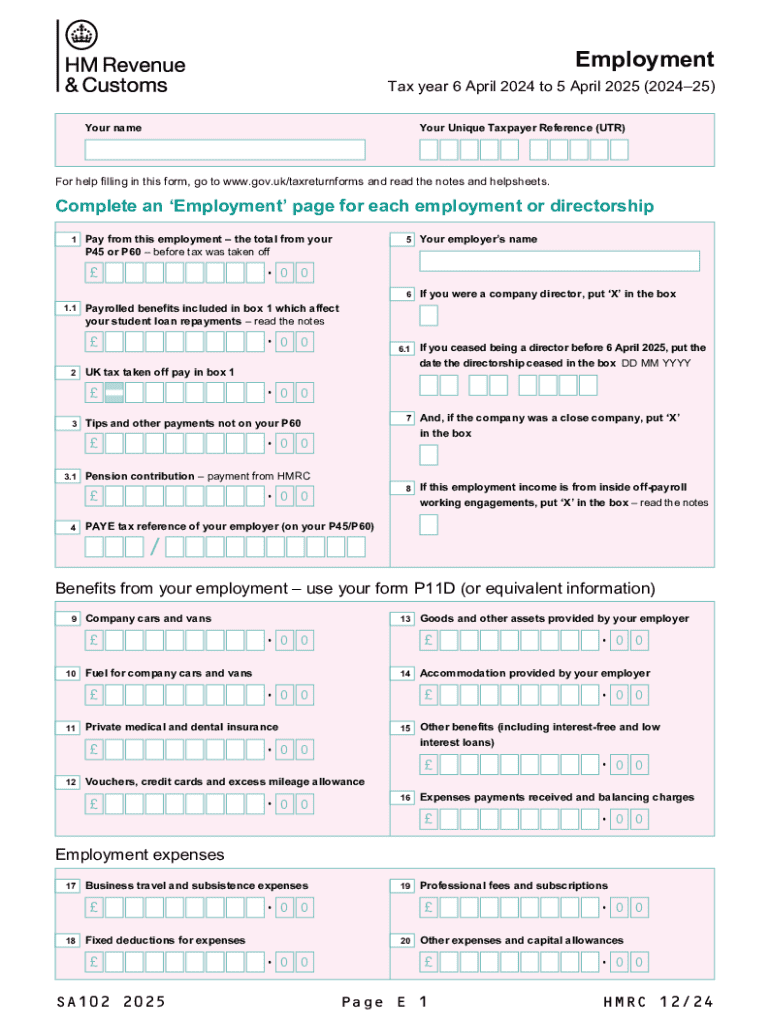

The SA102 Supplementary Pages are essential for individuals in the United States who need to report their employment details when filing a tax return. This form allows taxpayers to provide specific information regarding their employment income, which is crucial for accurate tax assessment. It is particularly relevant for those who have multiple sources of income or who have received benefits from their employer that need to be declared.

Steps to Complete the Employment Use The SA102 Supplementary Pages

Completing the SA102 Supplementary Pages involves several key steps:

- Gather necessary documents, including your W-2 forms and any other employment-related income statements.

- Fill in your personal information, such as your name, address, and Social Security number.

- Detail your employment income, including salary, bonuses, and any benefits received.

- Ensure all figures are accurate and match the documentation provided.

- Review the completed form for any errors before submission.

Legal Use of the Employment Use The SA102 Supplementary Pages

The SA102 Supplementary Pages serve a legal purpose in the tax filing process. They ensure compliance with IRS regulations by accurately reporting employment income. Failing to complete this form correctly can lead to penalties, including fines or audits. It is important to understand the legal implications of the information provided and to maintain accurate records of all employment-related income.

Key Elements of the Employment Use The SA102 Supplementary Pages

Several key elements must be included when filling out the SA102 Supplementary Pages:

- Identification of the employer, including name and address.

- Details of your employment income, including gross pay and any deductions.

- Information on any additional benefits or compensation received.

- Accurate reporting of any tax withheld from your pay.

Filing Deadlines for the Employment Use The SA102 Supplementary Pages

It is crucial to be aware of the filing deadlines associated with the SA102 Supplementary Pages. Generally, the tax return, including the supplementary pages, must be submitted by April 15 of the following tax year. However, if additional time is needed, taxpayers may file for an extension, which typically allows an additional six months to complete the return.

Examples of Using the Employment Use The SA102 Supplementary Pages

Consider the following scenarios where the SA102 Supplementary Pages are applicable:

- A full-time employee who receives a W-2 form from their employer must report all income accurately.

- A freelancer who works for multiple clients may need to use the supplementary pages to detail various income sources.

- An individual receiving benefits such as health insurance or retirement contributions from their employer should declare these on the form.

Create this form in 5 minutes or less

Find and fill out the correct employment use the sa102 supplementary pages to record your employment details when filing a tax return for the tax year ended 782153692

Create this form in 5 minutes!

How to create an eSignature for the employment use the sa102 supplementary pages to record your employment details when filing a tax return for the tax year ended 782153692

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA102 Supplementary Pages and how does it relate to employment?

The SA102 Supplementary Pages are essential for individuals to record their employment details when filing a tax return for the tax year ended 5 April. This form helps ensure that all income from employment is accurately reported to HMRC, making it crucial for tax compliance.

-

How can airSlate SignNow assist with the SA102 Supplementary Pages?

airSlate SignNow provides a streamlined solution for electronically signing and sending the SA102 Supplementary Pages. This makes it easier for users to complete and submit their employment details when filing a tax return for the tax year ended 5 April, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the completion of documents like the SA102 Supplementary Pages, ensuring you can efficiently record your employment details when filing a tax return for the tax year ended 5 April.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSignature, document templates, and real-time collaboration. These tools are particularly beneficial for managing the SA102 Supplementary Pages, allowing users to easily record their employment details when filing a tax return for the tax year ended 5 April.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality. This allows users to seamlessly manage their employment details and the SA102 Supplementary Pages when filing a tax return for the tax year ended 5 April.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the SA102 Supplementary Pages, provides a secure and efficient way to manage your paperwork. It simplifies the process of recording your employment details when filing a tax return for the tax year ended 5 April, ensuring compliance and accuracy.

-

Is airSlate SignNow suitable for individuals or just businesses?

airSlate SignNow is designed to cater to both individuals and businesses. Whether you need to record your employment details using the SA102 Supplementary Pages or manage documents for a larger organization, airSlate SignNow offers the tools necessary for efficient document handling.

Get more for Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

Find out other Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free